Commodities

Re-emerge

Everything that is old is new again can be a theme that we see play out in markets if you hang around them long enough. Markets are fast-paced and saturated with noise, so we are often distracted with the next big thing and can lose focus on the same old “boring markets” that may have been sideways or not as strongly trending.

I have been fortunate to see stocks come and go and that will not change anytime soon as changes occur all the time to companies as they merge, rename, or even fail in their business goals and leave the boards all together. Commodities remain a constant and they are starting to re-emerge in the collective’s eye as we see inflation and other economic factors propel prices higher and this may have slipped under the radar.

David encourages us to have an index, currency, and commodity on hand in our routine to be able to call on opportunities for our trading business. Chart 1 below shows us the value of keeping an eye on big picture positions of markets. An index of commodities that I have written about many times is the Goldman Sachs commodities index (GI-Spotv in ProfitSource). It is not really a trading chart to buy and sell the index as we would with the S&P 500 or SPI200 but it can act as a sentiment indicator for clues.

Chart 1 is GI-Spotv in ProfitSource and displays the 2008 GFC high and the 2020 Covid low as the major reference point. The 12 year move now provides us with a half way point or 50% level that could be significant in acting as support into this year.

Chart 1 – Weekly Bar Chart GI-SpotV

I always read my colleagues articles and as Mat has shared from his work at the recent MFC Congress 2023 shapes up as an exciting landscape for market moves.

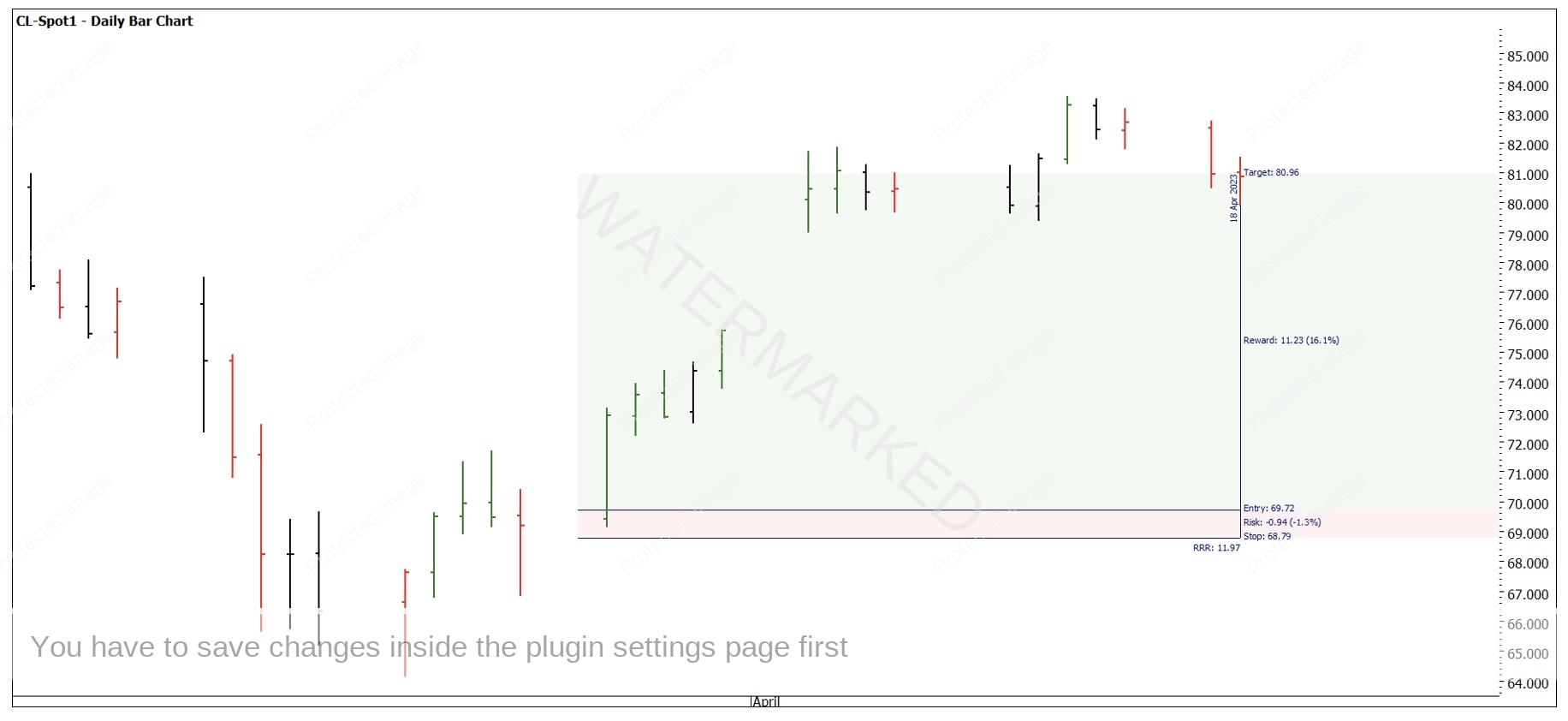

The recent move on Crude Oil should be an example of what can be achieved, that was discussed in several articles and sessions recently. Chart 2 shows, depending how you managed your entry and stops, the trade may still be open and a RRR is currently over 10 to 1.

Chart 2 – Daily Bar Chart CL-Spot1

Precious metals have been a mainstay of commodity markets for centuries now and continue to attract participation from all walks of life. The nature of jewellery use has also given way to metals such as silver becoming a more industrial focus in production as we continue to drive technology into more advanced day to day uses. I wrote recently about the banking issues and the attraction of gold. Chart 3 looks at the major highs and lows since 2020 and we can see an interesting picture.

Chart 3 – Daily Bar Chart GC-SpotV

The price action is approaching old tops and the potential for a top. If the market breaks through clearly it will be a sign of strength, however, we must respect the fact that the $2,000 an ounce price area has acted as resistance in the past.

Mat often refers to the First Range Out as an important yard stick. This can be said for price as well as time. Your homework is to take the range from the Covid low of 2020 to the all-time high and apply these price and time measurements into the current price action. It’s important to note the move up was 144 days and I have always found that natural number that we pick up from Gann’s work to be important for the Gold market.

Chart 4 – Daily Bar Chart GC-SpotV

Chart 5 breaks down the smaller picture and we see some time harmony on the smaller scale again with time frames we should be familiar with.

Chart 5 – Daily Bar Chart GC-SpotV

This all suggests we can be on alert for confirmation in the coming weeks on what may be the continuation of the current bull market or a reversal and potential short trades, as we saw in August 2020 and April 2022.

The swing ranges on the weekly chart are also suggesting some harmony so tie that in with your other work and then stalk a setup based on your trading plan. As we know, commodities valued in USD are subject to the variances of currencies as well, so this allows for us to analyse the US Dollar Index for some additional clues.

Markets abound with opportunities; don’t wait for the news to tell you the moves have happened.

Good Trading

Aaron Lynch