End of Year Celebrations

The year end is fast upon us and the next article after this that arrives will be in the dawn of 2023, with all of the new opportunities and market adventures that are coming. For all the could or should haves that have passed us all by post Covid, and now with what has been a challenging year economically, there has been a lot to take in and more importantly celebrate. The good news is those same large reward to risk ratio setups will appear again and be ready to tackle.

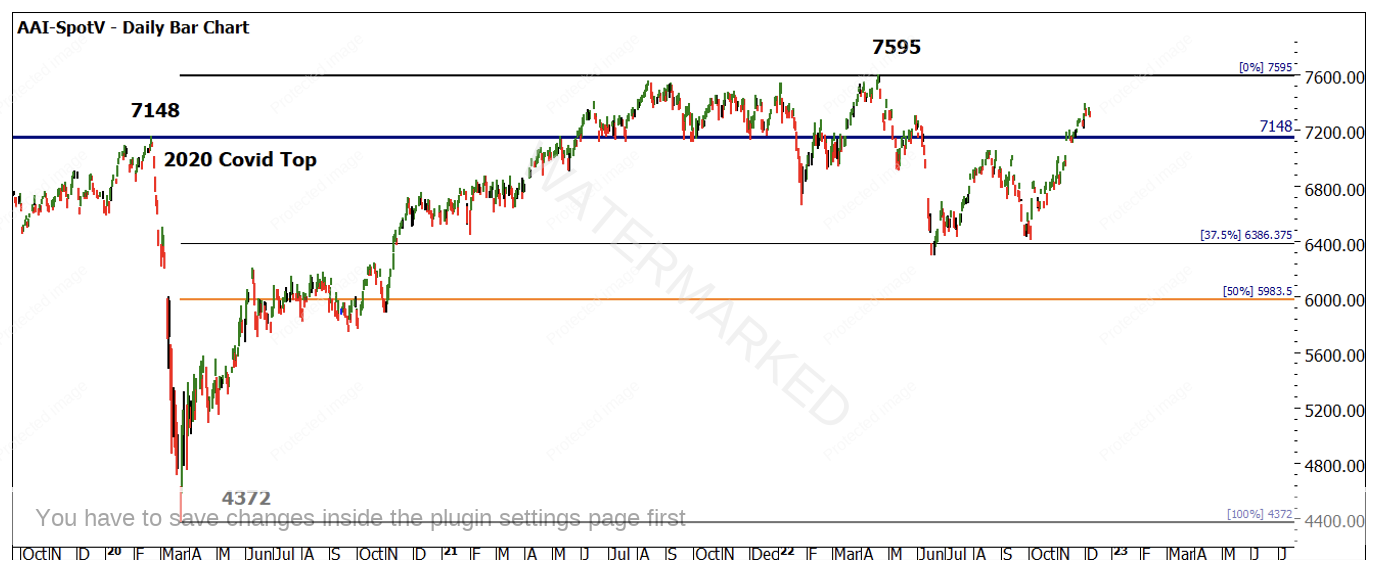

If we look over the performance of the SPI we can retrace our steps back to 2020 and the Covid top, we see that even with the bumps in 2022 we are trading above the 7148 top and if we can pull off a strong Christmas rally we may even end the calendar year with the index positive. That’s pretty solid given the year we have had with Ukraine, supply chains, inflation and interest rates.

Chart 1 – Daily Bar Chart AAI-Spotv

I am certainly not attempting to make a case for buy and hold, set and forget investing, but more to the point we have had waves in our market that have represented trading opportunities both long and short. As already mentioned, next year will throw up the same moves in markets but we need to be on top of our skill set and have a plan prepared that allows us to execute when the setups appear.

A quick follow up from the BHP discussion from the last few months, the late October low has pushed through any concern of a turn mid-November as I suggested may be importance to watch. This has enabled the long trade to continue to develop and a strong Reward to Risk Ratio of 8 to 1 is where it currently stands.

Much is made of the downside of markets and how panic and fear fill inches in news columns and markets can perform very differently. Cycles are what governs market tops and bottoms, as opposed to hot air or pessimism. The bear has not grabbed hold (yet) in Australian markets but when cycles dictate it’s time, it will of course change to the new season. We must be sure to recognise that the cycle of one calendar year is of course important to the people, as it governs much of our day to day, but the cycle of markets can be longer / shorter, and they don’t ring the bell when its changing.

Gann wrote about the importance of a December move into early January with his seasons of a market lesson. We know that volumes start to wane this time of year especially in Australia. The All-Time High of 7595 would be the next resistance level to watch with the naked eye but we can of course apply resistance cards and repeating ranges to understand what clusters exist.

As I write, the RBA has raised rates again and this will mean more pressure on the stock market as money becomes more expensive and the RBA looks to take spending pressure out of the economy, always hard to do a couple of weeks before Christmas.

The next chart positions the All-Time Lows card of 458 against the current position of the market. Chart 2 shows the heavy blue lines as full multiples of 458 and the green lines 25%, 50% and 75% levels. The current move is 1093 points in 167 days as a reference.

Chart 2 – Daily Bar Chart AAI-Spotv

Another lows card that probably doesn’t get mentioned as regularly is the 1987 low card of 1053 points, when we set this up in Chart 3, we can see the relationship of the same move in the previous chart. Added for reference we can see the current run from October to now is 125% of the previous range, expanding and maybe worthy of a retracement to refuel for another tilt higher?

Chart 3 – Daily Bar Chart AAI-Spotv

A quick study of the many articles written around the Christmas rally may provide some context of how that move may unfold, again, lessons from David and Gann on seasonality can look to anchor down the concept.

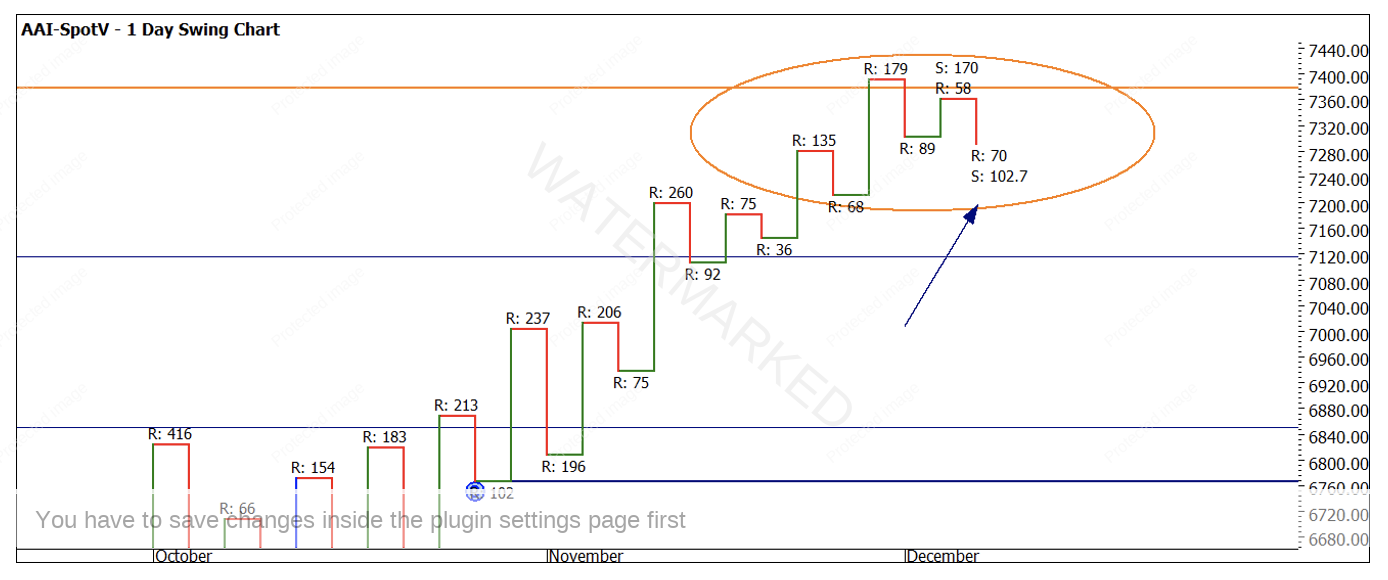

The swing chart always provides a guide for us, Chart 4 is the daily swing chart. The current move down is 70 points with the average move down over the last 10 swings at approximately 102 points. A shift greater than that may be sign of a pause in the bulls.

Chart 4 – Daily Bar Chart AAI-Spotv

Markets never sleep and so as we all move into a time with family and friends, I do hope you have a wonderful Christmas and New Year. It pays to keep an eye on markets over this period if you can, if not when you return in 2023, I hope you are refreshed, renewed and recharged for a fantastic 2023.

Season’s Greetings

Aaron Lynch