Look for Opportunities not Opinions

The media has its pros and cons as we all know, it’s a noble pursuit to want to tell the masses the facts about events and world history. It could be said however, that maybe that virtue is no longer the guiding principle in what we see in the news each day. Unfortunately, anyone involved needs to also make a profit, so in some cases we see that as the main priority.

I make this point based on what I am seeing and hearing in the media around finances and the economy. Yes, we are no doubt seeing many people and households coming under pressure from the changes to rates and inflation. To be clear, there are real issues out on main street, the media is making a great case in Australia talking us into a recession or worse. When surrounded by messaging like this it’s easy to take it onboard and in turn allow our thoughts to drive our actions.

Those actions could be only seeing short trades or believing there are no good long side trading opportunities available to us. We are fortunate that we can view charts that are totally lacking emotion, if we remove the name and price scale. If we look back to last month’s newsletter, I wrote about the position of some of the major US indexes. The debt ceiling was the topic of the day and we have been able to jump that issue for the moment, though rest assured there will always be another issue to take its place!

Chart 1 shows us a market, no name, no price scale. Just a chart.

A weekly swing chart over a bar chart. The major trend is uncertain, and the price action has been moving predominately sideways for the last few weeks. The price action is trading near the highest point on the chart (based on what you can see) and there seems to be some support forming around the last few bars. A quick summation would be that it is not the best tradeable trend you have seen, but also not a market that has taken a dive off the deep end.

Chart 1 – Daily Bar Chart???

The chart is the SPI 200 and the malaise of the pattern probably reflects the mood in Australia, a bit meh.

Using our trading travel machine, we can quickly jump to the US where maybe the sentiment is not as doom and gloom. The debt ceiling issue resolved quickly, and markets moved higher off that news. It would be a good review to re-read last month’s newsletter for context.

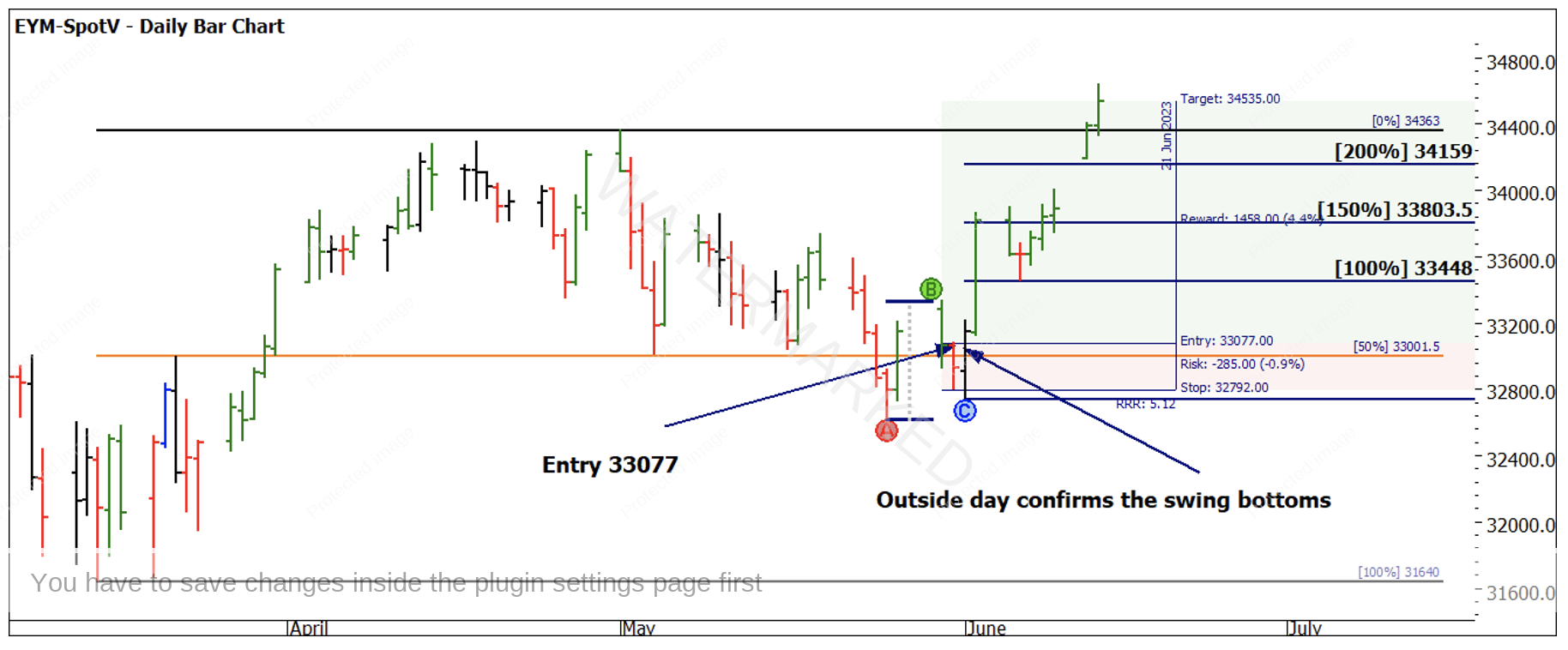

Chart 2 – Daily Bar Chart EYM-Spotv

We see the small scale 50% of the range act as support, the first higher swing bottom off support is Gann’s safest place to buy, and in this instance, you could have entered long on the outside day as it confirmed the higher swing bottom.

There are numerous ways to manage stops including intraday, but a simple strategy sees the current Reward to Risk Ratio of about 5 to 1. With over 1,400 points of profit potential this could have been a solid trading signal. The benefit has also been the ease with which trailing stops beneath swing bottoms and behind the gap would have allowed you to hold or add to the position.

An index that has been even more pleasing has been the Nasdaq. It is currently stronger than the Dow and S&P 500 when looking for relative strength. We lag the US in terms of economic headwinds so our local market may continue to underperform, this should not be a reason to buy into messages we see and hear daily.

Perhaps now might be a time to explore markets offshore for new opportunities.

Good Trading

Aaron Lynch