History Repeats Webinar

An Introduction to Road Maps

Saturday 19 June 2021 – 9.00 am – 5.30 pm Sydney Time

By the end of the seminar you will:

-

- Be convinced that WD Gann was speaking the absolute truth when he said that history repeats

- Know how to look for, find and set up a Road Map on most markets that you trade (a brand-new market has no history, so you will need to wait for patterns to emerge)

- Have a new set of rules for:

- Entering a “Ranges + Road Map” trade

- Managing your stop loss

- Adding to your position

- Locking in profit based on the Road Map

The day will be broken down into six sessions of approximately an hour each, and will cover the following topics:

Session 1: History Repeats

Session 2: Finding Road Maps: Part A

Session 3: Finding Road Maps: Part B

Session 4: Rules for Swing Trading a Road Map

Session 5: Case Study: Swing Trading a Road Map

Session 6: Preparation for a Big Campaign

When you register for our History Repeats live event, you will receive:

-

- A full day webinar on Saturday, 5 June 2021 (9.00 am to 5:30 pm Sydney time)

- Unlimited access to a full recording of the webinar

- Exercises to complete to help you cement the lessons from the webinar

- Unlimited emails to Mat during the month of July 2021 with ANY Road Map questions (note: Mat will only discuss MFC content with MFC owners)

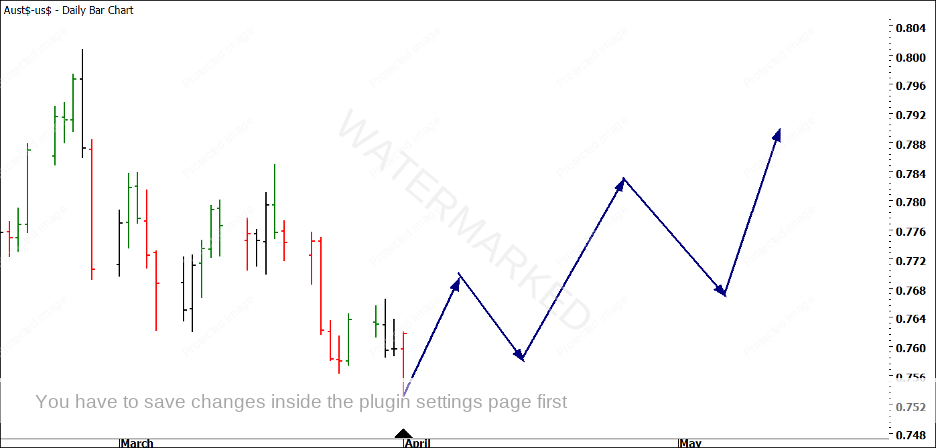

- Bonus 1: Australian Dollar ‘Ranges and Road Map Outlook’ before the event

- Bonus 2: Australian Dollar ‘Ranges and Road Map Outlook’ after the event

This is a one-off, special event that I have wanted to run for several years but the time hasn’t been right. And to be quite frank with you, had we run this event, with this content, in previous years, it would only have been made available to students at Master Forecasting Course level. However, given the ongoing challenges and disruptions caused by the pandemic, we want to do everything that we can to help our students take better trades, so for a limited time only, this event is open to ALL Safety in the Market students.

As I said, the numbers are limited because there are only so many that I can handle, both on the day and in the month of follow-up support. Once the event is full, that’s it, we won’t be running it again. Even if you can’t make it live on the day, if you wish to attend, I recommend that you lock in your place as soon as possible.

The Fine Print

Now, before you rush in and secure your place in this truly unique event, a few words of caution:

- I have not applied these techniques to all markets. I know that they work well on currencies and indices and this will be my focus for the event. I cannot promise that the market you wish to trade will work using these methods. I believe that they will, but not having tested every market, I cannot guarantee anything.

- Trading involves risk. Road Maps DO NOT eliminate that risk. They reduce the risk, while at the same time opening up much better Reward to Risk Ratios on trades, but they DO NOT eliminate the risk. I will not be held responsible for any losses made if you trade off a Road Map.

- Road Maps are wonderful, powerful techniques that will take your breath away at times. This makes them a wonderful addition to your trading, but it also makes them dangerous, so let me state a few things here that we will expand on during the event:

-

- WD Gann and David Bowden, despite their impressive records, used stop losses and recommended that students always use stop losses. I am no different – I ALWAYS use stop losses and recommend that you do too

- I’ve seen Road Maps work for only 6 weeks and for longer than 15 years, however, the majority of them tend to last from around 6 months to 2 years in length. Always remember that no matter how good a Road Map looks, it will not last forever

- You need to live through a few campaigns using Road Maps in order to get comfortable with them. I have studied them for over a decade. I will try to speed up your learning by going through case studies, but I encourage you to test and practice them before jumping into any live trade.

-

- MFC Owners, although I believe you will find value in the day, I will not be discussing Rating the Market, either on the day or in follow-up emails. This is something I only discuss as part of MFC Coaching.