To Bean or not to Bean?

Late into Mat’s Back to the Source webinar I realised that Coffee and I were born exactly 90 years apart (give or take 3 days)! This gave me hope that Coffee could well be my new friend. This realisation, along with the excitement every time I delve into analysing the Sugar market, tells me that there is some harmony here and I must push on with my journey of discovery.

So, I had set myself some homework at the end of last month’s article:

- Pro’s & Con’s of trading these markets using Futures contracts

- Dealing with the 10-minute Data delay

- Trades on the 3 markets

- Checking my alarm, on the ‘Sleeping Giants’

1. Trading the Futures market (particularly Coffee & Sugar)

Tighter spreads – Market price – Volume & liquidity – Rollovers – Account size – Brokers

This became a brainstorming exercise which brought up a lot of generalised points about whether or not to trade Futures, so I have made a comment below on three points that relate directly to Coffee and Sugar. Soybeans would seem to be more mainstream with its hours, its subscription fees & also having a ‘mini’ contract on offer.

Trading day starting in the late afternoon/evening – Personally I quite like the idea that the trading day starts after I ‘ve completed my days’ work. It takes away the need to organise my trades & stop losses as I’m running out the door in the morning. It also gives me all day to assess where the market is situated. I’m also getting more comfortable with the possible gaps.

No mini contract – This might push you to using CFD’s if your account size can’t accommodate the full Futures margin requirements. Just note that as soon as you use a ‘Market Maker’ the spreads will increase and the price that you are given is often incorrect, which will make it difficult for you to trade and apply all your hard work and analysis.

Delayed data – I have left this discussion for homework point #2 below:

2. Dealing with the 10-minute delayed real time data

As I have covered previously, to obtain live data for the Coffee and Sugar Futures price you need to subscribe to the exchange. This cost of $115 per month can pose a problem and if this is an obstacle for you then, below are some of your options if you choose not to pay the subscription.

If you are trading ‘End of Day’ style, then the delayed data shouldn’t affect you when using the futures market. You simply set up your orders to trade before the market opens, and let the days’ trading take its course.

The problems occur when you are intraday trading, and you are trying to manually enter a trade ‘At market’. The obvious difficulty being that what your chart is showing currently at that point, isn’t the live price. It will be close, (you hope), but you don’t know the price you are getting in at, or what price has done immediately afterwards, (during the last 10 minutes). The results will all be revealed shortly after you click the button on your mouse, but it would be a very messy and difficult method of placing a trade.

A possible solution around this would be to look up your 4-hour, 1-hour and maybe 15-minute milestones on your trading platform chart earlier in the day, and if you can foresee a cluster which marries up with your bigger timeframes, then you have a trading window. Then simply choose which price you would like to enter the market, place your trade entry & stop loss orders accordingly, and let the market do its thing as if you were trading ‘End of Day’.

3. Current trading opportunities

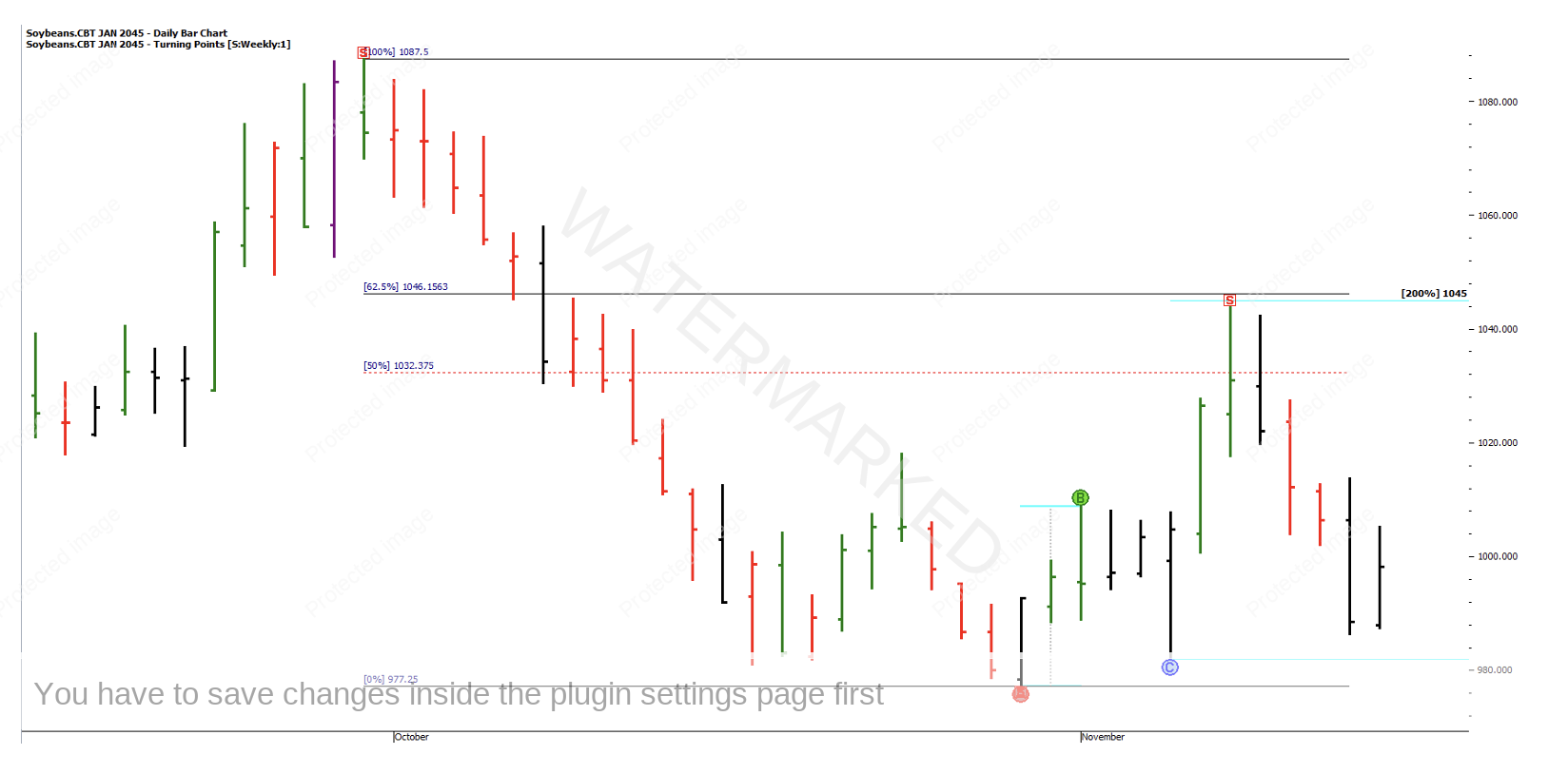

Soybeans – we were waiting for the market to fall a bit further before we grabbed our compass & ruler…

Here on the January contract you can see that the market bounced from the last newsletter issue in October, but could only retrace 62.5% of the previous weekly swing down and found 200% of the daily ‘First Range Out’ as a small cluster.

I think there’s a need to watch these lows around 980 for support or a breakout, and breaking these lows would put the August low in trouble at the same time…

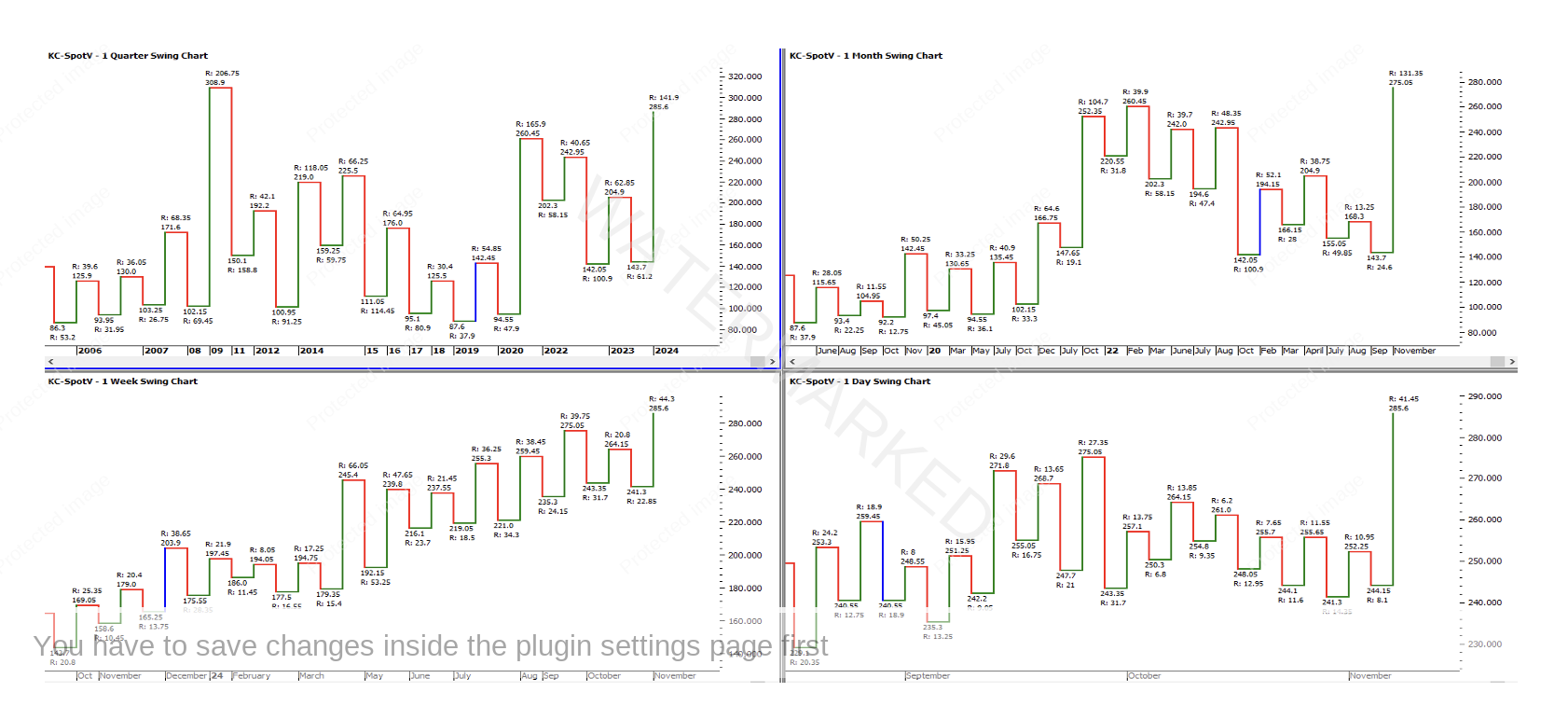

Coffee – I thought there was a nice top to work from in the October issue, but Coffee had other ideas, so upon realising that this is all one monthly upswing, I thought to look at the swing charts to get a better understanding. I’ve used the SpotV chart below:

Wow, it needs a pullback at some point, so we keep putting our retracement tool on the high of each day/week, waiting for the top to come in. Even though it’s overbought, it doesn’t look like it’s finished just yet. When it finally turns, it will give a bit more information about how to trade it, until then lets just watch and learn.

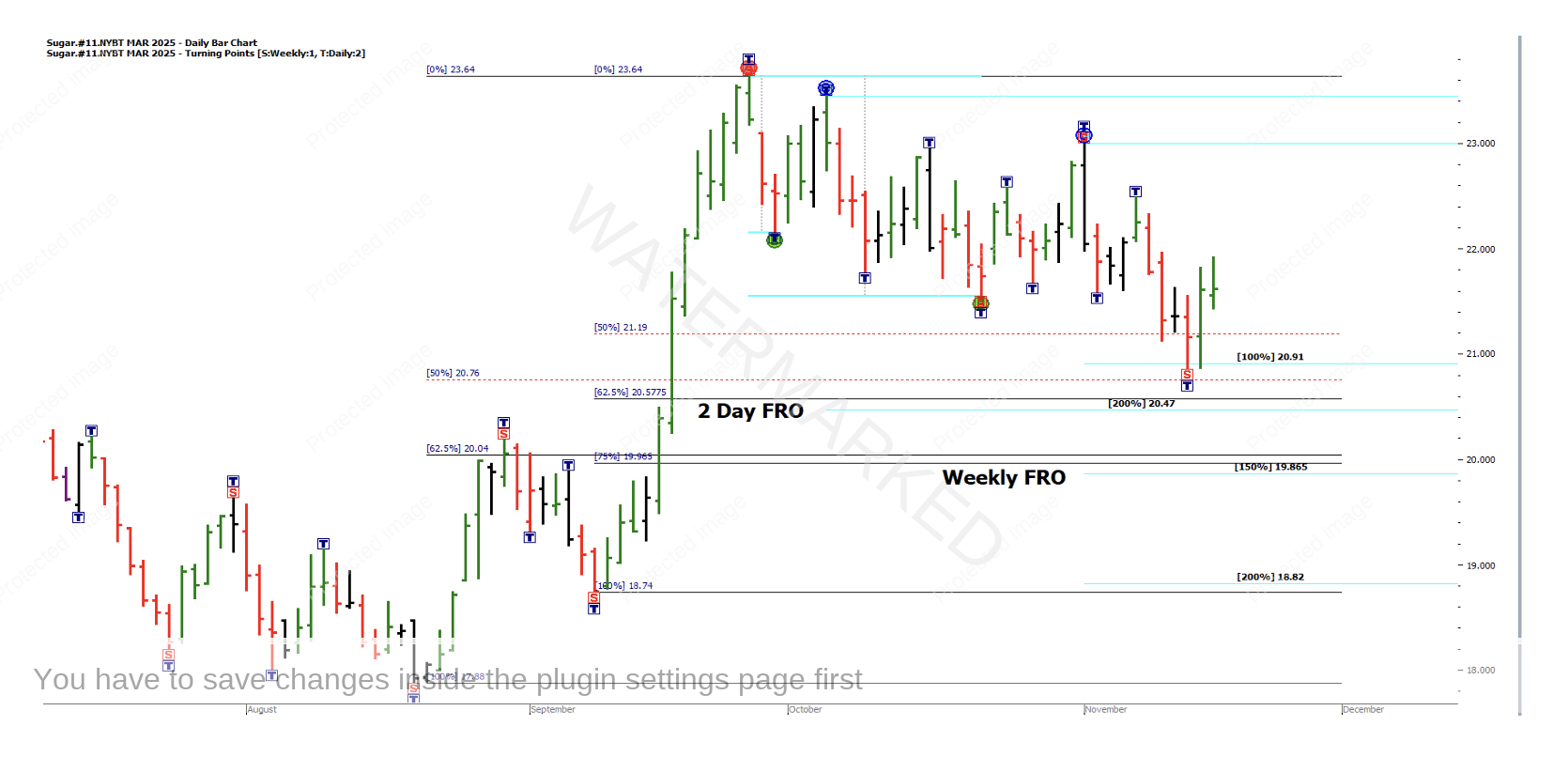

Sugar – I seem to remember that last month I had looked at the 37.5% retracement from the September top, but was mindful of more clusters below. Using the chart from the March contract below, you can see an interesting situation where the retracement levels from two separate lows are forming their own clusters!

Then, in the chart below you can see 200% of the 2 Day First Range Out lining up with the first cluster and 150% of the Weekly First Range Out hugging tightly to the second of the clusters. Note that it bounced off 100% of this range already.

So I think Sugar is the winner this month at this point. It just needs watching carefully for more confirmation if it heads down towards our possible targets…

4. The Sleeping Giants

Looking at the charts I would think Corn, Cotton & Wheat are heading back to bed, after their recent big moves. Although Andrew taught us last month using the Wheat market that if you are on the ball, there are still opportunities to be had before they tuck themselves in and turn out the light

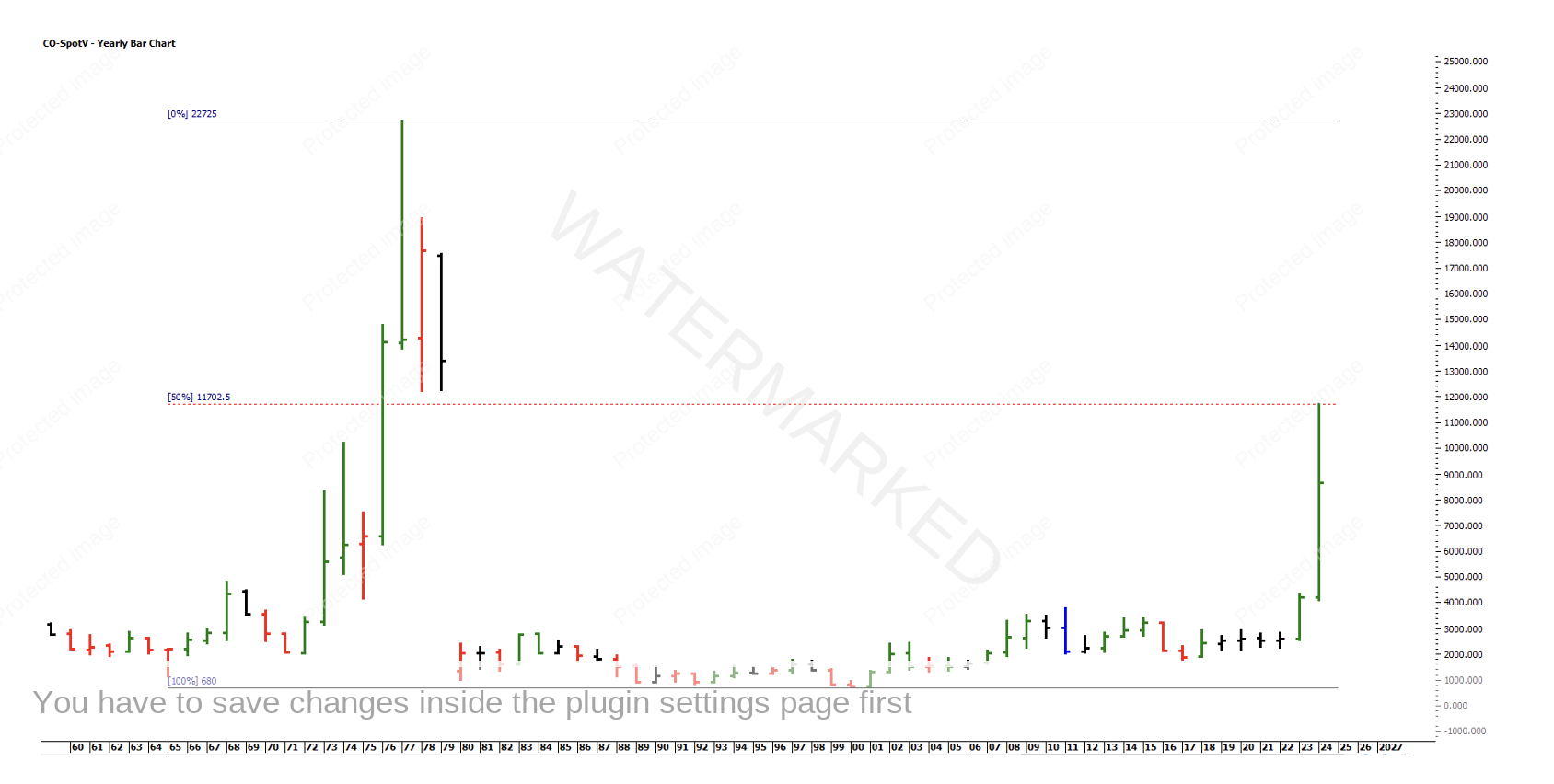

The market that stands out to me is the Cocoa market…

Initially I thought I had missed the boat with Cocoa and its move over the last two years, but when I looked back further into its history as with the SpotV chart below, I see all sorts of possibilities ahead. Having struck 50% of the All-Time Range, is it now heading down? Does it need to finally close that gap? Was that a failed attempt? If it’s been up there before, can it get there again? So many questions, and even if it just returned back down to the comfort of the 2,000 – 3,000 range there would be so many opportunities ahead.

See yearly chart below.

Cocoa is on the radar!

Homework:

- Keep a close eye on Soybeans & Sugar for possible set ups.

- Delve into Cocoa and try to unravel its upcoming movements.

- Paper trade the next set up that any of these markets may present.

- Use intraday charts & ranges to set up a trade with ‘Delayed Data’.

Be careful, it’s addictive!

Darren Young