Before we leave the tale of our two traders, there is one more interesting twist!

Good old Nev, who’s just about given up on the whole thing and hasn’t even looked at the market for weeks, gets a tip from one of his mates. He has a friend that works at XYZ and he reckons that they are about to announce a big deal that will send the share price well past $10.

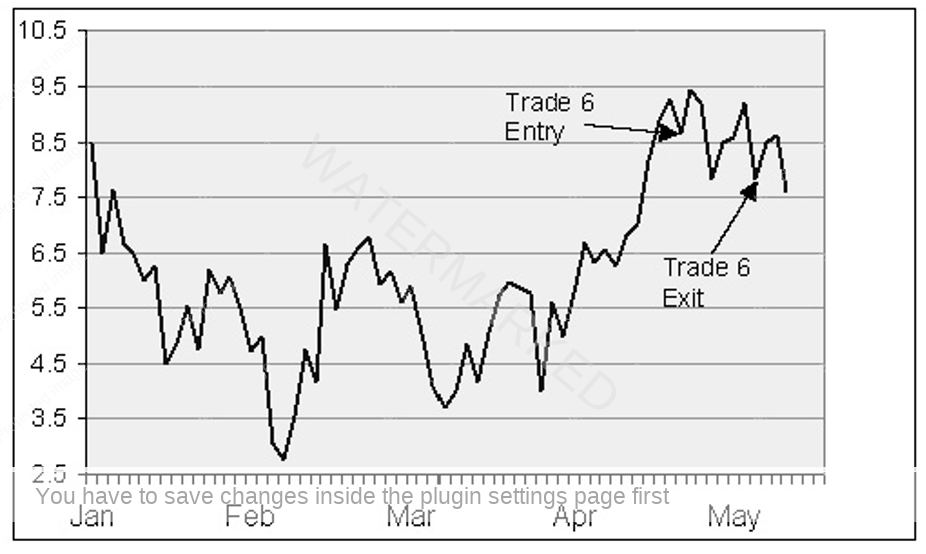

Neville, who hasn’t really had a reason to trade, suddenly has his interest in XYZ rekindled. This is a sure way to recoup some of his earlier losses. He hurries to call his broker and finds out that XYZ is trading at $8.65.

Although he is a bit nervous, he doesn’t want to miss out (Nev has the whole fear and greed thing going again) and he buys 300 shares at $8.65 which costs him $2595, more than 30% of his remaining capital.

Over the next couple of days, the price does rise a bit, however the company makes its announcement and the share price does nothing but trade sideways for a couple of more days.

Neville is at a bit of a loss. He had no real plan for getting in… it was a tip after all, and he has no plan for getting out. Consequently, Neville just holds onto the stock hoping it will go up.

After a few more weeks the share price has slipped down to $7.59 and Neville sells out blaming his mate’s bad tip for his misfortune.

Michael never got involved in this trade. His technical analysis had not given any signals on XYZ so he’s been off looking for signals in other stocks.

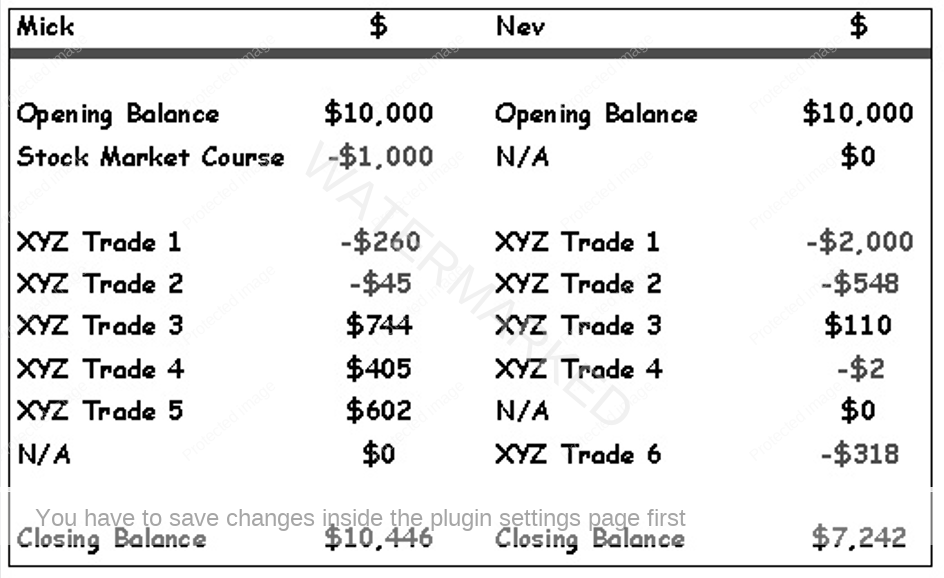

As a result, we can see what each of their accounts now looks like.