TSLA Full Circle

And just like that the year 2020 is over! What a year to remember. The end of the year is always a great time to review your trades, setups and your trading plan. Spending ample time reviewing previous trades and how you could have traded more profitably provides further wisdom and insight into hindsight, meaning a greater foresight in the year to come.

If we take a look back at the last year, I opened 2020 with the Tesla Series of articles which was far from the end of the bull run that was to come for Tesla (ProfitSource Code: TSLA). If you take the time to review the position of the market then and now, a year later, you will be aware that TSLA was trading at around $340. It had just had a fairly sizable pullback and found support at $320.

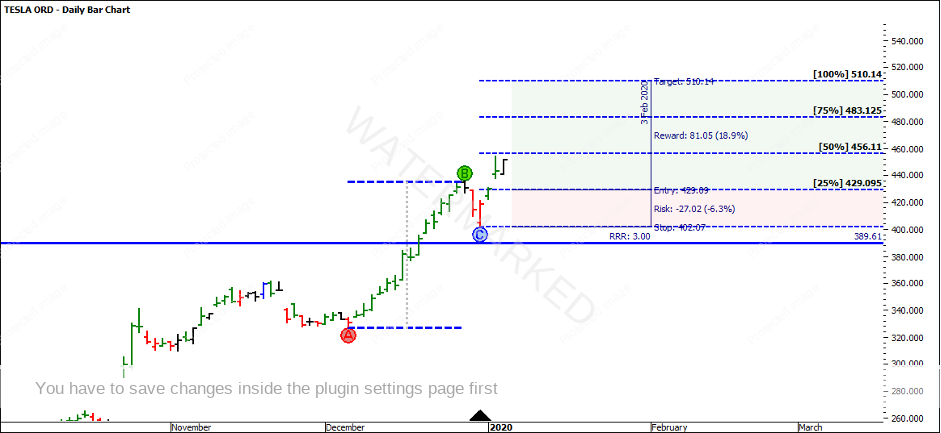

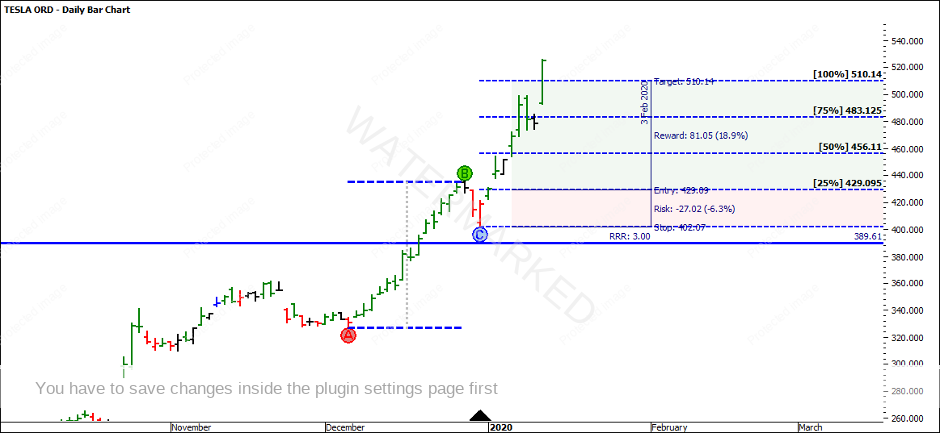

One of the more memorable trades of 2020 on TSLA was when it had just broken into new All-Time Highs. It smashed through the previous All-Time High of $389.61 and came back to test the previous All-Time High. You will notice that the market got close to the previous high before it pushed higher throughout the day. Volume was also very strong during the break, making this higher swing bottom/ ABC trade strong.

If we break down this ABC trade, you can look to recreate this and back test what system would have been most profitable. I also encourage you to trail that system on the next ABC trade that followed. ABC trades perform very well in strongly trending markets.

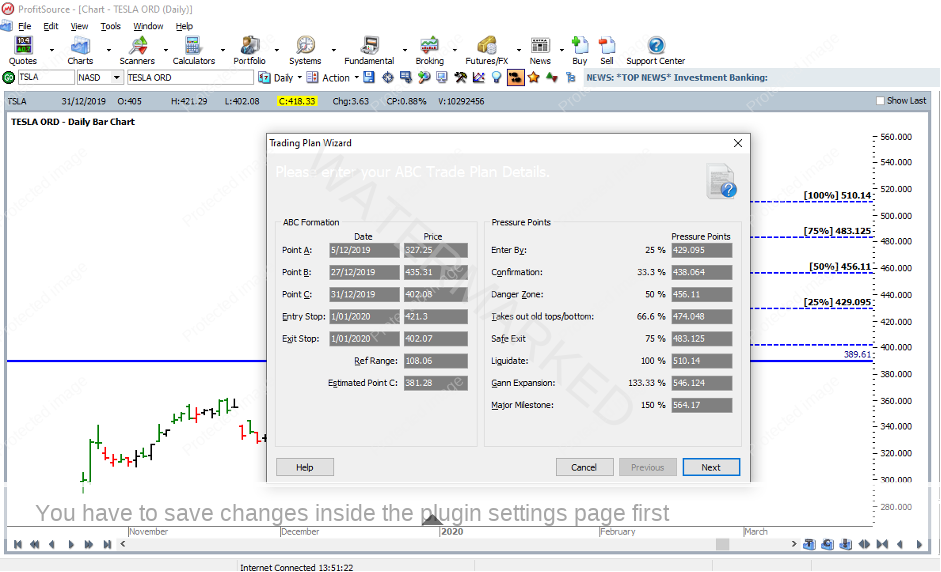

Assuming you had a $10,000 account available, 5% risk of the total account size is $500. If you refer to the ABC Trading Plan below, the reference range for this ABC trade is 108.06. Remember by dividing this reference range by 4 or 3 you will be able to project the 25% and 33% milestones from the bottom of Point C. In this case the software has generated this ABC Trading Plan for us.

We need to work out our risk. We need to identify our Risk Zone. This is the range between the 25% entry point and the stop loss. In this case, the 25% milestone is at $429.09 and the stop loss is under Point C. For this trade I will place it 1 point under Point C, however, it is recommended to test this. Often, I have found 1/3 of the average daily range is better for a stop loss.

25% Milestone = $429.09 –

Stop Loss = $402.07

Risk Per CFD = $27.02

Calculating our position size is then determined by the 5% risk of the account size divided by our Risk per CFD, as per the calculation below:

5% Risk of Account ($500) / Risk Per CFD (27.02)

= 18 CFDs (Rounded to the nearest whole number)

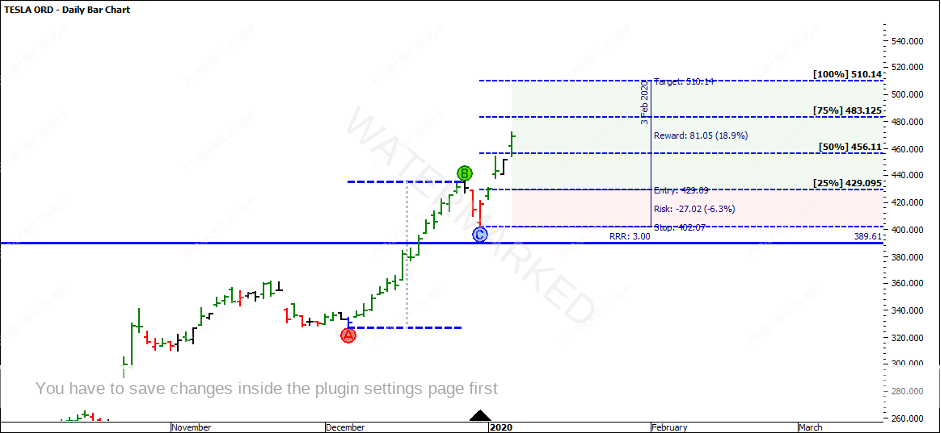

Once the order has been placed with your broker, entry would have been obtained on the 2nd of January 2020 on the open of the market at $424.50. The market gapped up which is a strong sign, however, the actual daily bar size was small, so you might have started to worry that the strength had been lost.

By day two of the trade, there was a strong rally on the trade. It also gapped up for a second day in a row. The market just missed the 50% level of $456.11. It is these situations where you start to think, should you move your stops up? The market closed on its low so there might be a potential risk to be stopped out as the proceeding day was a down day.

Fortunately enough, an inside day proceeded. Again, you would be thinking should you move your stops higher to cover any risk in the trade?

On the 7th of January, the market gapped up above the 50% level. At this point, you could move your stops to entry plus commission (depending on your trade management style).

On the 8th of January, you are thinking you are the best trader to have been born! Another strong push through 75% and closing high. Stops would have now been moved to 1/3 of the AR behind 50%.

On the 9th of January, you knew you should have closed the trade on the close. At this point, you might be considering taking profits. The gains made from yesterday have slightly been lost. A disciplined trader will follow their trading plan. On the 10th of January another day of potential lost profits. Should you take profit?

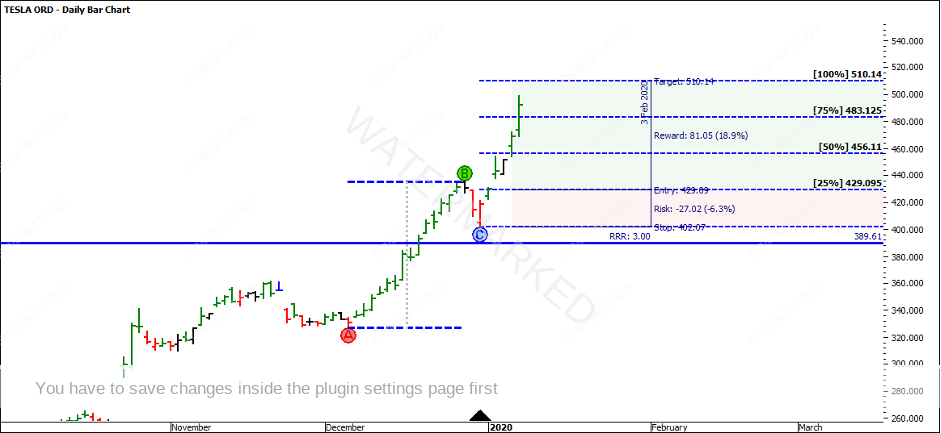

Luckily, you kept following your trading plan as the following day smashed through the 100% milestone. Common thinking is you should have taken more! Not to mention you have closed at 100%, yet the market has closed higher!

Now calculating the profit on this currency style management, you would have taken profit at $510.14.

100% Milestone = $510.14

Entry = $424.50

Reward Per CFDs = $85.64

Profit = $85.64 (Reward) * 18 CFDs (Number of CFDs)

Profit = $1,541.52

Based on the 5% risk you have just seen a 15% increase in your account size and out-performed many fund managers across the global. Now it is your turn to break down this ABC trade. Look to recreate this and backtest which system would have been most profitable (Stock, Currency or Index Style). I also encourage you to trial that system on the next ABC trade that followed.

We have a new year to look forward to. Sometimes we miss life-changing runs, though the next opportunity is always around the corner. Wishing you a very safe and Happy Christmas and Happy New Year. For everyone who does the work, I am sure you will be in for a prosperous journey in 2021.

It’s Your Perception

Robert Steer