Explosive Swing Trade

It sure was interesting to learn that the Central Intelligence Agency (CIA) has an investment arm, which predominantly invests in high tech companies, and the few high tech start-ups that are involved in military and space activities. All of course in support of the United States intelligence capability.

This sparked me to take a look at their latest investment, Palantir Technologies (ProfitSource code: PLTR) which trades on the New York Stock Exchange. PLTR was listed on the 30th of September 2020 and spent about a month trending sideways before it rallied 300%. Whether the CIA knew or not, it is a fascinating run, and it has just broken its All-Time High.

PLTR sparked interest due it its recent pullback to the 50% retracement. The price action has now turned into a pennant flag. Often, pennant flags work like a compressed spring, where price has been compressed together for a period of time and then it explodes one way or the other. In this case, PLTR has had an explosive move to the upside.

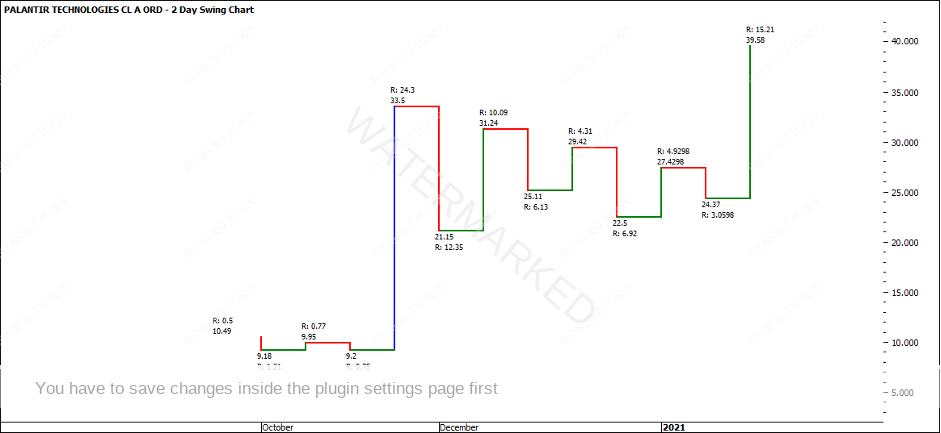

As you can see from the chart below, the All-Time High for the stock was at $33.50 and the All-Time Low was at $8.90. The 50% level was at $21.20 and the market bottomed close to this level on the 2nd of December 2020 at 21.15. The market also successfully held above this level making higher bottoms.

It is fairly easy to see the compression taking place on the 2-day swing chart. The up swings are contracting as well as the down swings. As the market made its first successful higher swing bottom, there were more signs that the market was likely to push higher as it had already sat above the 50% level and was making higher bottoms, as well as the up swings starting to expand, and the down swings were contracting.

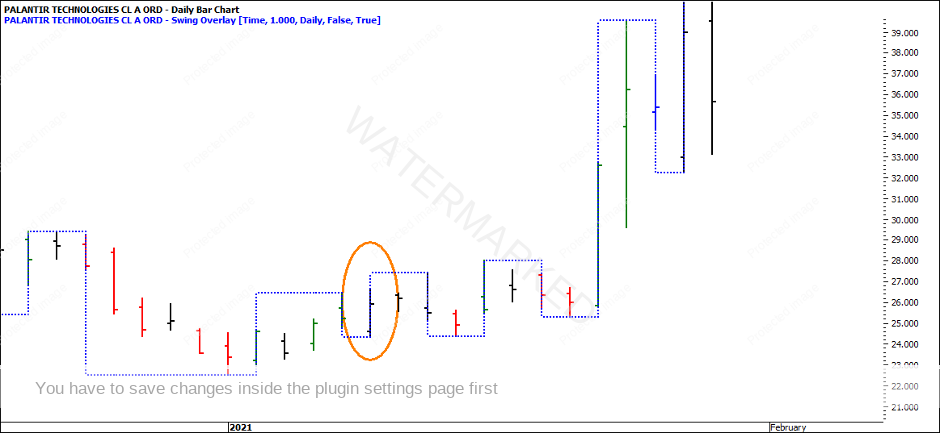

Let’s look at how you could have traded this setup. Overlaying a 1-day swing chart, the low on the 4th of January 2021 at $22.50 can be Point A, as any bottom can be a Point A in an ABC long trade. For those of you who are more advanced, you might have seen the outside day as an entry opportunity. As the market had not officially created a higher swing bottom yet, it might have stopped you taking this position – even though outside days are signs of strength!

If we turn to the Higher Swing Bottom trade, entry would have to be obtained by 33%, as it is outside the parameters for 25%.

|

Entry Limit |

$26.01 |

|

Entry Stop |

$25.63 |

|

Exit Stop |

$24.35 |

|

Account Size/ 5% Risk |

$10,000 / $500 |

|

Risk Per CFD |

$1.66 |

|

Number of CFD’s |

301 CFD’s |

Entry would have been obtained on the 15th of January 2021. The market gapped open and rallied prior to spending most of the day running down to fill you into the position.

Often in situations where the market gaps away, traders tend to cancel their position, in fear that the market will come back through and fill the gap, prior to stopping them out, in what is called a Whipsaw.

Assuming, you didn’t cancel the position, depending on the trade management style, your Currency and Index style would have been stopped out. Given you were trailing swing bottoms, your stops would currently be at $25.29, while the market is at $35 (at time of writing). In this situation what would you do? Take the profit, move your stops or keep your stops below the swing low?

It’s Your Perception

Robert Steer