Let Hindsight Guide You

As a Safety in the Market Super Trader, you’d know by now that in the early 1900s, W.D. Gann discovered that market retracements tended to occur at the halfway mark of the original move from the low to the high. In fact, Gann commented that the most profitable retracement is a 50% retracement. By mastering this set up, it became one of the many reasons why I love trading. Hindsight started guiding me to find the exact same set up that has worked previously and replicate it over and over again on other markets.

As a bull market would pull back into the 50% level, one could assume to buy as if the trend would resume. Gann saw retracements occurring at the halfway point of a move, such as 50% – which is half of 100, 25% – which is half of 50%, and 12.5% which is half of 25%. While every market is different, it sometimes doesn’t show the actual percentage change at precisely 50%, but rather in a range of 45 to 55%. For those who have done this sort of research, you will know to look at the market like a ‘loose garment’ as David suggested. The importance here is that the danger zone provides opportunity and that is what we will be exploring in this article.

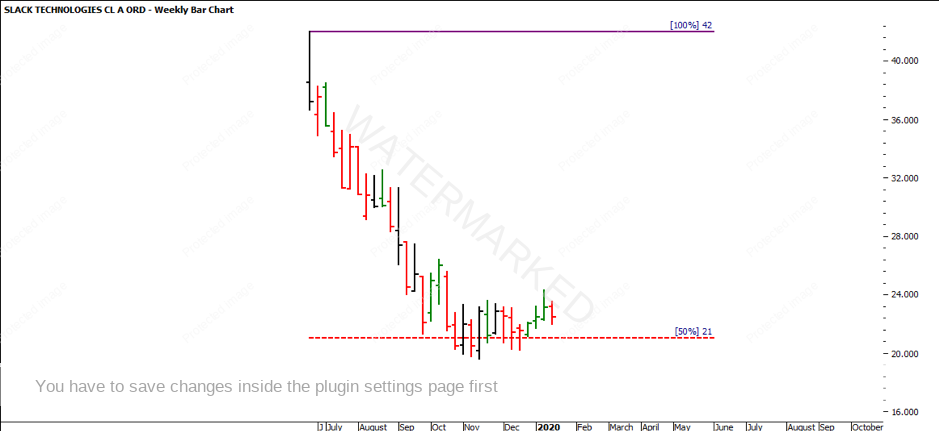

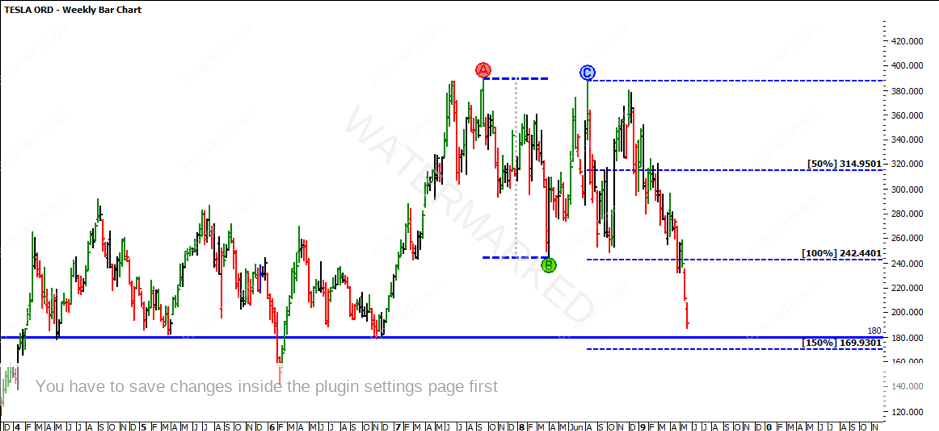

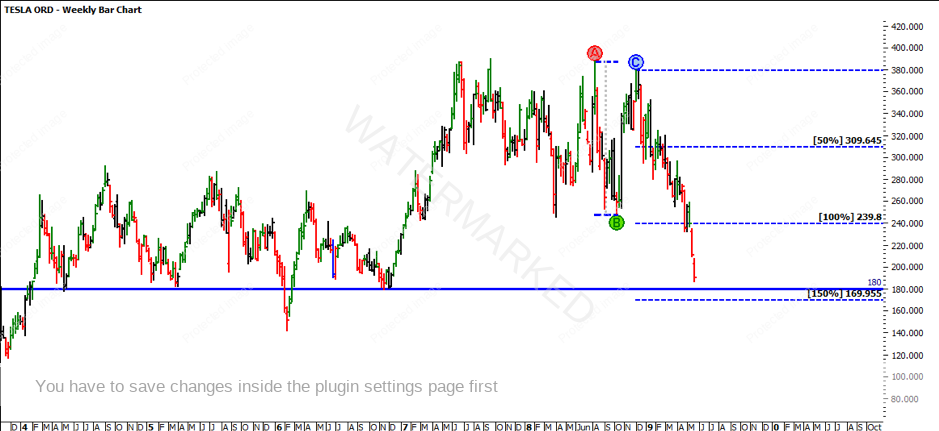

To illustrate 20/20 hindsight using the Gann 50% retracement tool, we will explore the drop to the 50% level (danger zone) on Tesla (NASD: TSLA) vs the 50% drop that occurred on Slack Technologies (NASD: WORK).

Tesla’s All Time High (ATH) (prior to it’s recent run up!) was $389.61 on 18 September 2017. Applying a High’s Resistance Card to this seasonal top you can see that the market broke through the 50% level at $194.80. As the market broke this 50% level, it doesn’t mean the theory is wrong – if you do note the previous 2014, 2015 and 2016 lows all sat below the 50% level and hence it would be common for a market to retest these lows.

WORK only had its IPO on 20 June 2019, which was the day of its ATH, so there isn’t a large amount of historical data available, however by applying the FRO from 20 June 2019 to 5 August 2019, it produced a range of $12.90 in 31 trading days. Projecting the FRO from 22 August, gives us a projected 100% milestone at $19.58. The market bottomed at $19.53 on 12 November 2019 in 57 trading days, close to 100% in price repeat and 200% in time.

Projecting the FRO from the 3 April 2019 high at $296.17 – the market overshot 100%, with the 150% level projected to be at $168.07. This clusters with our other price points. Projecting 68 calendar days from 3 April 2019 provides an estimate date of 10 June 2019.

It is important to have done your own research, and it is encouraged to explore the concepts in the article more freely as there are a few hidden gems within for those who are prepared to do the work.

It’s Your Perception,

Robert Steer