Decide, Design, Execute

I’ve mentioned previously that hand charting one market has many benefits. You could go in-depth and have a hand chart for every technique or you could go as simple as having a one-page combined set of swing charts. This month I want to put a shout out to Tom W from WA for sending in his one-page setup that I then wrote about in the July newsletter. I loved the simplicity and its effectiveness.

The downside of following just one market is at times ranges can become small, making the Reward to Risk Ratio unsatisfactory, or making it hard to know what the market is doing. In this article I’m going to go through a process to bring together another way to find alternative trading opportunities.

First, I’m going to decide what and how I want to trade, then design a trading system around it and finally, how I could execute this system.

Decide:

- What instruments to trade?

- What setup to target?

- What time frames to trade on?

I’ve got a quote list of 30 markets with a mix of currencies, commodities, indices and stocks that I can watch. This is easy enough to do by going into ProfitSource, ‘Quotes’, ‘New Quote List’ then add in all the markets you prefer to watch. You’ll need to save the quote list to use later.

In this trading system I want to scan for weekly ABC setups with the goal to enter on a daily or 4-hour swing chart if there is a cluster at ‘Point C’.

The aim is to be very selective and filter out the high probability, high Reward to Risk Ratio trading opportunities.

Design:

- Design a trading strategy

- Design a market scan to reduce time and filter out the best weekly ABC trades

- Design an execution strategy

Design a Trading Strategy:

This you will have to put together yourself. Some things to think about will be:

- What makes up a cluster/setup that you would trade? List all the aspects of a cluster and what needs to come together. (You might like to start by considering Mat’s list of Four Kinds of Acceptable Setup from Active Trader Program Coaching)

- How often would you expect to see a cluster of this standard across any one market?

- How often would you see a cluster like this across all markets in the quote list?

- What will be your entry parameters?

- What will be your trailing stop strategy and exit strategy?

- How will you keep track and stalk your weekly ABCs when looking for your strategy to come together?

Design a Market Scan:

If you have your trading plan sorted, we can set up our ‘New Market Scan’ for these weekly ABC setups.

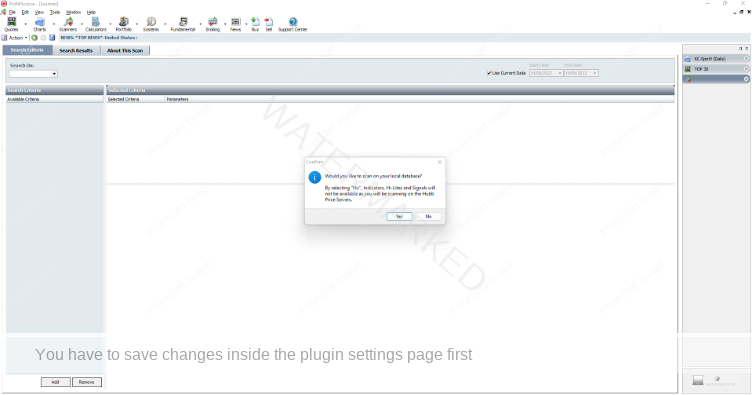

Select ‘Scanners’ and ‘New Market Scan’. You will get a pop up that asks would you like to scan on your local database? Select Yes.

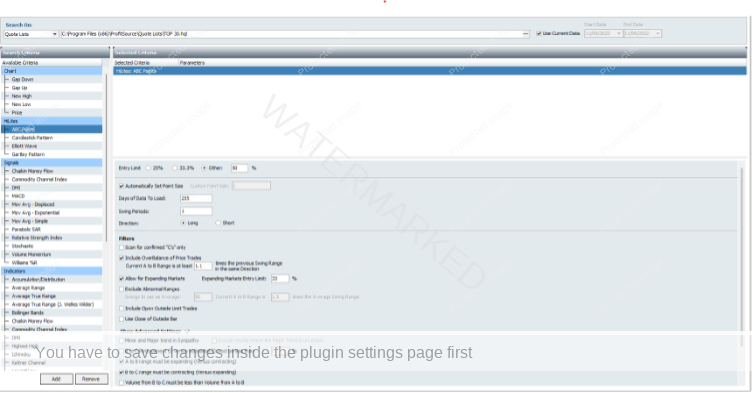

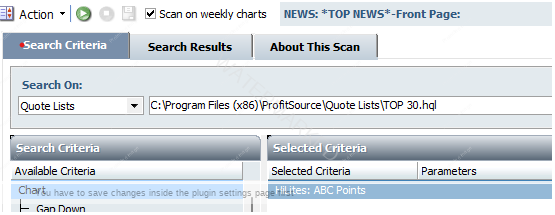

Then you can select the quote list you created to scan on. In the top left under ‘Search On’, use the drop down and select ‘Quote Lists’. Select the three little dots to the right which will take you to your saved list. Select the one you created.

Now we need to create a set of instructions for our new scan.

On the left side under ‘HiLites’, double click on ‘ABC Points’.

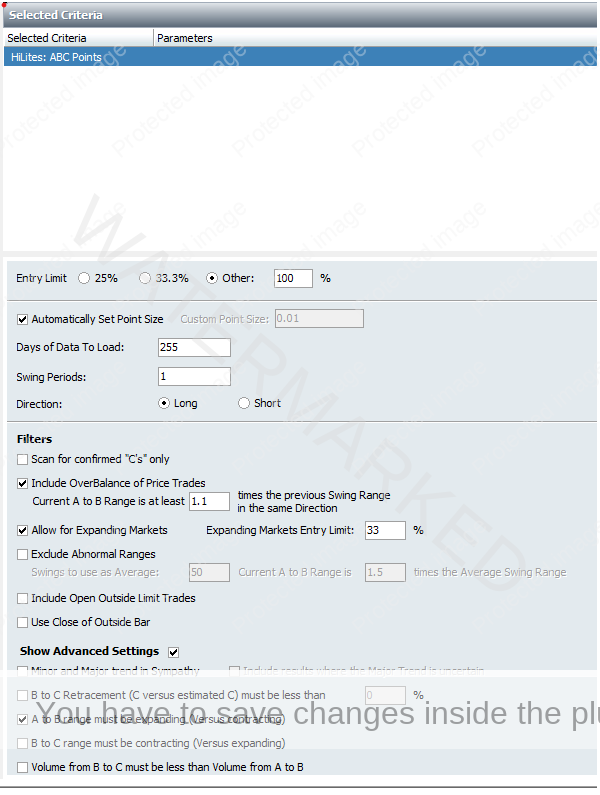

This will be the main set of instructions to work on and will auto populate with a set of parameters. I’ve gone ahead and changed some settings, but I would strongly encourage you to adjust them to suit yourself and learn about each one.

Then up the top, tick the box that says, ‘Scan on weekly charts’. This will scan for weekly ABC’s with the above parameters.

Next go to ‘Actions’, ‘Save Scanner As’.

Now click on the green ‘play’ button and you will get a list of all the current weekly ABC long setups. If you want to look for ABC short setups, go back to ‘Search Criteria’ and select ‘Short’.

One thing to remember is to always run ‘Update Manager’ first before you scan so that you are scanning on the most recent data.

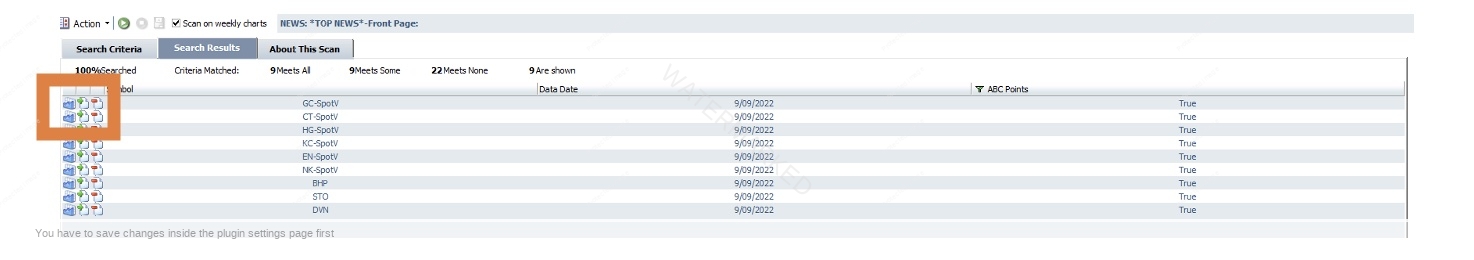

The search results will look something like the below. You can see from the 30 markets I have in my quote list that there are 9 potential weekly ABC trades that meet my initial search criteria at the time that I ran it.

Click on the far-left chart symbol to open up the first chart. You can then use the + or – key to change from a weekly chart to a daily chart and use the F4 key or F3 key to move forward or back through the quote list.

Design an Execution Strategy:

Some things to consider.

- How often will you run these scans?

- What is your target time you have to execute this trading system? E.g. 1 hour per day?

- How will you keep track of potential trading opportunities as they unfold?

- How will you keep track of your results?

Of course, you don’t have to stop here, you could run any number of combinations to feed your trading system!

As always you have your course material to refer to. There is also the Safety in The Market Members Portal and the YouTube channel for more resources to help give you ideas for putting together your trading strategy.

Happy trading,

Gus Hingeley