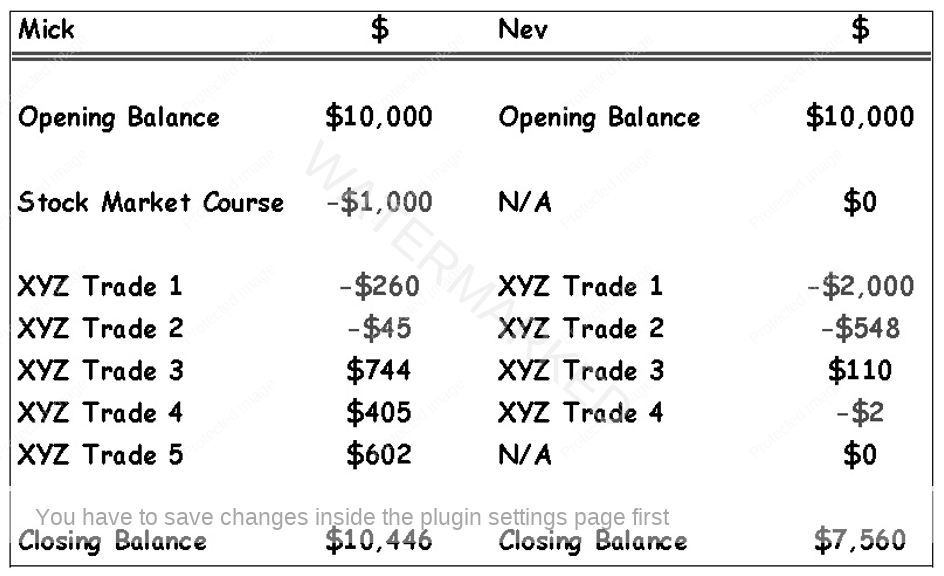

After his last effort Neville has become very unsure of himself. It’s not really the fact that he has lost a bit of money, its more that he feels “lost at sea”. Because he never really had a plan, he has no way to measure what he has done so far and compare it against what he should be doing. He is starting to lose his interest in trading altogether because it is certainly not fun to lose money or to feel out of control.

Michael, on the other hand, is beginning to feel like he might yet become a successful trader. He knows that he will have losses but he feels that he can deal with them.

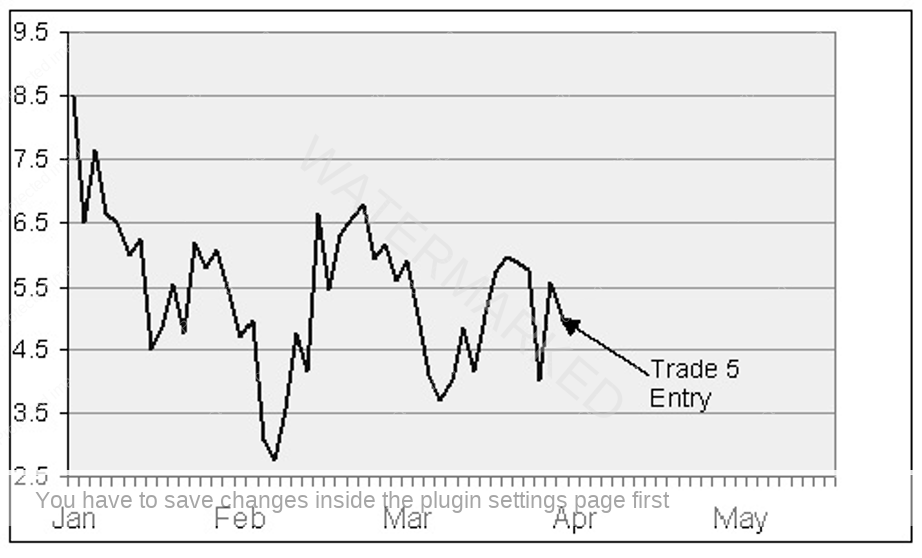

The latest stage of his investment course has been focusing on technical analysis and with some of this new information, Michael has gone back over the price chart of XYZ. He sees one of the pattern signals that he has learned about and that he believes increases his chances of picking the winning trades.

Based on this information, he decides to enter the trade, buying 190 XYZ shares at $4.98 for a total cost of $946, which is still less than 10% of his account. He also sets a stop loss, a profit target and implements a profit protection strategy.

Neville who has no way of identifying trades other than ‘gut feel’ misses this one and stays on the sidelines feeling rather disillusioned about the whole “trading” thing.

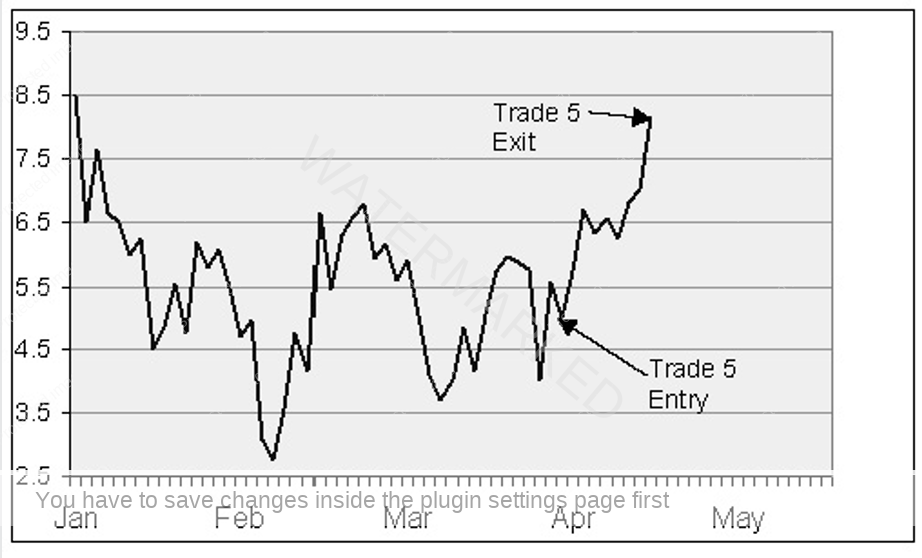

As it turns out, Michael’s work has paid off and he has entered the market at the right time. Over the next couple of weeks, the share price of XYZ moves up strongly on good news for the company.

Michael’s profit target of 50% is $7.47 and by mid April the stock has jumped to $8.15. He feels that the stock has a lot of upward momentum and is likely to go higher. It is very hard for Michael to stick to his plan…but he does selling out at $8.15.

Michael shouldn’t feel too disappointed. He has just made a profit of $602 on one trade after investing only $946. That’s equivalent to making 63% in only a few weeks. There is no way he could have made that sort of interest leaving his money in a bank.

Nonetheless, from what we’ve seen of Michael, he seems like a pretty persistent guy and it won’t take him too long to adjust his trading plan. Actually, he’ll learn that you probably never stop adjusting and refining your trading plan. However, the most important thing is to have one to begin with.

So, based upon his technical analysis, Michael is working to pick more winning trades than losing trades. It obviously worked for him in this trade and is certainly better than guessing. Importantly though he realises that technical analysis won’t get it right every time either and so it’s critical to have his stops and money management rules in place as well.

So after the 5th trade, let’s consider the accounts of our two traders.