New Commentary… Same Old Story

Hi all and welcome to 2021, a lot has happened since I last penned an article on the markets. We have celebrated a new year and I am sure along with you, we all hope for a quieter and more manageable 2021. We have a new administration in the US with expected changes in policy direction and leadership. Finally, we have more of the same on the COVID-19 front in terms of no international travel and the potential for lockdowns ever-present as the country attempts to find the new normal.

For me, it is clear we will not be back to the old ways for a long time if at all. The world will need to learn to do business in ways it hadn’t thought it needed to. The technology push will continue in earnest as we can now see even with vaccines the chances of the old tech ways of face-to-face enterprise is a long way off, especially overseas, as more countries lockdown for the third or fourth time.

Against this backdrop, it’s easy to believe as traders we somehow must reinvent our methods to stay relevant. This is likely the opposite, we will see new commentary on the new challenges we globally face be it financially, medically, or culturally. However, the commentary is in many cases noise, society has emerged from challenges before and will do so again but with a new perspective.

Markets are great as they are easy to access, all you need is a computer and the internet along with rules that can be learnt and modified where required. So, let’s start the year by keeping it simple. Can we manage our trade risk, can we define and measure trends, can we expect history to repeat?

If so, we are part way to building a future-proof business, if trading markets are not taken away, then the tools are in front of us to succeed. I do like the thought that we as a planet are being pushed harder and harder down the line of technology so there is no better place to look than at stocks and indexes that represent this space. We know Australia is a very shallow pool when it comes to listed technology stocks, so we may be forced to look to the US and the Nasdaq as a bellwether.

If we are students of history one of the best ways to break down a market and get the analysis flowing is to look at monthly charts and break down the pieces into sections and measure the movements and reaction in price (and later time).

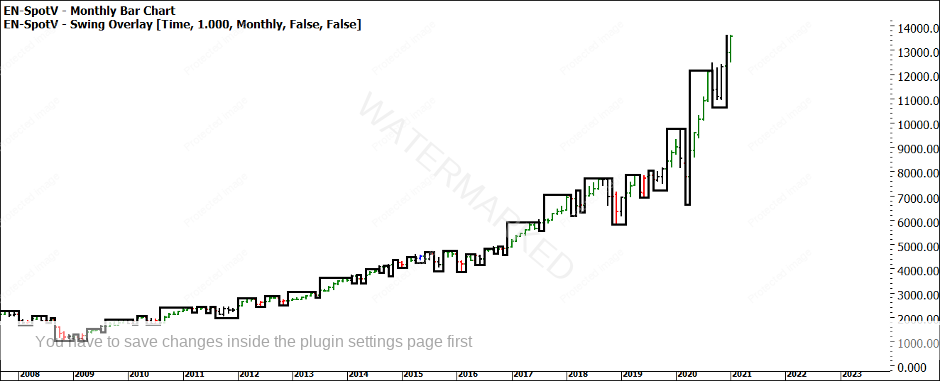

Chart 1 shows the Nasdaq since the lows post the GFC in 2008 on a monthly bar chart and swing overlay. This index has risen over 1300% and if we could build time machines, a buy and hold strategy would have delivered a small fortune. It’s rare to have a market travel like this, but we can still get to know it’s personality. The commentary is already starting in 2021 that this market is a bubble, but again that is noise. The price action should be able to tell us if this market is balanced or overheating.

Chart 1 – Monthly Bar Chart Nasdaq

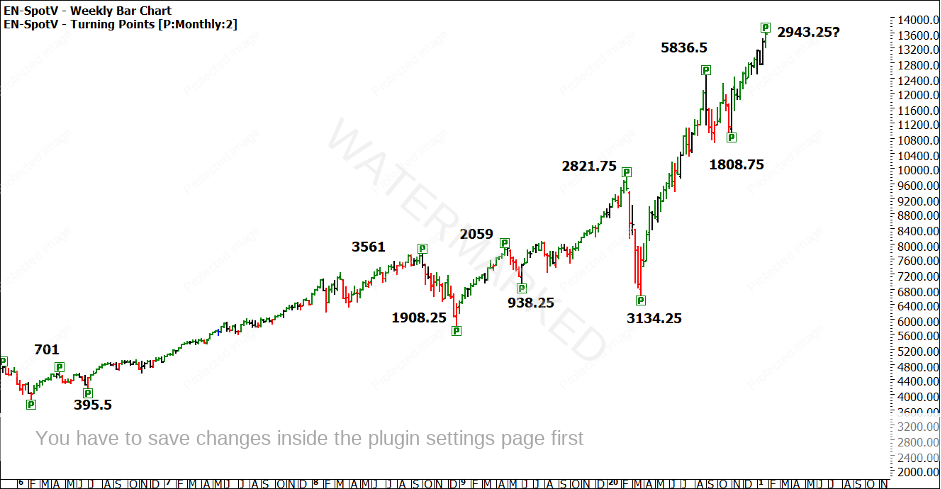

Chart 2 zooms into a smaller section and you should feel comfortable tackling a market at this more macro level to start to understand its heartbeat, we do not need to jump to any conclusions just yet on what the future holds. Let the market tell its story.

Chart 2 shows us the ranges that have developed since the lows of 2016. To get a fuller picture on this market you should run this exercise back to the 2008 low as we could argue there have been no major lows since then.

Chart 2 – Weekly Bar Chart Nasdaq

Once we have some “big picture ranges” to work with we can see how they interact with each other, by that I mean what percentages do they represent in contraction as well as expansion? As a guide, if we take the first numbers 395.5/701 gives us a 56% retracement.

The next up range is 3561, how many multiples of the previous range do we see (3561/701)? Just over 5 multiples.

If you do this for all the ranges on this chart is there a pattern that repeats that we can use to understand what is normal and abnormal?

Another task would be to compare ranges to the major lows and highs and again look for harmonies. We will continue to tackle this index on a regular basis this year to get familiar with absorbing the big picture of a market (and a good one at that). Remember we are not trying to forecast or find some hidden indicator. If we can assess what’s normal and abnormal we can then counter the chatter that we are already hearing in early 2021 that asset markets like stocks, property and commodities are overvalued and in a bubble. Our job is to know not to speculate like commentators.

Good Trading

Aaron Lynch