In the constantly changing world of trading, where decisions must often be made in seconds, having a well-tested strategy can be a game changer.

One of the most valuable tools in a trader’s toolkit is Backtesting. David Bowden, Founder of Safety in the Market, tells us very early in our first training manual, the Smarter Starter Pack – “Get to know your stock or your commodity like a cow knows her calf. That is the best advice I can give you. The market is a living thing. If you get to know it – to live it and to love it, it will be your friend – otherwise look out.”

One of the best ways to get to know your market is through backtesting. The backtesting process involves applying a trading strategy to historical market data to assess its potential performance. But why is backtesting so crucial? Let’s explore the key reasons why every trader should make backtesting a fundamental part of their trading routine.

1. Strategy Validation: Proving Your Concept

Backtesting is the litmus test for any trading strategy. By simulating trades using historical data, traders can validate whether their strategies would have been profitable in the past – and it can help you identify the best way to trade a particular market. As David Bowden tells us, “the market is a living thing” and each stock or commodity has its own idiosyncrasies.

This step is essential to ensure that a strategy has the potential to work in real market conditions. Moreover, backtesting helps identify any weaknesses or inefficiencies in a strategy. This knowledge allows traders to refine or even abandon strategies that do not perform well, saving time and money.

2. Risk Management: Understanding Your Exposure

One of the primary concerns for any trader is risk. Backtesting provides a comprehensive view of the risks associated with a particular trading strategy. Backtesting allows you to test things like the best place to put a stop loss and the best way to manage them as a trade unfolds, as well as things like the best places to exit a trade for a profit.

3. Performance Metrics: Measuring Success

Backtesting generates crucial performance metrics that help traders evaluate the effectiveness of their strategies. These metrics include total returns, average return per trade, profit/loss ratio, and consistency over time. By comparing these metrics across various strategies, traders can determine which strategy adds the most value to their bottom line. These insights are invaluable for refining trading approaches and making informed adjustments.

4. Optimisation and Refinement: Fine-Tuning Your Approach

No strategy is perfect from the outset. Backtesting allows traders to optimise their strategies by fine-tuning various parameters, such as average market ranges, stop-loss levels, and entry/exit rules. This process helps improve the strategy’s performance and adaptability to different market conditions. Whether in bullish, bearish, or volatile markets, a well-optimised strategy can significantly enhance profitability and reduce risks.

5. Confidence Building: Trusting Your Strategy

Confidence is key to successful trading. Knowing that a strategy has been rigorously tested through backtesting builds trust and assurance. This confidence is crucial when it comes to executing trades in live markets, as it reduces the likelihood of emotional decision-making and impulsive actions. A tested strategy helps traders stay disciplined and stick to their plan, even during turbulent market conditions.

6. Cost and Time Efficiency: Save Resources

Backtesting is a cost-effective way to evaluate multiple strategies without risking real capital. It provides rapid feedback on a strategy’s effectiveness, allowing traders to make quick adjustments and learn from their mistakes. This efficiency saves both time and money, making it an essential tool for traders of all experience levels.

7. Historical Insight: Learning from the Past

Markets often repeat certain patterns and behaviours. Important factors that back testing can highlight include things like the average range markets like to move in from extreme tops and bottoms, repeating numbers, repeating ranges and dates, and how it reacts at certain price levels. Despite what you’ve previously been told, Markets are NOT random and the market leaves clues. Backtesting will help you identify them.

By backtesting a strategy across different historical periods, traders gain valuable insights into how their strategy would have performed during various market scenarios, including financial crises or significant rallies. This historical perspective helps traders prepare for future market conditions and refine their strategies to better navigate potential challenges.

So How Do You Back Test a Market?

This is where having a charting software program can prove invaluable.

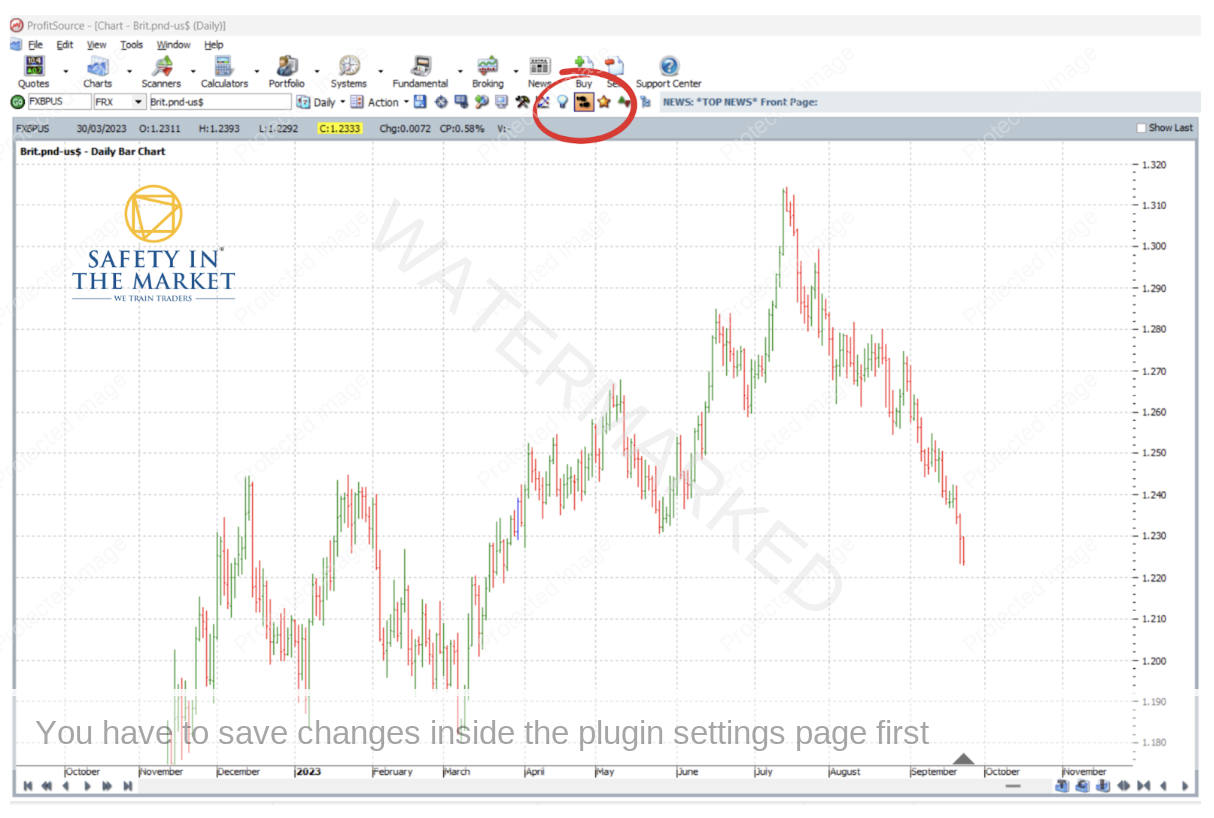

At Safety in the Market we recommend ProfitSource with a special SITM Module that includes our tool kit of indicators and drawing tools. ProfitSource has a ‘Walk-Thru’ mode where you can select a starting point and watch the bars of a market unfold day by day in as little as one every second so you can test with ‘real time’ data, without waiting days for it to unfold.

You can find it here in ProfitSource:

If you’re just starting out on your trading journey, and wanting to keep your costs down, TradingView is a great FREE option.

In their FREE version, you can access some of the smaller time frame charts – down to as small as a 1 minute chart, and it has a lot of the functionality of the paid memberships.

It has another great FREE functionality we love and that is the ability to ‘Rewind’ a market (button found in the top menu bar) and see how the charts unfolded. This is an excellent way to backtest a market strategy you’re working on.

It’s easy to get started – Just go to TradingView.com and sign up for a free account and if you do decide to purchase a paid subscription you’ll get a small discount using this link.

Once you’ve chosen a market and a means to back test, you can then work your way through your various trading strategies to test it. You could just focus on testing one thing at a time, for example Stop Loss Management, and seeing where the best and safest place would be to place your stops. Or the best places to enter a trade.

Conclusion: Backtesting as a Foundation of Trading Success

While backtesting is a powerful tool, it’s important to remember that past performance does not guarantee future results. Markets are forever changing, and unexpected events can impact even the best-laid plans (That’s why, at Safety in the Market, we ALWAYS recommend you use a stop-loss in your trading!).

Nonetheless, backtesting remains an invaluable practice for validating strategies, understanding risks, optimising performance, and building confidence. In fact, many of our advanced students that are now professional traders still use Backtesting as an important part of their trading arsenal. It’s still one of the best ways we recommend to ‘get to know your market like a cow knows her calf’ as David Bowden suggests.

By integrating backtesting into your trading routine, you can make more informed decisions, manage risks more effectively, and ultimately, give you the insights you need so that you can trade with confidence and increase your chances of success in the markets.

If all of this is sounding foreign to you, then it’s something we cover extensively in our FREE short course – Trading Plan Tune Up. It’s ideal if you’re just starting out in trading, or maybe you’ve been trading for sometime and just aren’t getting the results you want.

Using the principles taught in this free course, many of our students, even at the foundational level, are achieving 10 to 1 Returns on their trades.

Broken down into bite sized modules, in this three hour online introductory course, here’s what you’ll learn:

✅ Why it’s so important to have a Trading Plan and how it will give you the focus, clarity and confidence you need to be able to escalate your trading returns

✅ We will guide you through the steps to develop your own effective Trading Plan and you’ll be privy to the exact Trading Plan our students use.

✅ You will gain insights and strategies for determining the optimal entry and exit points for your trades, along with stop loss management approaches.

✅ You’ll learn why the Reward to Risk Ratio of your trades is so important, how to calculate it and how to use it to give you the exact entry and exit points of your trades

✅ You’ll learn how our students aim for, and achieve 10 to 1 or greater returns on their trades – safely, while using the market’s money and protecting their capital.

As an extra bonus,

✅ We will introduce you to the basics of Price Forecasting (yes it is possible!)

👉🏻 Ready to learn how to trade the Smart Way?

Normally priced at $199, it’s currently available for FREE for a limited time. If you’re looking to improve your trading results or start on the right path, our Trading Plan Tune Up may be just what you need.

You can access it here: Trading Plan Tune Up

Refine Your Strategy with Backtesting—Unlock Your Trading Success

Backtesting is essential for honing your strategy and enhancing your trading performance. The Active Trader Program equips you with time-tested strategies and tools to confidently test and perfect your approach, setting you on the path to success. Order your copy Today!