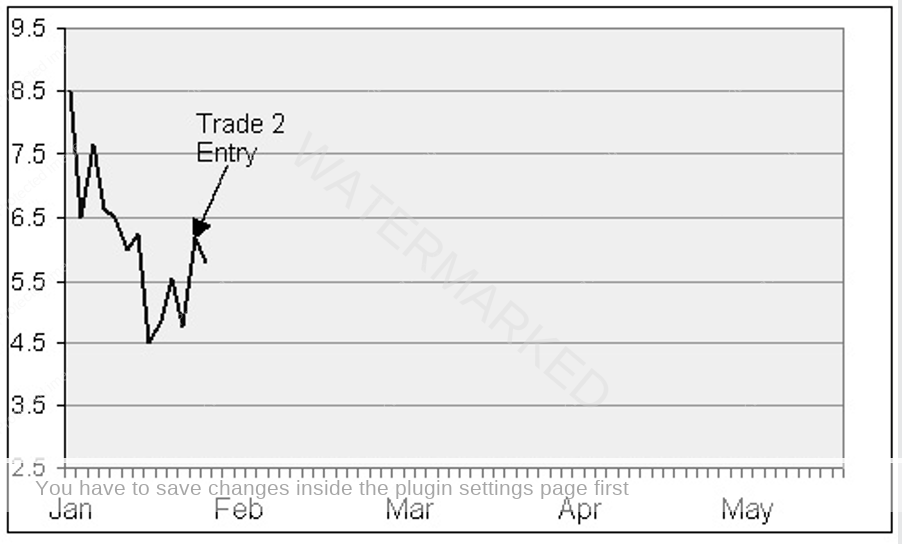

For their second trade both of our traders have chosen to invest in XYZ again. Given that it has begun to move back up they believe that it has reached its lowest level and should continue on its way up.

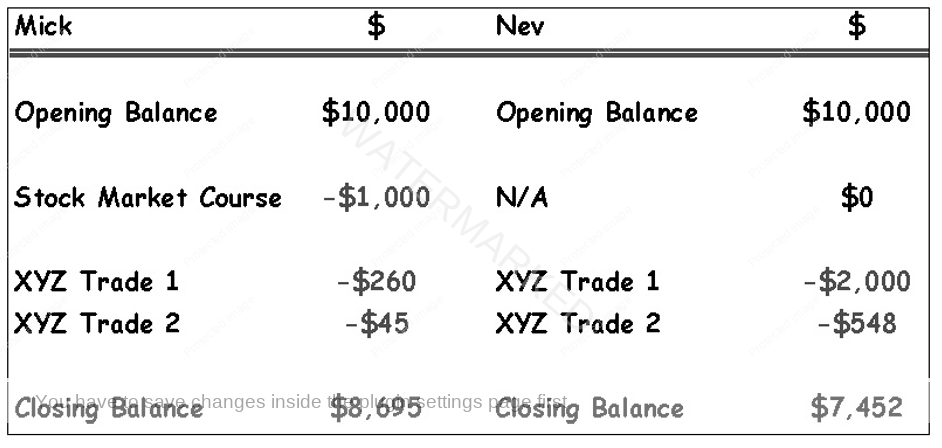

Michael has been studying his course further and now understands that not only should he limit the amount of his investment, he should also be very careful to keep his losses small. Correspondingly he has committed himself to losing a maximum of 5% in any trade.

Looking at the chart again we can see that XYZ has now moved to $5.80.

Michael calculates that if he buys the stock at $5.80, the maximum loss of 5% that he could accept occurs if the price goes below $5.51.

He buys 150 shares at $5.80 costing him $870.

Nev on the other hand was a little shell-shocked that he lost so much money in his last trade. He has realized that he shouldn’t put so much of his money in one trade but he still has no strategy to limit his losses.

Nev buys 200 shares at $5.80 costing him $1,160.

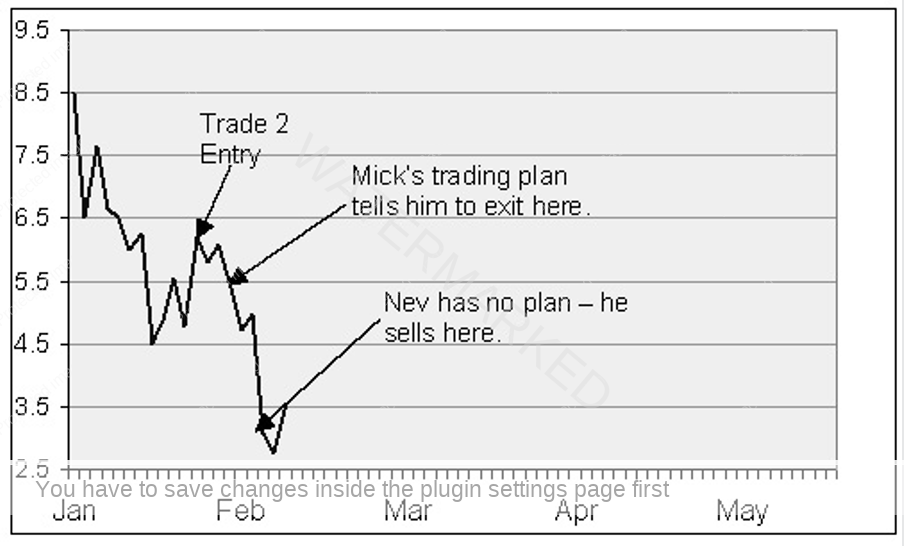

Once again the market makes its own decisions and not long after our traders buy the stock it promptly turns around and heads down.

As soon as the market goes down past $5.51, Michael sells all of his 150 shares at $5.50. He has made another loss but it is only small because he got out where he set his limit.

Nev on the other hand is not sure what to do. He believes that the share price must surely go back up. He doesn’t want to admit that he was wrong and holds onto his shares hoping they will go up.

Our chart below shows what happens.

A couple of weeks later the price of XYZ has slipped all the way to $3.06 and Nev can’t stand the pain any longer. He sells his shares and works out that he has recorded a loss of $548. Let’s look at the accounts.