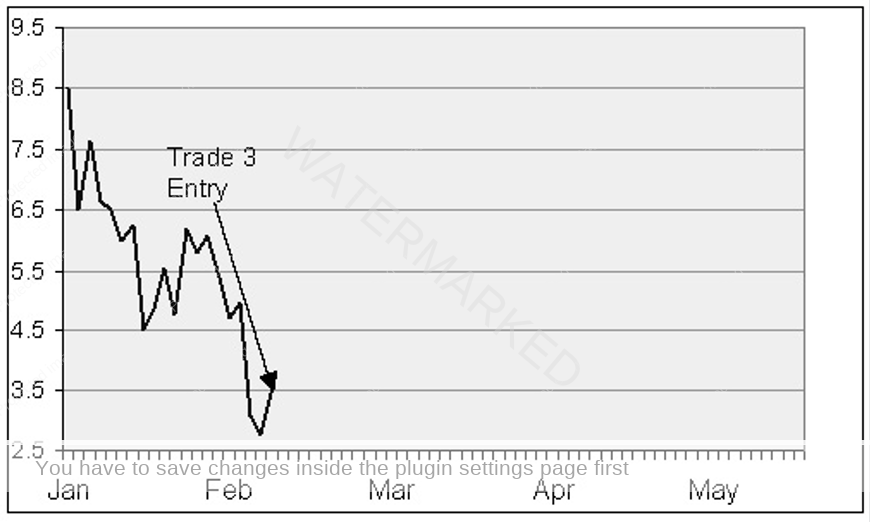

Both of our traders are very stubborn and have decided to stick with XYZ for their third trade. The share price is currently around $3.55.

Michael has been very encouraged by his first two trades even though he lost money, because he has seen the effect of his new knowledge in protecting his capital. He has gone further with his studies and has decided to add a 50% profit target. This will mean he has to sell his shares when XYZ goes past $5.32.

While this is quite ambitious, Michael has looked back at the way that the chart of XYZ moves and is confident that this is a reasonable objective. He buys 240 shares at $3.55 for a total cost of $852.

For Neville it is a different story altogether. After his first two trades he has lost over a quarter of his money and he is not really any wiser. Because he has no plan, he has no yardstick against which to judge and adjust his investment method.

He decides that he will buy 200 shares at $3.55 for a total cost of $710 because he is sure that XYZ will not go down any further.

After entering the trade, both Michael and Nev are very pleased to see the price of XYZ shares move sharply upward.

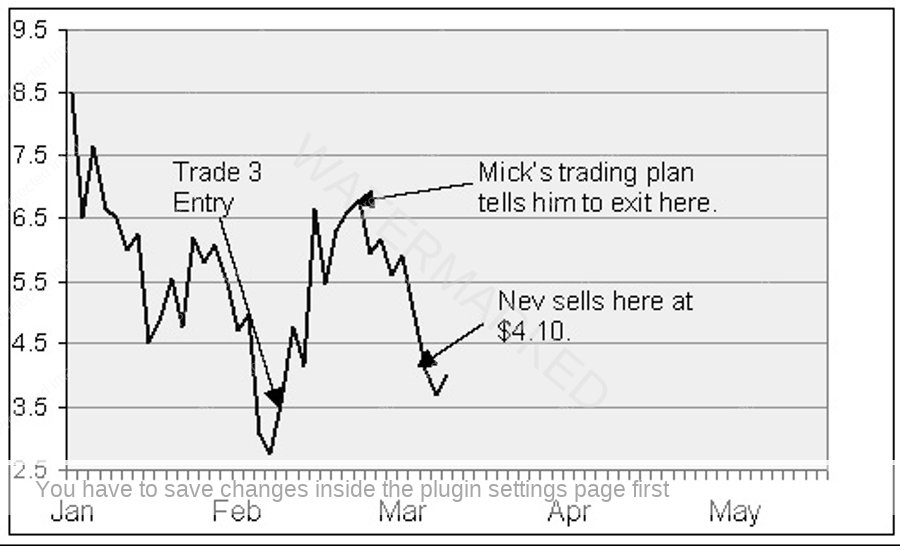

The company XYZ has made an unexpected announcement that will see the company’s profits increase sharply. The share price moves strongly up to $4.50 and then, after another positive announcement spikes up to $6.65.

This is way past Michael’s profit target of $5.32 and so he must sell his shares. This seems very difficult to do because it looks like the XYZ price is going from strength to strength. Michael can feel his greed pushing him to hold his shares and disregard his plan but he forces himself to stick to it and sells the shares at $6.65 for a profit of $744.

Neville is sure that he is on a winner this time. He is very excited and tells all of his friends how successful his trade has been (he forgets to mention his two earlier trades of course).

However, Neville has spoken a little too soon. The market starts to move back down again. After going up to $6.80, it then starts going down and continues going down for the next month.

Neville has had his emotions in turmoil and finds that he is very indecisive. He does not want to admit that XYZ is going down and hopes it will go back up.

Finally, he cannot take it any longer and sells his shares at $4.10 for a profit of only $110. If he had sold his shares earlier he could have made a profit of up to $650 but he had no plan as to when to get out.

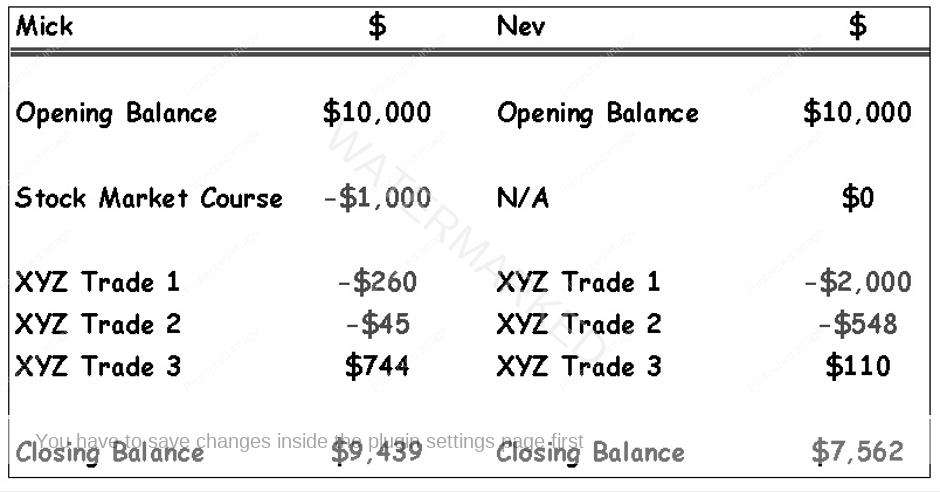

When we look at their accounts, we can see that even though they have both had two losing trades and one winning trade, Michael’s trading plan is starting to pay dividends. He has now made a profit of $439 on his $9,000.

Neville on the other hand is not looking so good, with a loss of $2,438 on his $10,000.