It’s been only a few days since Nev closed his last trade and given it was a winner, he’s looking forward to placing another trade. Despite the fact he has lost nearly a quarter of his capital, Neville is feeling very confident because his last trade was a winner. It’s human nature to see things the way we want to see them.

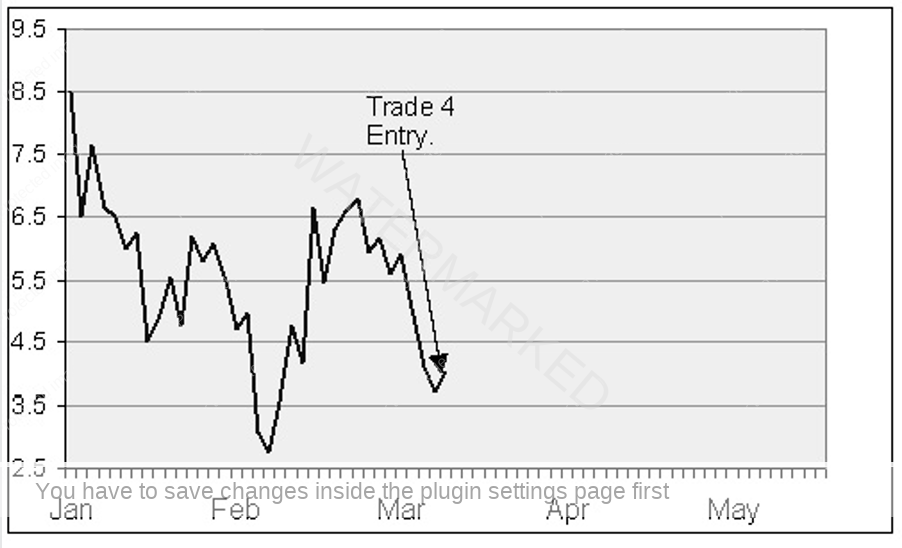

Michael has not been in a trade for several weeks now because the XYZ stock has been moving consistently down, but having watched the last few days he believes it is ready for a move up and so he is looking for a trade as well.

On the other hand, Neville is still flying by the seat of his pants. There is nothing really intelligent about the way he is approaching his investments. He is essentially gambling and the only thing he has learnt is that he needs to keep his ‘bets’ small so he doesn’t get wiped out. He decides on 200 stocks for a total investment of $798 (which is still more than 10% of the money he has left).

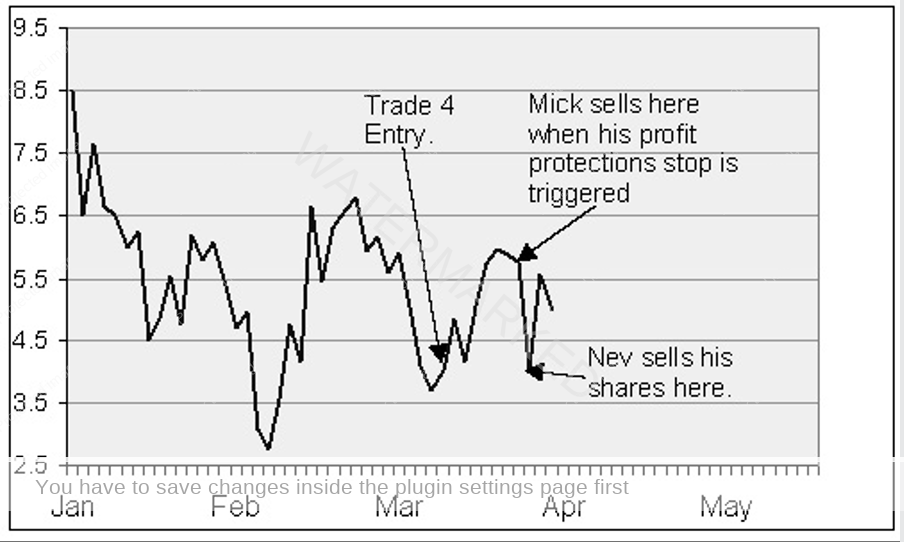

After a couple of weeks, the price of XYZ has moved up to $5.98, which is nearly at Michael’s 50% profit target of $6.00. He is getting ready to exit his position but he also knows that he has to adjust his profit protection stop of 10%.

Michael calculates that he has an unrealised profit of $1.99. Therefore, he calculates that his profit protection stop is at $5.78, which means that if the price of XYZ goes below this level he must sell his shares and keep the remaining 90% profit.

The next couple of days sees the market move down to $5.77 and Michael sells his shares because his profit protection stop has been triggered. He has decided to be conservative and uses a profit protection stop of 10%, so that the value of his unrealised profits will never fall below 90%.

Neville has committed a cardinal sin. He has let a profitable trade turn into a loss.

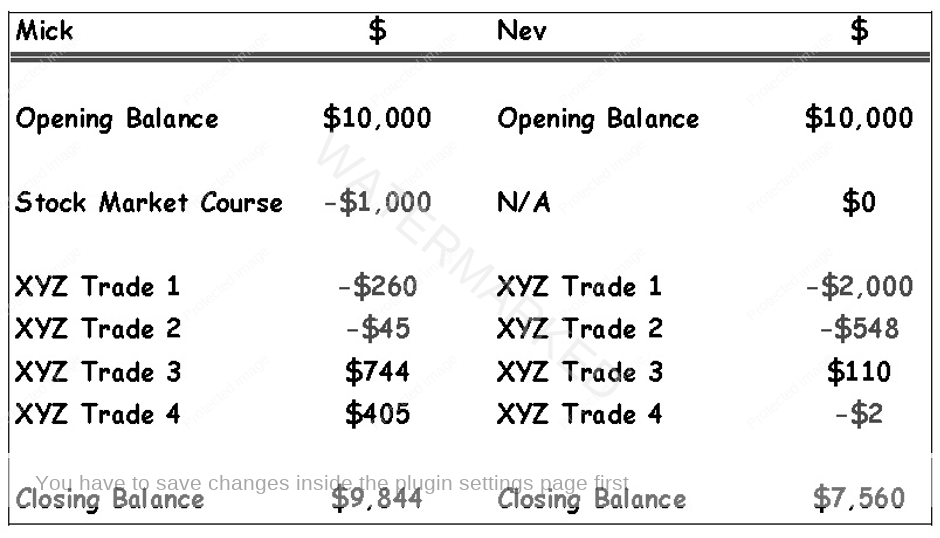

Let’s have a look at their accounts after 4 trades.