Coffee – Breaking Down the Risk

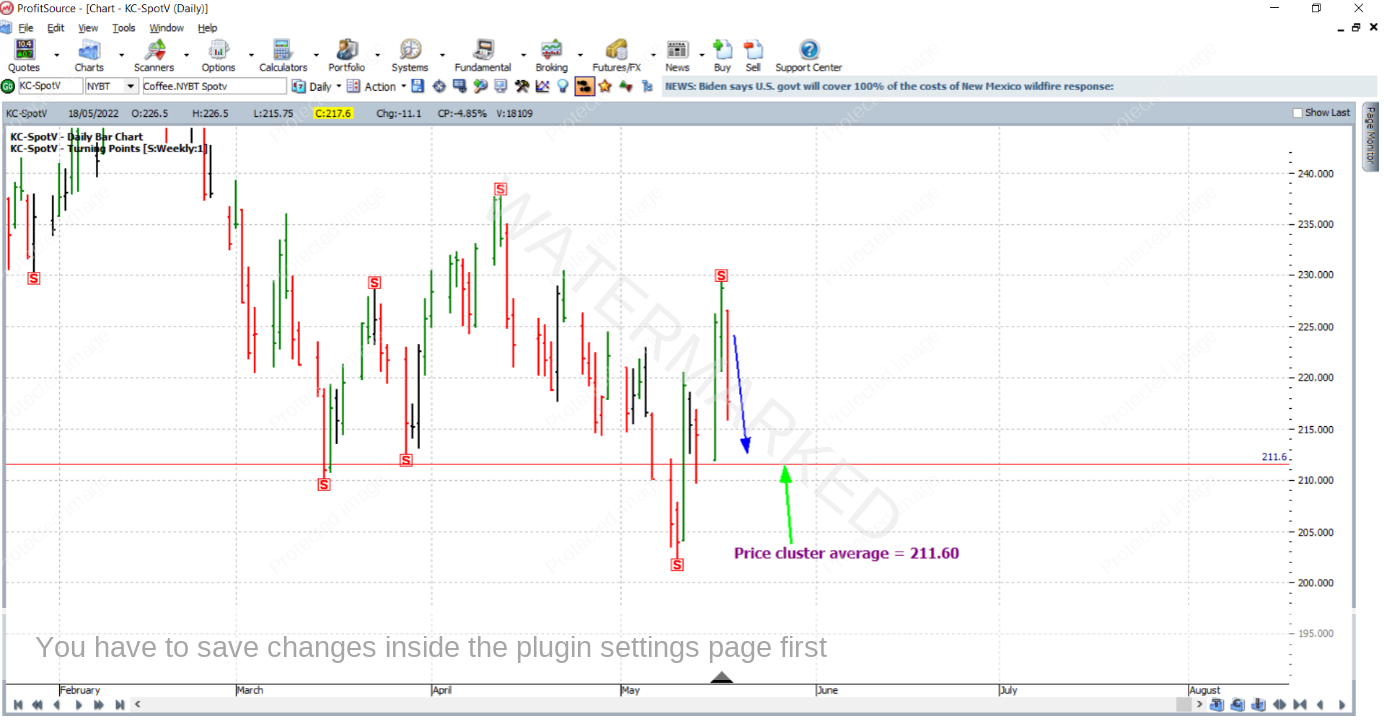

As 24 May 2022 approached, the market was heading down towards a price cluster (made up of three separate price analysis reasons) which averaged out at 211.60 cents per pound. This is illustrated below using the ProfitSource chart KC-SpotV in Walk Thru mode. Also included on the chart are the Weekly Turning Point Hi-lites, which serve as a hint for one of the three price reasons.

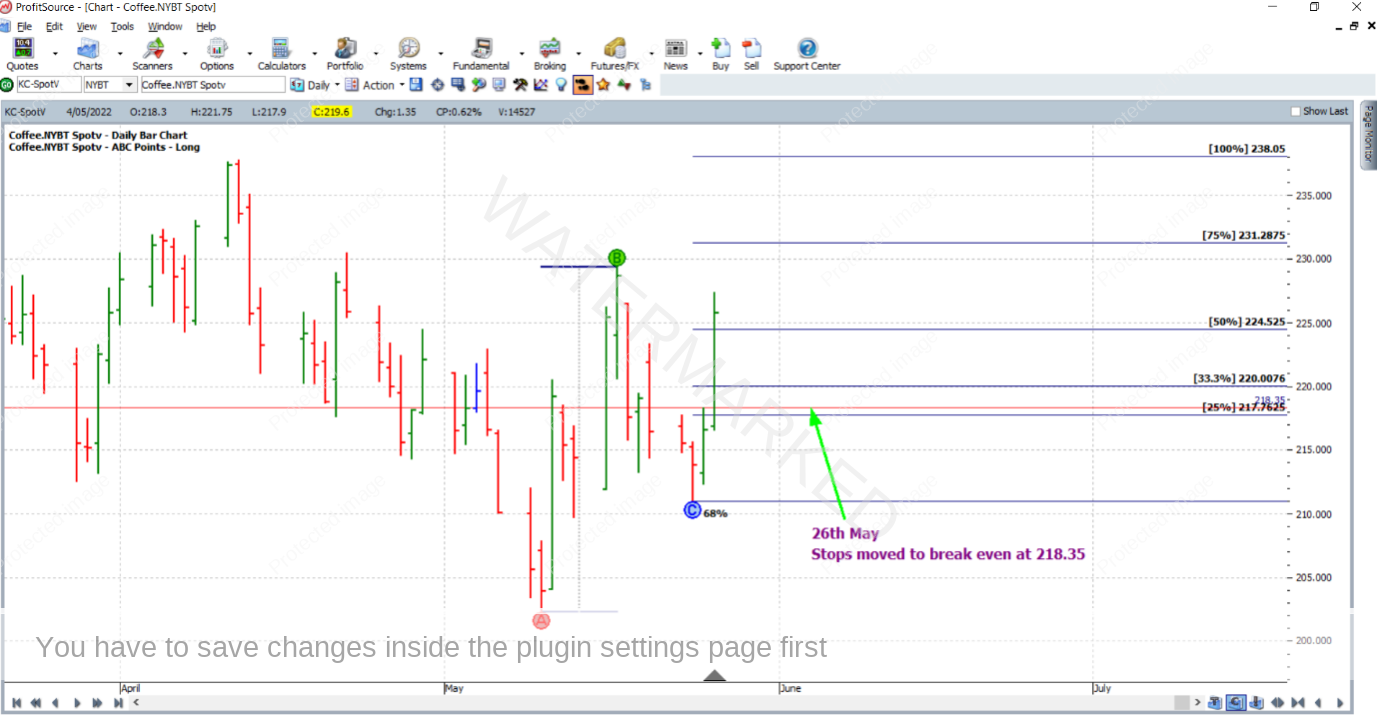

As you can see below, 26 May 2022 was a strong day to enter the market, with the 50% milestone being reached quickly, with stops moved to break even for what was just a very standard 2-day swing chart ABC trade as defined by the Number One Trading Plan Manual.

Reward to Risk Ratio:

Initial Risk: 218.35 – 210.95 = 7.40 = 148 points (point size is 0.05)

Reward: 238.05 – 218.35 = 19.70 = 394 points

Reward to Risk Ratio = 394/148 = approximately 2.7 to 1

If you look up the contract specifications on the ICE website, each point of price movement changes the value of one Coffee futures contract by US$18.75. Therefore in absolute dollar terms the risk and reward (in USD) for each contract of the trade was calculated as:

Risk = $18.75 x 148 = $2,775

Reward = $18.75 x 394 = $7,387.50

At the time of taking profits, the reward in Australian dollars was approximately equal to $10,260.

For simplicity in this article, let’s assume that no matter how we trade, that US$30,000 was the account size before the trade was taken, and that one contract was traded. This would mean that the percentage of the account risked at entry would be 2,775/30,000 which equals 9.25%, which while quite large, was taken with the more conservative approach of waiting for the confirmation of a higher bottom on the 2-day swing chart. And it was still within Gann’s absolute maximum risk of 10%! So with that in mind we can calculate the resulting percentage change in account size:

2.7 x 9.25% = 25% approximately

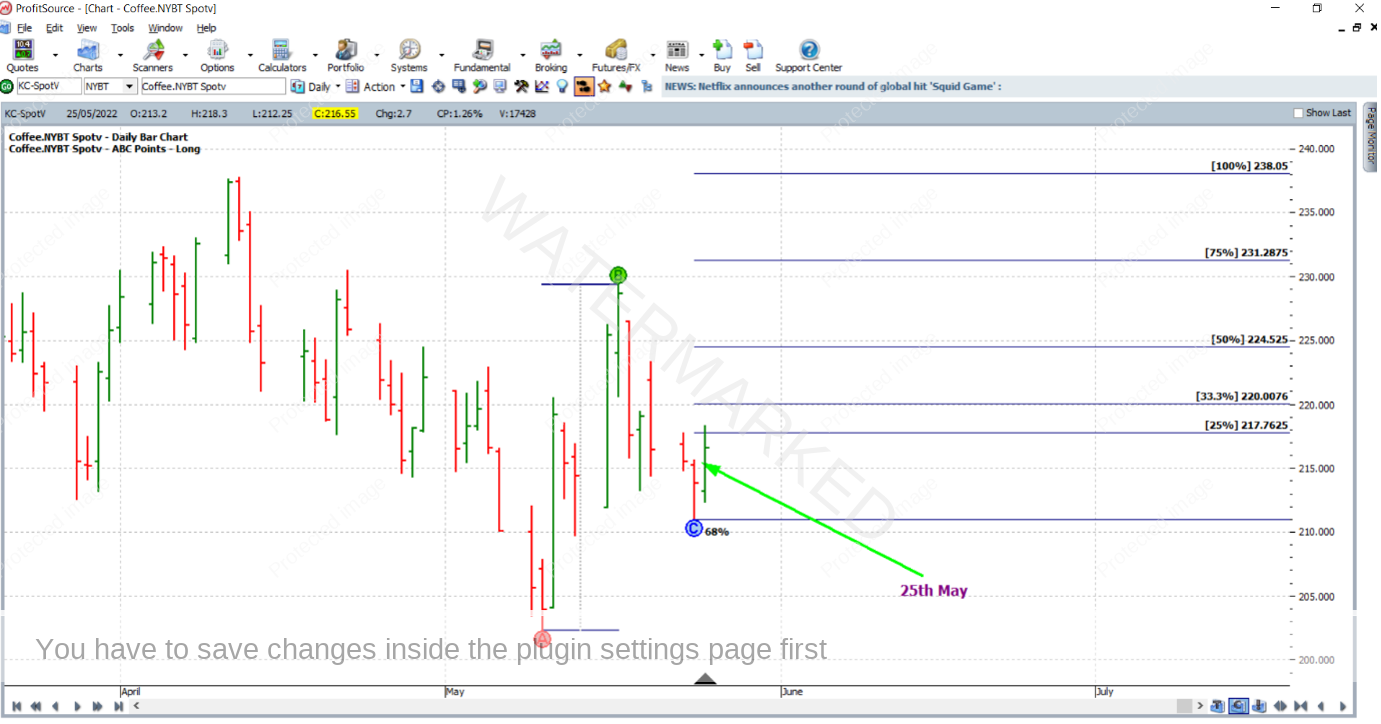

But like I said this is not the end of the article. What if instead you were more confident in your price cluster? Let’s consider entering earlier, for instance as the 1-day swing chart turned up. Entry would have been achieved with the up day that was the 25 May 2022 at 215.65 (well within the 25% milestone this time) as the high of 24 May 2022 was taken out, with an initial stop at 210.95, one point below the low at 211.00.

Reward to Risk Ratio:

Initial Risk: 215.65 – 210.95 = 4.70 = 94 points (point size is 0.05)

Reward: 238.05 – 215.65 = 22.40 = 448 points

Reward to Risk Ratio = 448/94 = approximately 4.8 to 1

In absolute dollar terms the risk and reward (in USD) for each contract of the trade is calculated as:

Risk = $18.75 x 94 = $1,762.50

Reward = $18.75 x 448 = $8,400

At the time of taking profits, the reward in Australian dollars was approximately equal to $11,667.

The percentage of the account risked would be calculated as 1,762.50/30,000 which equals approximately 6%. As a result of this the approximate percentage change to the account size after taking profits was:

4.8 x 6% = 28.8%

So there has been an improvement. Both the percentage and absolute dollar rewards are slightly better than having traded off the 2-day chart, plus the initial risk in absolute dollar and percentage terms was less.

But can we improve on this any further? Again, it all depends on the strength of the analysis and how confident you are in that analysis. Let’s say you are confident enough to take an even more aggressive approach, and trade off the intraday chart only just after the low itself. Below is an extract from barchart.com, showing the hourly bar chart around the time of the 211.00 low. A first higher swing bottom entry on the hourly chart would have had you long at a price of 214.30 with initial stop at 212.20 in the early hours of trading in the US on 25 May 2022.

Reward to Risk Ratio:

Initial Risk: 214.30 – 212.20 = 2.10 = 42 points (point size is 0.05)

Reward: 238.05 – 214.30 = 23.75 = 475 points

Reward to Risk Ratio = 475/42 = approximately 11.3 to 1

In absolute dollar terms the risk and reward (in USD) for each contract of the trade is calculated as:

Risk = $18.75 x 42 = $787.50

Reward = $18.75 x 475 = $8,906.25

At the time of taking profits, the reward in Australian dollars was approximately equal to $12,370.

The percentage of the account risked would be calculated as 787.50/30,000 which equals approximately 2.6%. As a result of this the approximate percentage change to the account size after taking profits was:

11.3 x 2.6% = 29.4%

Yet again, we see an improvement to the rewards in both absolute dollar and percentage terms and a significant reduction to the risk as well. And remember that many brokers will also make this soft commodity market accessible via a CFD to allow for much lower risk in absolute dollar terms.

Have a go at reproducing the analysis which gave the price cluster average at 211.60; a hint for one of the first three reasons was already given earlier in this article. For the other two, think big ranges, big turning points, important milestones and resistance levels!

Work Hard, work smart.

Andrew Baraniak