Turning 1 into 10:

A Standout EUR/USD Trade Example

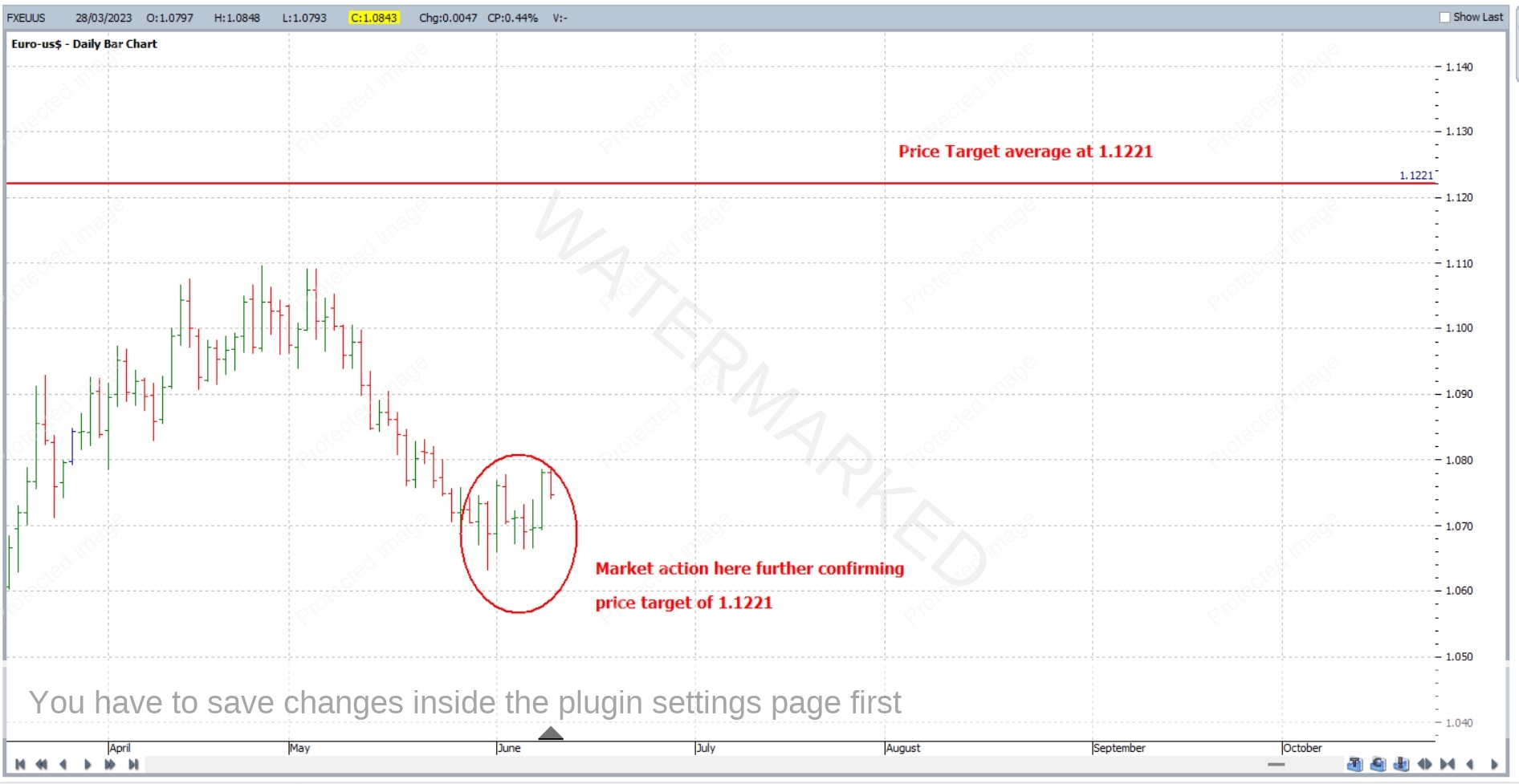

For students applying what we teach in our Active Trader Program, this trade setup was visible months in advance on the charts. The market gave four solid price cluster reasons why this was to be a significant top – with the average price of them all being 1.2221.

With further pieces of confirmation locking in as we approached the targeted price, the market gave another piece of confirmation of the anticipated top by way of chart patterns in late May/early June 2023 – some 6 weeks before the top came in.

We teach our students that a 1% tolerance is acceptable so this was well within the tolerable levels to take the trade.

(If you’re not familiar with the concept of ‘Short Selling’ you can find out more here – but in essence it means that you can make money as the market goes down!)

Therefore your risk per share would be –

Entry Price of 1.1206 minus your Stop Loss of 1.1276 = 70 ticks or pips per share.

As the market unfolded over the following days (after a nerve racking day on the 27th of July 😬) your stop loss would have been moved to ‘break even’ on the 28th of July and you now have Zero Risk in the trade and are effectively trading with the markets money!

You can now sit back and relax and let the market unfold. It doesn’t get any better than that in trading!

Applying what we teach, there are varying ways you could manage your stop loss on the way down to lock in profits as you go – but this is something that is personal to each individual student depending upon their goals and attitude to risk.

When it comes to managing stop losses, we teach our students to ‘give the market room to breathe’ however when emotions kick in and it’s real dollars at risk, it is not easy to do – and that’s WHY we teach our students to have a Trading Plan in place – it helps keep the emotions in check.

We teach our students to aim for a 10 to 1 Reward to Risk return on their trades – meaning that for every $1 they risk on their trade, they should expect a return of at least $10.

In this instance, in early to mid August, as the market began to run down, it started to give clear indications that another price cluster was beginning to form to the downside at around the 1.0495 – 1.0517 mark – an average of 1.0506.

Now, with zero risk in the trade and a clear price cluster in place, we give the market room to move.

The market continued to run down and reached our price cluster target of 1.0506 on the 27th of September.

Let’s take a look at the possible rewards on offer from this trade:

Initial Risk: 1.1206 (short selling price) – 1.1276 (initial stop loss) = 70 ticks or pips per share

Reward: Target Reached of 1.0506 (closing trade buy price) – 1.1206 (open trade sell price) = 0.0700 or 700 ticks or pips

Reward to Risk Ratio: 700 ticks/pips reward divided by 70 ticks/pips risk = 10 to 1

Therefore this means that for every dollar you risked on the trade, you would have made $10 return. That is without adding to your position along the way, which is something we teach too!

We suggest when you are starting out in trading, you should risk no more than 2.5% of your account on any one trade, if not less, so in dollars terms:

If 2.5% of the account size was risked at entry, the growth in account size from this trade alone would be as follows:

10 x 2.5% = 25%

Working this out in actual dollar returns:

With 2.5% of a $10,000 account risked at entry, the rewards in dollar terms would be:

$10,000 x 2.5% = $250 Risk

10 (Reward to Risk Ratio Return) x $250 = $2,500. AUD

(For simplicity we have kept this example in AUD, but returns would be higher with allowances for USD/AUD conversions. )

This trade was a conservative example, with entry into the trade being on an ‘end of day basis’.

An intraday entry using our ‘Wheels Within Wheels’ technique on an hourly chart, rather than an end of day chart, could have provided a much more aggressive entry with just 7 ticks of risk and a much higher reward-to-risk ratio return on the trade of 100 to 1!

However, such an aggressive entry isn’t for every trader and this approach is best considered once you’ve gained a significant amount of experience.

While we can’t promise profits of this scale as trading outcomes are highly individual and depend on the commitment and study each trader invests – our Active Trader Program is a complete course that equips you with the skills and tools needed to pursue, and achieve, returns of 10 to 1 – or even greater – in your trading, just like many of our other Active Trader Program students have.

Want to spot High-Reward Trades with Confidence too? Turning $1 into $10 isn’t luck—it’s about strategy, timing, and risk management. The Active Trader Program teaches you how to identify and execute high-reward trades just like this standout EUR/USD example.

👉 Order your Active Trader Program Today and start making smarter, more profitable trades.