Platinum

This month it’s back to the metals, in particular, to visit a trade which took place in the last quarter of 2020 in the Platinum futures market. The trade entry was very close to the low of the second section up out of the major low in 2020. A high reward to risk ratio was available for the prepared trader. See the chart below with code PL-SpotV in ProfitSource.

The instrument initially used was the January 2021 Platinum futures contract, but because this was a slightly longer-term trade, contract “rollover” was required. This will be detailed a little more at the end of this article.

While getting into the market right at a major low sounds ideal – it’s actually not always. If we zoom in a little closer to the low of the second section, we can see that had you bought right on the low of the 24th of September, after moving up only a little from there the market ground away in a sideways fashion for well over a month – enough to test even the most patient trader!

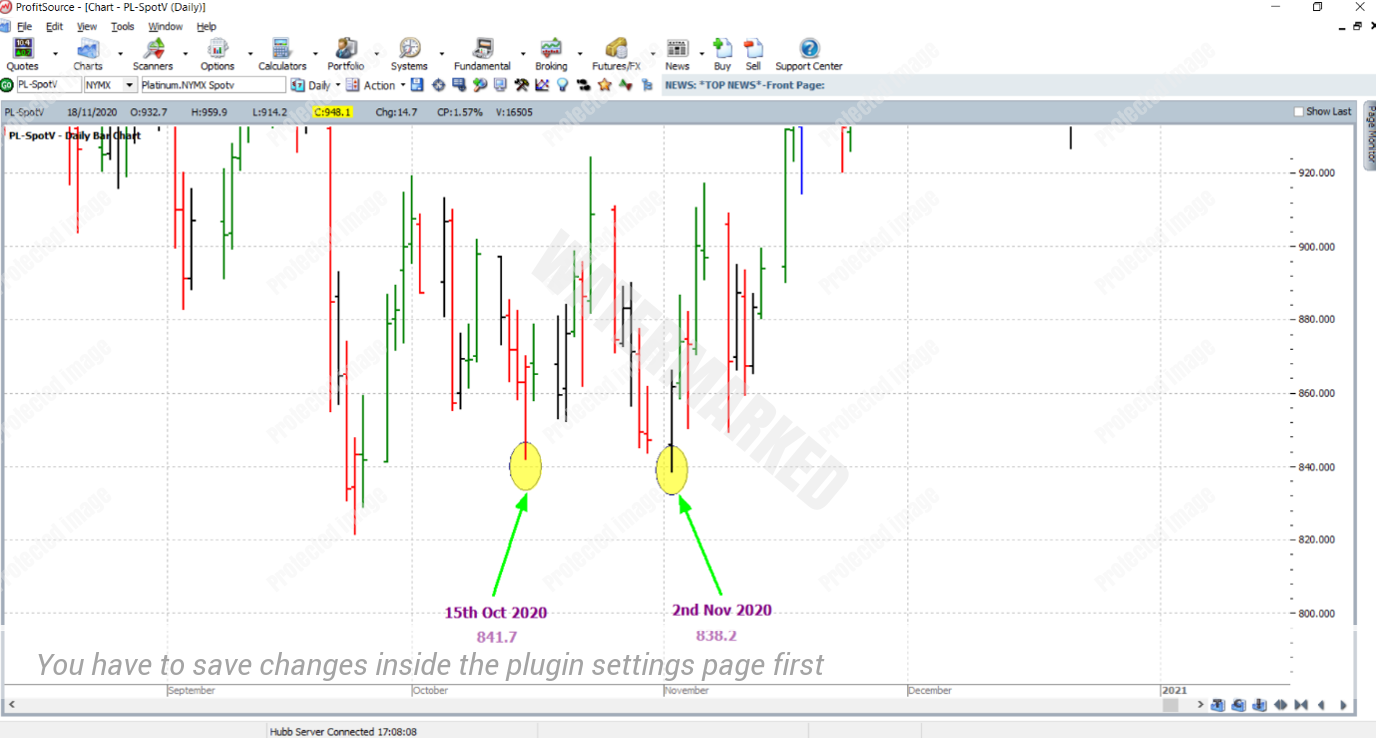

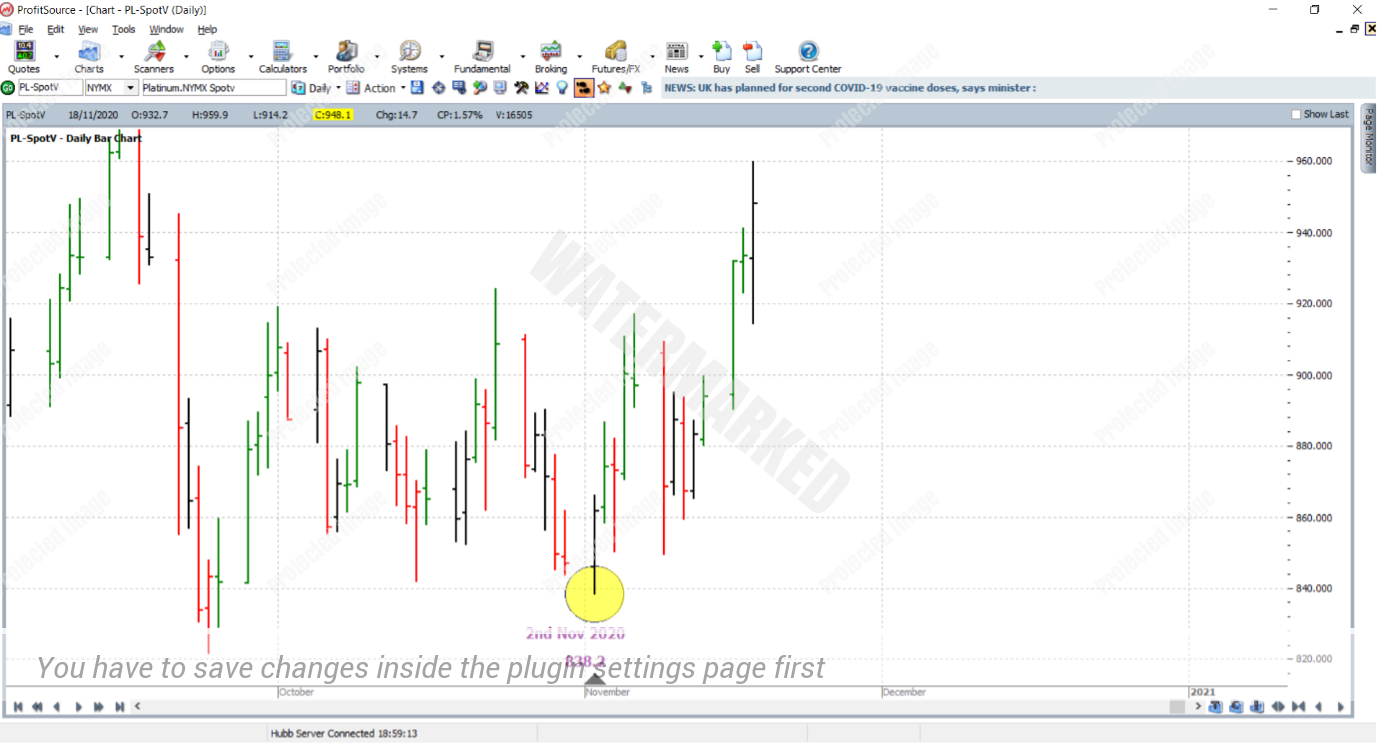

The excitement only really began after the low of the 2nd of November. And that will be the focus of this article. As for the technical analysis price reasons for this low, first of all, it was a double bottom with the 15th of October. While there was a false break, let’s still call these lows a pair of double bottoms, even if the break was only just within tolerable limits.

As for the other price reasons for the 2nd of November low, they came from a combination of Repeating Ranges and Resistance Cards. Feel free to try and create the rest of the analysis as a homework exercise. Send it in and as usual, we’ll be happy to give you some feedback.

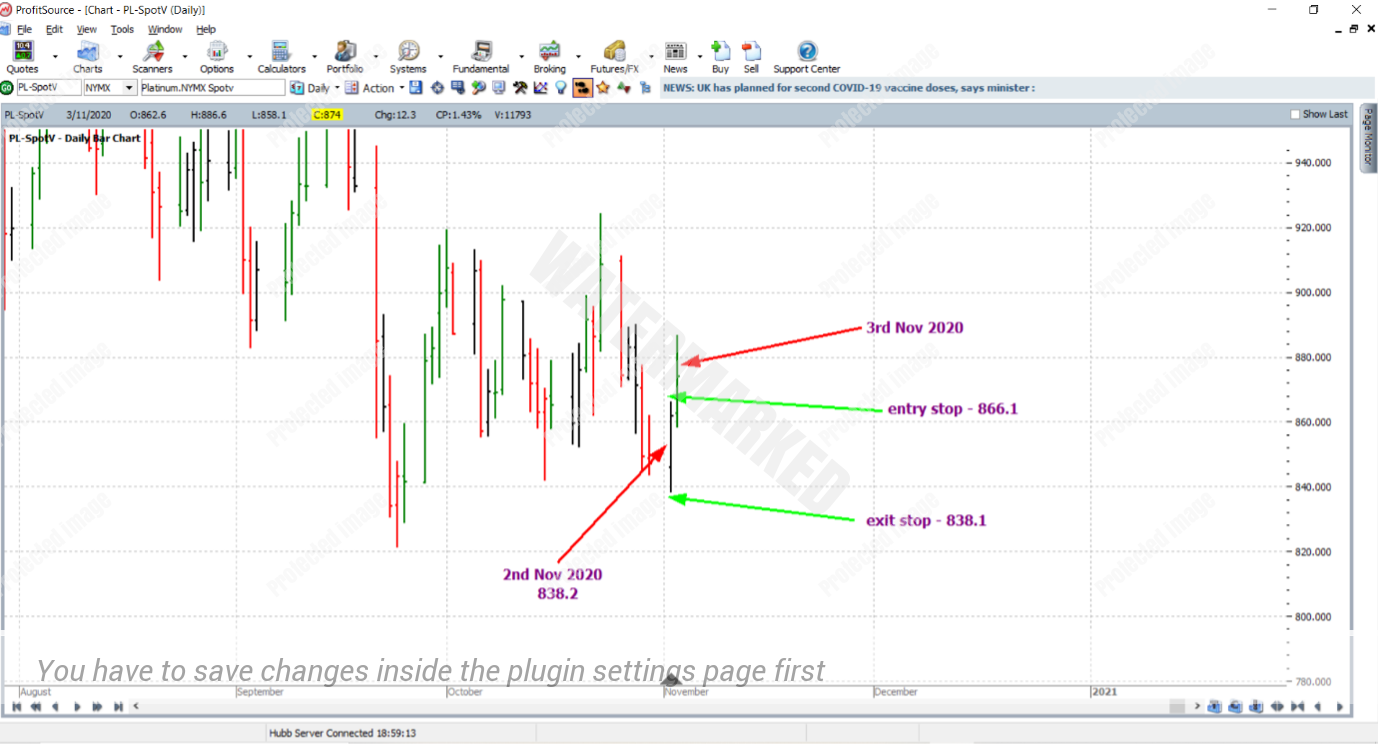

And with the analysis now complete, below we focus on the 2nd of November low and consider the entry that turned the swing chart up from this low. This entry was of course on the up day of the 3rd of November. Entry stop was at 1 point above the high of the 2nd at 866.1 USD per troy ounce, with the initial stop loss placed at 1 point below the low of the 2nd at 838.1.

As you can see on the chart below, the market moved away from the 2nd of November low in a strong fashion for a couple of weeks.

Next as usual is the trade management. This time we’ll use the monthly swing chart for a reference range, or what can now also be called the first major section up out of the 2020 low. Let’s use the trading plan which says to move stops to break even when the market reaches the 50% milestone of this range, and take profits at the 75% milestone. As you can see below the market reached the 50% milestone on the 4th of December 2020, and as mentioned stops were then moved to break even.

Patience was still required. It took until the 8th of February 2021 for the 75% profit target to be reached. Exit was at 1176.4, this milestone calculation being rounded down to the nearest whole point.

Was it worth the wait? You can decide upon that after some reward calculations.

In terms of the reward to risk ratio:

The initial risk was: 866.1 – 838.1 = 28.0 = 280 points

The final reward was: 1176.4 – 866.1 = 310.3 = 3103 points

So the reward to risk ratio was 3103/280 = approximately 11.1

In terms of a percentage gain to the trading account, first of all let’s assume the standard 5% risk across the size of the daily bar of the 3rd of November, that is 5% of the account being risked on the trade. In this case, the percentage gain on the account would be calculated as follows:

11.1 x 5% = approximately 55.5%

According to the specs on the CME Group exchange website, each point of price movement for a contract in this market is worth $5USD. So the risk and reward in absolute dollar terms (USD) would be:

Risk = $5 x 280 = $1,400

Reward = $5 x 3103 = $15,515

Using the Australian Dollar/US Dollar exchange rate at the time of taking profits the reward in AUD for trading one futures contract would be approximately $20,176. This futures market requires a larger minimum position size to trade than others, but many brokers will allow it to be traded with a much smaller position size via a CFD. In this case the reward to risk ratio and the percentage gain in account size are still the same.

The initial trade entry was into the January 2021 contract, so as far as contract rollover was concerned, this took place around the 30th of December, the typical date of each year when the April contract takes over the January contract in terms of trading volume. So the last weeks in the trade were spent by holding the April 2021 contract.

Work Hard, work smart

Andrew Baraniak