How to Choose a Market to Trade

Every year it seems like there are more and more markets for us to choose from, as new stocks are listed and new products come on the market, like the explosion of cryptocurrencies over the last few years. Traders who have been around for a little while tend to just stick with the markets that they know well and profit from, however for a new trader, it can all be a little overwhelming.

The first thing to keep in mind when selecting markets to follow and trade is that whatever you choose, no matter how much thought or effort you put into it, it’s probably not going to be the market that you trade forever. So just relax and treat it as a learning experience. It is much better to pick a reasonable market and start learning from it now, than to spend weeks or even months agonizing over the choice, which is time that you could be using to gain valuable trading experience and learning. Remember, before you earn, you’ve got to learn, so get that learning process started as soon as possible!

Before you decide which markets to follow, it helps to consider the time of day that you will be looking to do your analysis and trading. For example, if you want to trade Australian stocks, you will need to be able to place orders between 10am and 4pm from Monday to Friday, Sydney time. If you live in Sydney but plan to do your trading in the evening, you might consider UK or US stocks, or perhaps currencies or one of the global indices. To explore this concept further, check out our YouTube video called ‘When Can I Trade’ on the Safety in the Market YouTube channel.

Once you know the time frames that you are available for trading, you need to pick some markets to trade. For most time zones, there will be stocks, currencies, commodities, indices and cryptocurrencies that you can trade, so rest assured that you will be able to find something to trade!

I am predominantly a currency trader, and the reason I trade currencies is that ever since I was young I’ve been a coin collector. I was always fascinated by the varying coins and notes from different years or countries. My initial thoughts were that currencies would be too hard to figure out, but once I started, I realised they were just as easy to trade as stocks, and actually had some advantages. To learn more about trading currencies, check out our FREE FX Trading Course on our Safety in the Market YouTube channel by clicking here: Part One – Introduction to the FX Markets.

Now, currency trading may not be for everybody, but I believe that everybody has a field of interest that can help them choose some markets to trade. Some traders who work in finance gravitate towards bank stocks, while those in the mining industries might look into the resources sectors. A friend of mine is a coffee distributor and naturally followed the coffee futures prices, while another friend who liked jewellery decided she would trade the precious metals like gold and silver. Take a moment to consider areas that might be of interest to you, then see if there are markets available that you could trade. If you are already a Safety in the Market student, remember that you can email our Trading Tutors service if you have any questions here.

In Safety in the Market’s Active Trader Program, David Bowden recommended that students pick a stock, a currency, a commodity and an index to get started with. Although there is a case to be made for starting off with a group of stocks or a group of currencies, keep in mind that stocks will trend differently to currencies and commodities, for example, so if you are following one of each, there’s a very good chance that you’ll always have a good trading opportunity on at least one of your markets.

So what should you look for in a market? The two main things that I look for are volume and volatility.

1.Volume

You want a market that has enough trading volume each day so that you will be able to place your trades without affecting the price. You also don’t want to be stuck holding shares that you can’t sell if you need to get out of them. If you are looking at currencies or any of the major indices, most of them should have more than enough volume. With stocks, there needs to be a bare minimum 200,000 shares traded per day, but preferably 1,000,000 or more. Again, if you stick to the larger indices like the ASX200 or the S&P500, you’ll find most of the stocks have more than enough volume. You can check the volume by visiting the website of the exchange your stock or commodity trades on, like www.asx.com.au for Australian stocks.

2.Volatility

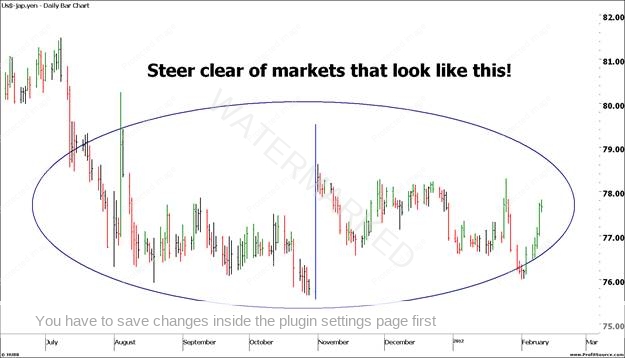

Just because a stock has enough volume to trade doesn’t mean it will be a good market to trade. There needs to be enough volatility or movement in the stock. A great example is the following chart of the US Dollar / Japanese Yen currency pair. This is a very high volume currency pair (trillions of dollars go through the currency markets every single day, and this is one of the largest pairs), but for a period of around nine months in 2011 and 2012, the pair barely moved at all, as you can see in the chart below.

Now, this doesn’t mean that you would never trade this pair again – as many of you know, the US Dollar / Japanese Yen has made some terrific moves of late! But when your market is moving sideways like this, the best thing you can do is leave it alone and wait until it starts trending again, either up or down.

Again, this is why it can be helpful to follow a few different kinds of market, so that if one of them starts going sideways you can focus on another market that is trending.

At the end of the day, keep in mind that our job as traders is not to be on top of every possible market out there. Some people experience a Fear of Missing Out (FOMO) when they hear about the exciting moves in markets like Bitcoin. But in reality, we only have so much capital, so once we have selected some markets to trade, we generally have more than enough opportunities. All we need to do is find a few markets that we are comfortable trading, and be open to trading other markets from time to time should the opportunity arise.

Also remember that the markets you start out with are probably not going to be the markets you trade for the rest of your trading career. So it’s not about choosing the perfect market. Instead, it’s about selecting some promising markets, and then learning how to read them and how to trade them. If you’d like to learn a powerful 3 step process for identifying both the direction or trend of the market and the likely places to watch for turning points in the market (a turning point is the end of one move and the start of a new move in the opposite direction), check out our Active Trader Program. Click here for more details.