Who Was WD Gann?

William Delbert Gann, usually referred to as WD Gann, attained legendary status as a market operator on Wall Street between 1902 and 1955.

He was born in East Lufkin Texas on June 6, 1878, which at the time was cotton growing country. He came from a family of modest means and had an interest in mathematics and the sciences from an early age. His mother taught him to read using the Bible – a book that was to later influence his analysis of the markets. He spent his teenage years working as a cotton warehouse clerk, where he was introduced to commodity trading.

In 1902, at the age of 24, W.D. Gann made his first commodities trade in cotton, the market he knew best. This was to become the start of a long and legendary career as a trader, speculator and educator.

In 1908 he moved to New York City and it wasn’t long before he opened his own brokerage firm, W.D. Gann & Co.

Over the next 53 year, Gann is reported to have taken over $50 Million from the market. It has been reported by a colleague who worked with Gann in the last eight years of his life, that approximately 2/3rds of the money he made was for clients and 1/3rd he made for himself.

In the month of October 1909, Richard Wyckoff, who was one of the most respected writers on the stock market at the time and Ticker and Investment Digest editor, asked Gann if he could follow his trading for a full month and report on his finding.

During this time, Gann executed 286 trades on various stocks, both long and short side trades. He profited on all but 22 of those trades. By the end of the 25 day period (back then, the markets traded on a Saturday) his starting capital had increased by 1,000%.

Gann was influenced by his upbringing in rural Texas, where he developed a strong work ethic and an interest in observing natural cycles, which he started to recognise in the financial markets. While most technical trading systems used today are based on Price, Gann based his methods on Time AND Price, making it possible to determine not only the best price point to exit or enter, but also WHEN a market is likely to change trend. Such was the accuracy of his methods that in 1933 he made 479 trades, of which 422 were winners and 57 were losers. His return on capital was 4,000%.

During the month of October, 1909, in twenty-five market days, Mr. Gann made, in the presence of our representative, two hundred and eighty-six transactions in various stocks, on both the long and short side of the market. Two hundred and sixty-four of these transactions resulted in profits: twenty-two in losses.

The capital with which he operated was doubled ten times, so that at the end of the month he had one thousand per cent on his original margin.

In our presence, Mr Gann sold Steel common short at 94-7/8, saying that it would not go to 95. It did not.

On a drive which occurred during the week ending October 29, Mr Gann bought Steel common at 86-1/4, saying that it would not go to 86. The lowest it sold was 86-1/8.

During his early career, Gann experienced great success more than once, but he also experienced some hardship. At one point, the brokerage firm at which he held his account was bankrupted as a result of the spectacular failure of another legendary trader. This would not be the only time he would rebound from a major setback.

As his career on Wall Street progressed, so did his following. He began to publish his “Supply and Demand” forecast newsletter for stocks and commodities and demonstrated an uncanny ability to forecast major market turning points. His forecast of the 1929 bull market top in the stock market was published nine months before the high in his yearly report. Exploits such as this would earn him the titles of “Guru of Wall Street” and “Master Economic Forecaster.”

He is the only man I ever knew that I thought had worked as much as Mr. Thomas Edison.

WD Gann’s Study of the Markets

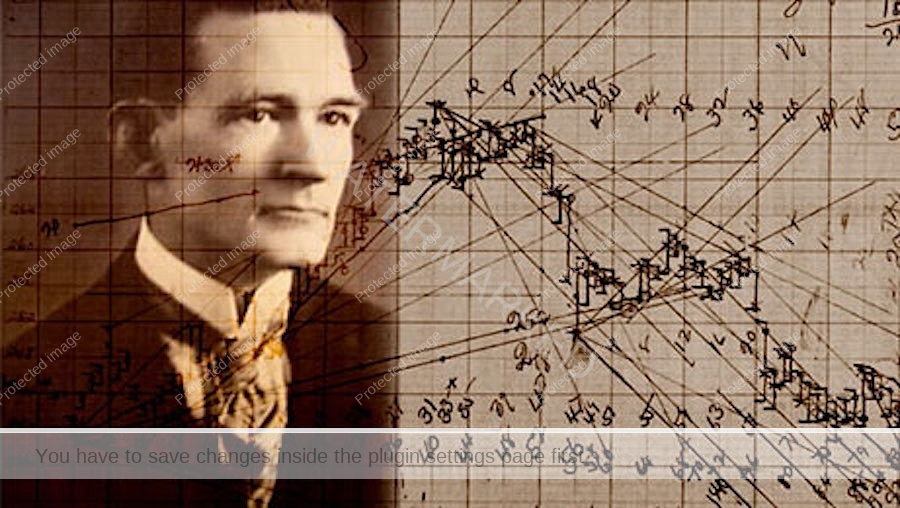

Gann was an insightful observer. As a student of the markets and human nature, he committed his life to gaining an understanding of what lay behind market movements. This pursuit led him to develop several theories that had their basis in mathematics.

To give you a sense of Gann’s commitment, he travelled to England to study English Price history. This was necessary because there was a much longer historic record of financial markets and Price history in England, compared to the relatively young U.S. markets. He also spent 10 months in deep study at New York’s Astor Library. In total, W.D. Gann devoted 10 years of his life researching in order to prove his theories.

Gann the Chartist, Mathematician and Analyst

There were no calculators in Gann’s time as we have today. He used a slide rule, number arrays that he drew up along with his hand drawn charts to follow and forecast the markets. It’s reported that he had an extraordinary memory for figures and he kept a staggering amount of hand drawn charts. In later years he had a team on hand to maintain his charts, comprising of daily, weekly, monthly, quarterly and yearly charts. He believed that charting was an art and if you took the time to understand all that the chart held, it would aid in forecasting market movements.

Gann was the first Wall Street advisor to use an aeroplane to monitor the condition of crops so he could advise his clients quickly of any changes that would impact the prices of the commodities. In 1936 Gann purchased “The Silver Star” a metal aeroplane he used to make crop surveys to aid him in his analysis. in 1939 he purchased a new Fairchild aeroplane for the same purpose.

WD Gann’s Books and Courses

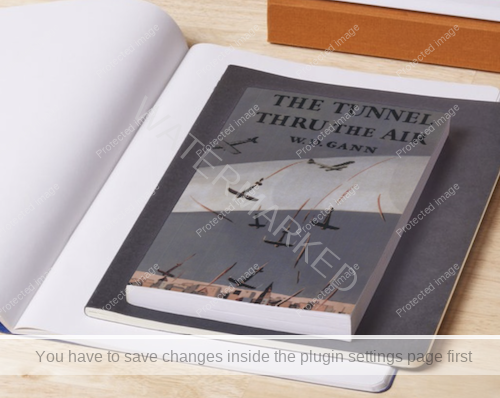

Gann wrote many books and courses in which he shared his thoughts and techniques. It is believed that most were written assuming he would be available to support the reader in understanding the content, and so they are renowned for being difficult to read and understand. In his later years he would command a fee of US$500 a day to consult with a trader to teach them his lessons. His books live on and are a wealth of knowledge for those that are prepared to do the work. Some of his most popular books include: 45 Years in Wall Street, How to Make Profits in Commodities, New Stock Trend Detector and Truth of the Stock Tape, along with his ‘novel’ which predicted World War II and in particular the attack on Pearl Harbor in The Tunnel thru the Air, which was written in 1927! Follow the links to read a review of each book.

WD Gann’s Legacy

W.D. Gann died on 18 June 1955 at the age of 77. He was buried with his second wife Sadie, overlooking the Manhattan skyline and his beloved Wall Street.

Time has done a great deal in adding to the legend of W.D. Gann. Yet, despite his published books and the Stock and Commodities Courses he updated over the years, a great deal of mystery has been attached to his methods of forecasting and trading.

In essence, Gann’s teachings on the law of action and reaction in the marketplace are rooted in the fundamental truth that people do not change. They do the same things and respond in the same way from one market cycle to the next.

Throughout his long and illustrious career, which includes the difficult period of the Great Depression, Gann was to consistently repeat these forecasting and trading feats, and though his methods may seem unusual, they have proven themselves time and time again.

Time has done a great deal in adding to the legend of W.D. Gann. Yet, despite his published books and the Stock and Commodities Courses he updated over the years, a great deal of mystery has been attached to his methods of forecasting and trading.

They therefore offer today’s investors a real opportunity to profit from the markets – with safety.

Although W.D. Gann is no longer with us, his work remains highly relevant today because his methods are based on timeless market principles—patterns, cycles, and the belief that history repeats itself, along with the unchanging nature of human behaviour.

Gann’s skill in reading the markets through price, time, and geometry laid a foundation for traders to anticipate movements with precision.

David Bowden, founder of Safety in the Market, committed himself to mastering, testing and refining Gann’s groundbreaking methods, simplifying them for everyday traders.

Today, we teach traders how to apply these timeless principles to modern markets. By using these techniques, our students not only identify opportunities but also trade with greater confidence, reducing risk and maximising returns—keeping Gann’s legacy alive and as relevant now as it ever was.

Learn more about David Bowden, founder of Safety in the Market and his renowned market forecasts 12 months in advance using Ganns techniques here.