At this point, we would like to introduce you to a couple of friends. This is a tale of two investors or “traders” as they often like to be called once they start doing it a lot.

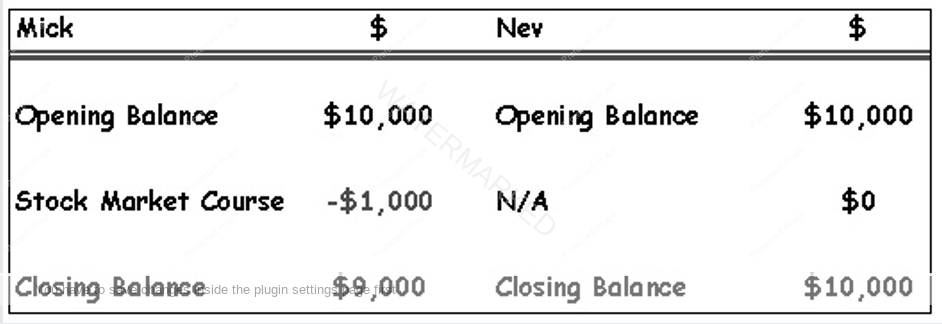

Both of these gentlemen have saved a bit of money and both of them have decided that they can afford to put aside $10,000for trading on the stock market. While this is a significant amount of money for both of them, they are able to put it aside for investing without jeopardising their current financial position. This is important because it is well known that you should never risk money that you cannot afford to lose.

The first of these traders is Michael. Most of his friends call him Mick.

Our second trader is Neville or better known as “Nifty Nev”.

The only difference between these two investors is that Michael has decided that he will spend some time learning about the stock market before he starts. He decides to buy an investment course for $1,000. While this does represent 10% of his money, he figures that he will be able to do better with $9,000 if he knows what he is doing than he would with $10,000 if he does not.

Nev on the other hand figures that he has always been good at these types of things. He reckons that he’s just a lucky type of guy, and besides he has a few friends in the industry that often give his other mates tips and they tell him they are doing well.

So before we begin, let’s have a look at their investment accounts.

One of the first things that Michael learnt in the investment course he purchased was some of the principles of money management. Only good money management allows you to protect your capital and hang onto any gains you make.

Trade #1

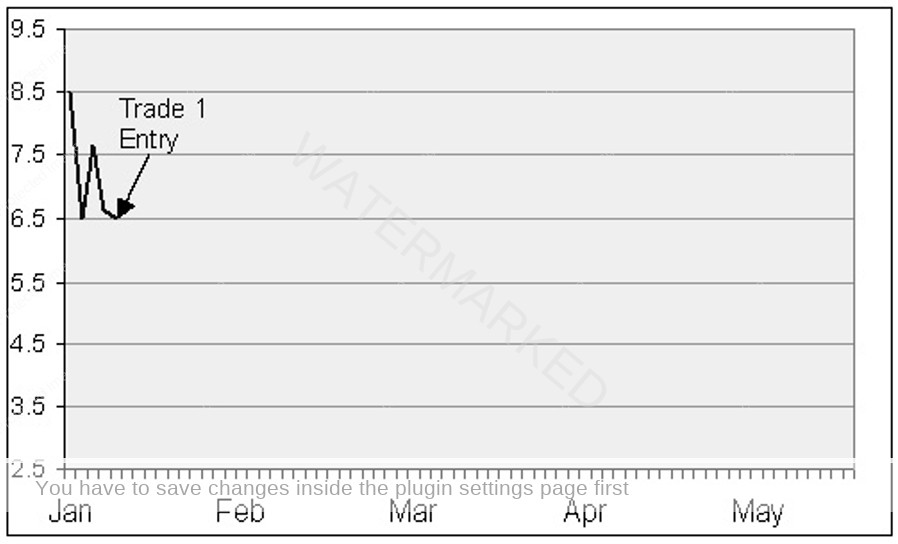

Both Mick and Nev have been following a stock called “XYZ” and are looking to take a trade.

Our traders have identified that XYZ has dropped down $2.00 since the beginning of January. You can see this on the chart below.

Both the traders reasoned that since the share price of XYZ had fallen so sharply that it would probably be a good buy.

Neville jumped right in and bought 1,000 shares at $6.50 costing him a total of $6,500.

On the other hand, Michael was still studying his stock market course and knew that he probably had more to learn, however he couldn’t resist taking the trade, which he felt was a good one.

Michael had however learnt some lessons already and he knew that he should not commit such a large portion of his money to one trade. He made sure that he stayed within a limit of 10% of his capital.

Consequently, Michael bought only 130 shares at $6.50, which cost him $845. This was equal to less than 10% of the $9000 he had in his account.

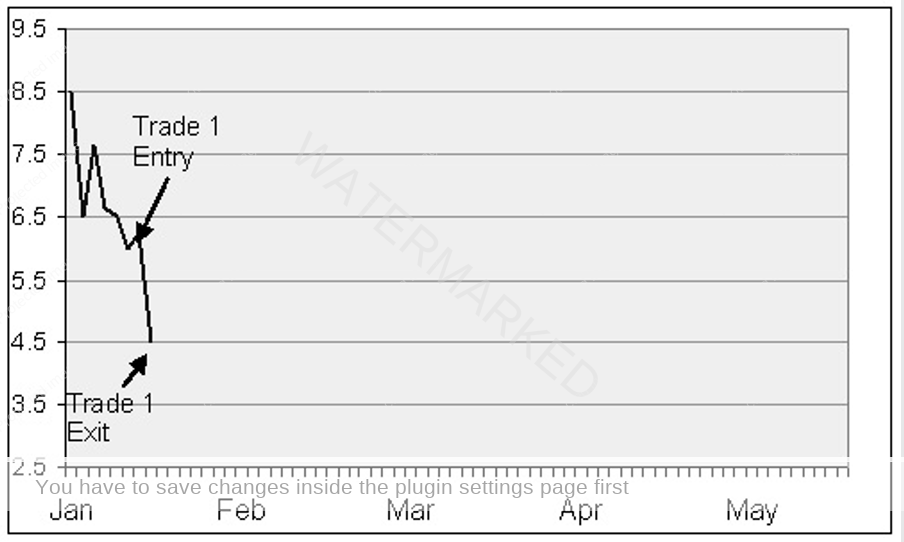

As it turned out the price of XYZ shares did start to move up, but only briefly. The stock was actually in a down trend and after moving up $1.00 it quickly reversed and moved down to $4.50 within a couple of weeks.

Both Michael and Nev knew that they had made a mistake and sold their shares in XYZ at $4.50.

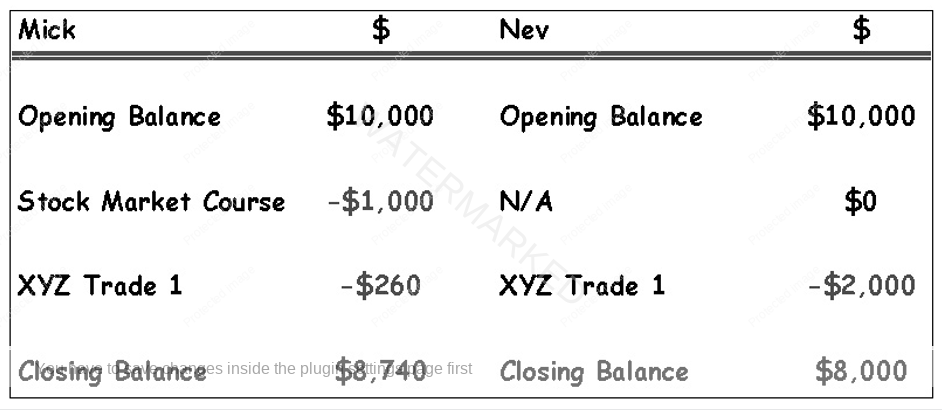

Nev had lost $2,000 but Michael had lost only $260 because he had limited his risk. Even though Michael had lost some money he was pleased that he had used the first money principle that he had learnt and it had worked!

He felt that his stock market course had already paid for itself by saving him from losing money.

Let’s look at the trading accounts of our two traders after their first trade.