Show me the Cluster!

“It’s your consistency over time that counts” – Unknown

Welcome to February’s edition of the Platinum Article! A new trading year and a new decade. A lot has happened so far in 2020, the East Coast of Australia has been inundated with fires and now floods, the outbreak of Coronavirus, Brexit and Trumps impeachment just to name a few.

We also saw the passing of one of basketball’s greats, Kobe Bryant. I’ve heard Kobe speak a number of times in interviews and it is clear that his work ethic was next level. I find it incredibly inspiring to hear people talk about how hard they worked, no matter how ‘gifted’ they are said to be.

In the Master Forecasting Course, David says:

“You’ve got to do the work yourself, there’s no substitute for hard work. You know the old story the harder I work the luckier I get.”

“I’ll tell you how I used to out think the opposition and outsmart them, I used to outwork them. No one used to do the work I would do.”

For me that puts us all on an even playing field and gives us no excuses as to why we can’t succeed in any endeavour.

DVD 1 and Chapter 2 in the Ultimate Gann Course covers the technique, Position of the Market. This is such a great lesson and is the key message of this article. If you need a refresher, please read the part called ‘Sections of Market Campaigns’. Do you know which move Gann said is the most important to watch for the end of a Bull or Bear Campaign

With that in mind I would like to revisit the first time I found and traded a Double Bottom Setup on Oil (CL-Spot1) back in 2017. Chart 1 below shows how Position of the Market was one of the key components with four weekly sections down into a textbook Double bottom.

If you’ve done a bit of work on the Ultimate Gann Course, you should be able to identify other pieces of evidence for Time, Price, Position, Pattern and Volatility that makes this a ripper of a Double Bottom Setup! To start with there were ranges of equal price, the date 21 June definitely shouldn’t go over your head and the relationship between the day counts should be reasonably clear. To top it off there was a nice daily Overbalance in Price coming out of the Setup!

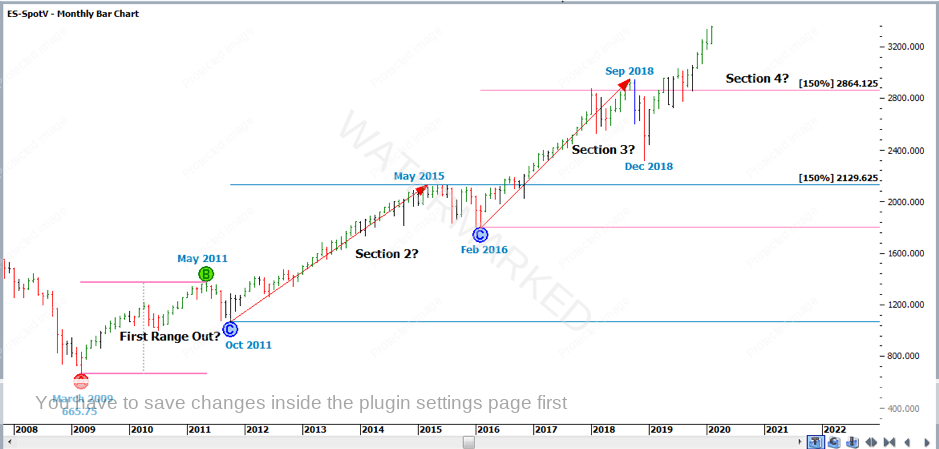

That was just one Setup where Position of the market and four sections down helped to identify a great turn. Now it’s 2020 and a more recent (and very exciting) example of Position of The Market can be seen starting from the 2009 GFC low to the current market high on the S&P500.

If you look at Chart 2 below, you can see I’ve already marked up most of the sections, but can you complete it and find the clusters? You might like to consider studying the First Range Out from the March 2009 low, or run Section 3 milestones from the next major low. Of course you could turn on the telly and see what’s on Netflix, but what if one of these milestones calls the yearly top? In any instance, you should look for other milestones that bring the cluster together. I’ve used the code ES-SpotV in Profit Source which is the E-Mini chart, but you could also use the SP-SpotV which is the full contract.

As always, there are plenty of other techniques that can be applied to this market to put together a Classic Gann Setup (Cluster), but I’ll leave that to you to find as my word limit is nearly up!

However as you saw with Oil, four sections called the end of the move! It’s exciting times at the moment so I hope you can stay on top of your chosen markets to profit from any potentially big moves that lie ahead this year!

If you’re not quite where you want to be in trading or if you’ve hit a roadblock in your studies, Ultimate Gann Course Coaching really helped me to better understand the course material and the application of these techniques, but also coaching helped to keep me motivated and moving forward.

Before I wrap up, I just want to leave you with one last quote from Jay Z, who in an interview alongside Warren Buffet once said, “the genius thing we did was, we didn’t give up”.

Bon Voyage!

Gus Hingeley