Thinking Big – Part 3

As the year wraps up, it’s time to finish off our three-part series on Thinking Big. When we start to look at the next sequence of Gold charts, one thing that stands out to me is that the theory of Gann is made up of many parts. If you really think about every chart being explored, it is designed to add a piece of the puzzle to the overall bigger picture. It is factual information that will govern your scenarios and ultimately allow you to make a decision and execute.

In this article, we’ll look to finalise our ‘Thinking Big’ laws and the theories that you should include into your daily routine. When we decide to know a ‘market like a cow knows it’s calf’, we need to be disciplined in treating that market as the mother cow would it’s young.

All laws and theories depend on basic elements of the scientific method, such as generating a hypothesis, testing that premise, finding (or not finding) observed evidence and coming up with conclusions. Eventually, your sequence within your daily routine should be so detailed it can be replicated.

Like a scientist or investigator that has many tools available to them, you as a trader have much to draw on. Hence the ‘Thinking Big’ series of articles. Often, a scientist reaches for laws and theories first. David talks about having your trading plan made up of formulas and theories. So, what’s the difference between a law and a theory?

A scientific law can often be reduced to a mathematical statement, such as E = mc²; it’s a specific statement based on empirical data, and its truth is generally confined to a certain set of conditions. For example, in the case of E = mc², c refers to the speed of light in a vacuum.

A scientific theory often seeks to produce a body of evidence or observations of particular facts. It’s generally — though by no means always, a distinguished, testable statement about how nature operates. You can’t necessarily reduce a scientific theory to a pithy statement or equation, but it does represent something fundamental about how nature works. When you think about the Gann Theory, this is the scientific law and theory you are governed by.

Jumping into the next E and F sequence of charts. If you are only new to this concept, refer back to the October & November 2019 Platinum articles. For example, the pricing analysis was in the sequence, A01, A02, etc to B01, B02, etc. This is designed so that when you open your chart in ProfitSource the daily routine and analysis can flow.

| Chart Code | Chart Set Up |

|---|---|

| E01 | Calendar Bar Counts - Backwards |

| E02 | Trading Bar Counts - Backwards |

| E03 | Time by Degrees - Backwards |

| E04 | Time by Degrees - Anniversaries |

| E05 | Time by Degrees - Coloured Dots |

| E06 | Master Time Cycles (10 Years) |

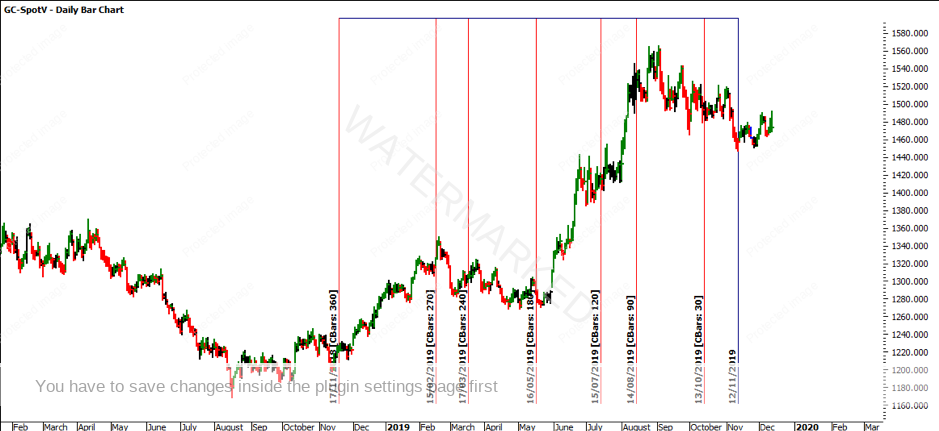

As you can see from the charts below, we have run the Calendar Day, Trading Day and Time by Degrees back from the low on 12 November 2019. These charts don’t need to be updated all that often because new cyclical highs and lows aren’t being made all the time. Be consciously aware, and don’t be fooled into thinking too short term.

Calendar Day Counts

Trading Day Counts

Time by Degrees Counts

One Year Anniversaries

Coloured Dots

Master Time Cycles

The proceeding sequence of charts after the projected time frame counts are the Gann Angles. As mentioned, while the theory might be spot on it is about having all the puzzle pieces lined up to provide a high probability scenario.

Chart Code Chart Set Up

F01 Gann Angles Short-Term

F02 Gann Angles Medium-Term

F03 Gann Angles ATL/ATH

Below is the short-term Gann Fan chart. When we say short-term, it often refers to the last cyclical move or the major yearly tops and bottoms. In this case it has been placed on the August 2018 low and September 2019 high.

Short-Term Gann Fan

Medium-Term Gann Fan

All Time Low and All Time High Gann Fans

In closing, remember to focus on what you need to do every day to the point of knowing. Step back and look at the bigger picture. Start to see the subtle signs, patterns and scenarios that might play out, but most importantly, understand what the likely scenarios are and have a plan to execute based off these set ups. This is where you get paid for your work.

Have a very safe and enjoyable festive season and I look forward to kicking off the next decade in 2020 with you.

It’s Your Perception

Robert Steer