It’s all just a little bit of….

…history repeating! Sound familiar? Well, there was a catchy song released a few decades ago by the Propellerheads featuring Shirley Bassey which said so, but if you’ve been with Safety in the Market for any length of time you will know that one of our favorite sayings is History Repeats. There are a number of ways in which we recognize this in a market. This article gives an example.

First of all, let’s do an overview of the Trading Tutors monthly article from September 2022. The subject of that article was a price cluster from an individual contract chart of the Soybean Meal futures market. And in case you hadn’t gone and reproduced the price cluster in full, here it was:

- Ranges Resistance Card (RRC): 50% resistance level of the Range from the October 2021 low to the February 2022 high.

- Support on the old top of April 2021

- Double Bottoms (DBs) by late June of 2022

This analysis is illustrated in the ProfitSource weekly bar chart below in Walk Thru mode up until late June of 2022. Chart symbol is NSM-2022.U which was the discontinued chart for the September 2022 Soybean Meal futures contract. The final low (second of the two double bottoms) for the trade in the case study was 387.4 USD per tonne on 23 June 2022.

The resulting long trade went on to reach 75% of the previous monthly swing, to yield a very generous reward to risk ratio.

That article is still available in our archives for those who wish to go and read or revise the case study in full. And as you are about to see, even if you had missed the trade at the time of reading in 2022, the article was still worthy of a read. Why? Because a very similar pattern of analysis and trade execution has repeated itself again in 2023 in the very same market with the same kind of chart, with the same kind of reward…

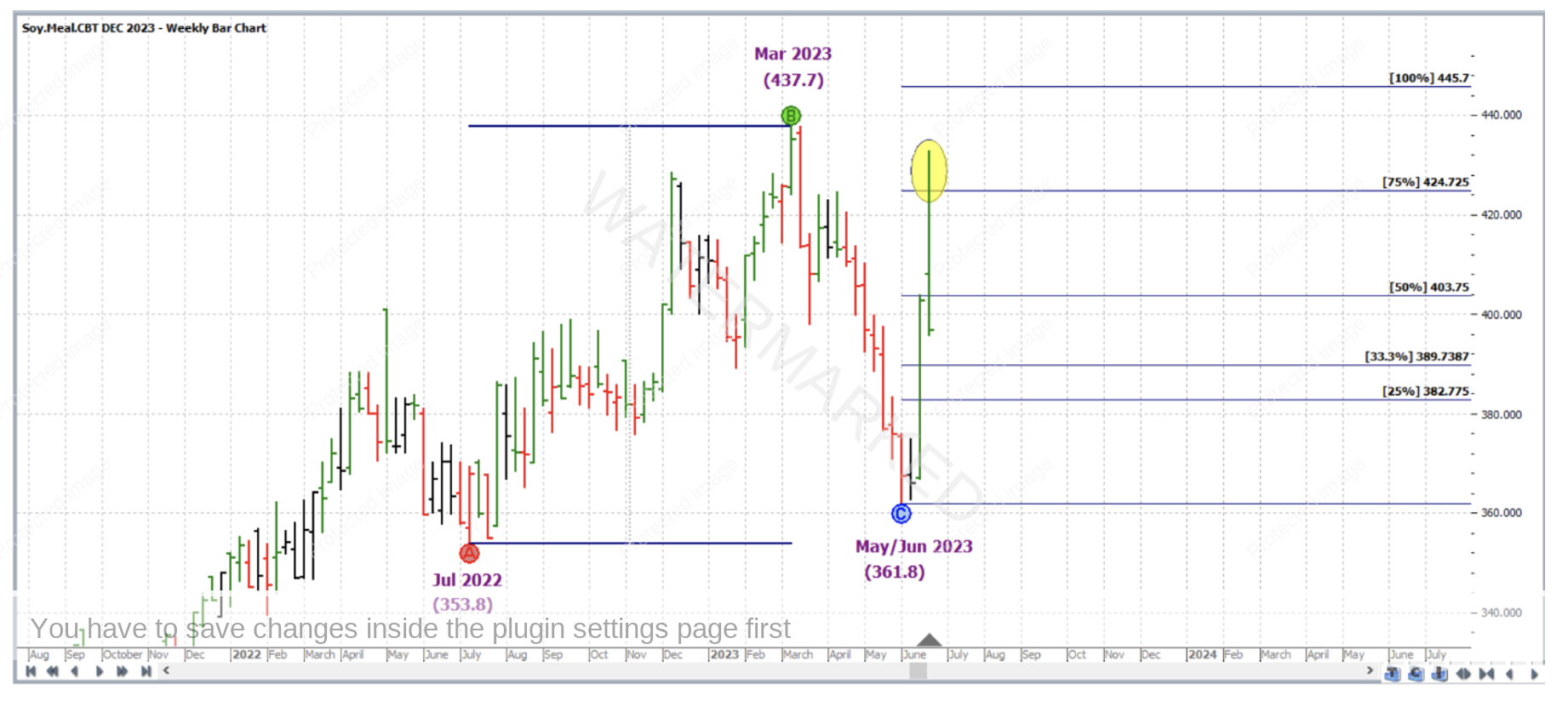

Shown below is another individual contract chart, this time for the December 2023 contract (chart symbol NSM-2023.Z), also in weekly resolution, and in Walk Thru mode up until late May/early June of 2023. Here are the inputs to its price cluster (the first two of them are the exact same type of analysis as was done prior to the trade from last year):

- RRC: 50% resistance level of the range from the May 2020 low to the March 2023 high.

- Support on the old top of April 2021

- Repeating Ranges 150% milestone – ABC Pressure Points tool, with points applied as follows:

- A: high of week ending 10 March 2023 (437.7)

- B: low of week ending 24 March 2023 (397.8)

- C: high of week ending 14 April 2023 (424.5)

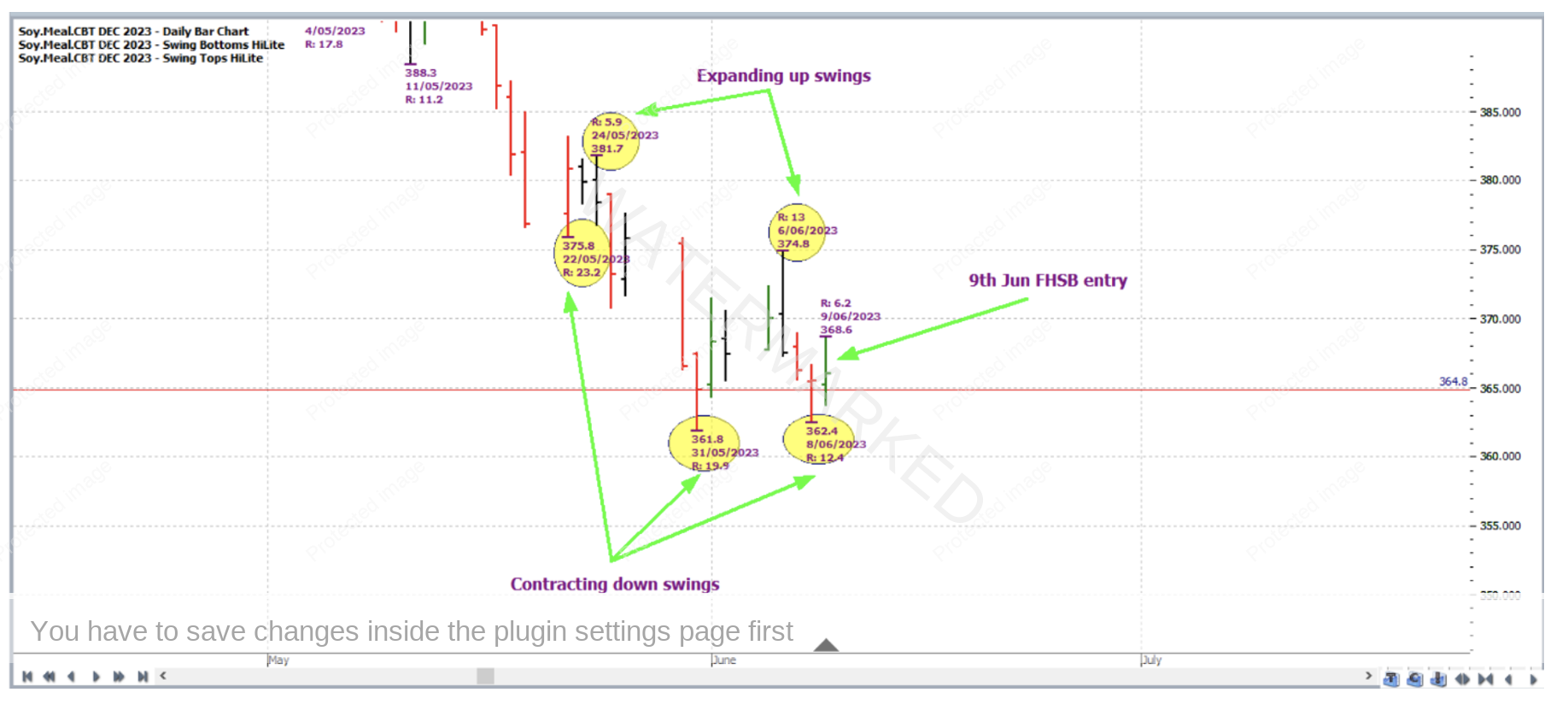

364.8 was the average of the price cluster above, and the market made a low not far from this level on 31 May 2023 at 361.8; A first higher swing bottom entry on 9 June 2023 would have had you long this market at 366.7 with an initial stop loss at 362.3; Three successive contracting downswings and two (with potentially three) expanding upswings (as illustrated by the Swing Tops and Swing Bottoms Hi-Lites) meant the daily swing chart was already starting to favour the bulls.

In this year’s trade, the market also made it to the 75% milestone (424.7) of a previous major swing, that of the quarterly swing chart.

Managing the large ABC trade Stock style, and exiting at 75% after a very quick steep run up resulted in a Reward to Risk Ratio of 13 to 1 (Reward = 424.7 – 366.7 = 58.0) / (Risk = 366.7 – 362.3 = 4.4), a 65% increase in account size (13 x 5% of account risked at entry), with the reward in absolute USD terms for trading one futures contract being $5,800 (point size of 0.1 is worth 10 USD according to the CME Group specifications). CFD brokers can offer access to this market with much smaller minimum position sizes.

In summary, the below charts in split screen mode show, side by side, the analysis and execution of the trades from last year and this year.

On both occasions the market retraced to 50% a major range. On both occasions the market bounced off an old major top.

On both occasions the market made it to the 75% milestone of the previous major swing range.

It’s all just a little bit of history repeating…

Work hard, work smart.

Andrew Baraniak