An important tip that Michael picked up in his investment course was to document as much as possible about each trade he made so that, regardless of whether the trade made a profit or not, he could go back and review the circumstances under which he made decisions. He knows that it is important to keep tabs on himself. Once he had finished a trade and was away from the emotion of making decisions about his money he was able to take an unbiased eye to actions and motivations.

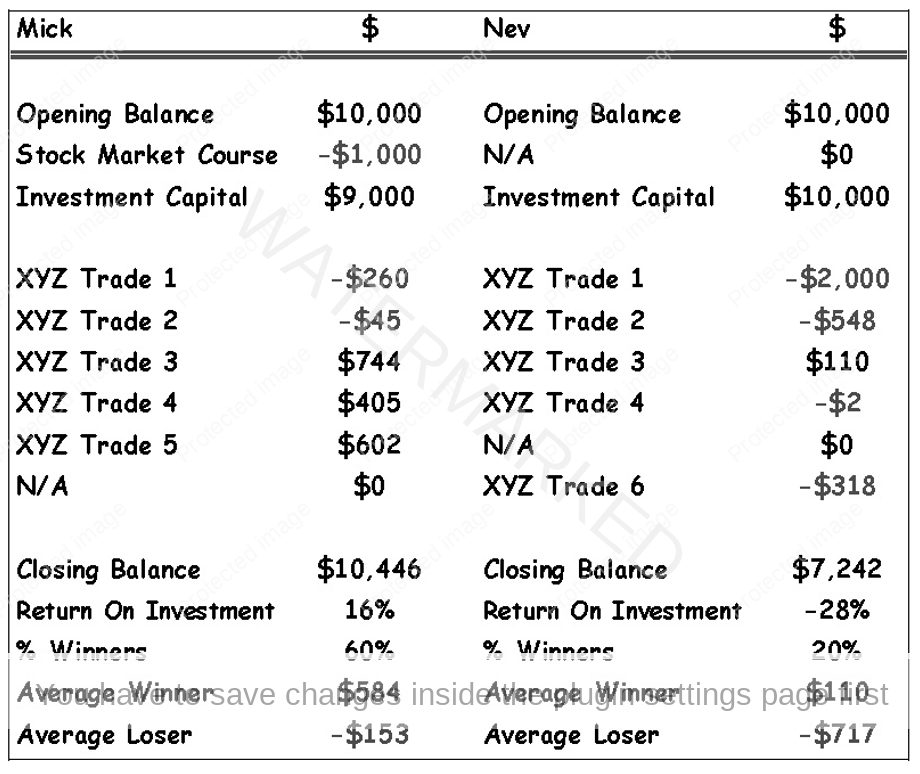

Let’s take a look at the results of our traders and apply some really simple analysis.

Michael managed to win on 60% of his trades. This tells us that even if he was winning or losing the same amount of money on every trade, he would be ahead.

Even better than that, we can see that Michael has managed to keep his losses small in comparison to his wins. The average winning trade was $580 while the average losing trade was – $150.

If Michael could stick to his system and maintain these types of results he could earn a substantial income from trading. As his account grew bigger he would be able to afford to trade larger parcels of shares and his profits would also increase.

Neville on the other hand is a different story and unfortunately is representative of a lot of people that try to get involved in trading their own investments.

Neville made a few major errors:

- He failed to properly educate himself

- He failed to keep any records

- He failed to do any analysis and learn from his mistakes

Consequently, he had more losers than winners and his losers were way bigger than his winners.

Neville will probably not try trading again. He is very unlikely to take responsibility for the fact that he lost his money and will probably find other people to blame or other reasons why he lost money – all because he didn’t take the time to get some basic “Investment Know-How”.