A Balanced Market

Regardless of how long you have been a Platinum Trader, the basics of trading always show their worthiness. David Bowden often got traders to go on a ‘Smarter Starter Pack’ diet to gain clarity before re-entering the markets. If a Super Trader lost a certain percentage of their account, he would send them to the Sin Bin to gain control over themselves and their trading plan before stepping back into the markets.

It is often very easy to get ‘too confident’ in the markets, especially after a prolonged trend. The fundamental basics are often the first thing to be thrown out, telling ourselves we don’t need to follow our morning routine because we are naturally good. It is when this emotional confidence erodes that we start to realise that our foundations have come unstuck and that mistakes are becoming a lot more common. We immediately rush back onto a trader’s diet to get some overall control again.

When talking fundamentals, these include our daily routines, the subtle signs of the swing charts and watching for harmony within the markets using the Gann Methodology. This requires structure and discipline. The W.D Gann Stock Market Course outlines these basics under the heading ‘Fundamental Rules’:

“Keep this well in mind. For stocks to show up-trend and continue to advance they must make higher bottoms and higher tops. When the trend is down, they must make lower tops and lower bottoms and continue on down to lower levels. But remember, prices can move in a narrow trading range for weeks or months or even years and not make a new high or a new low. But after a long period of time when the stocks break into new lows, they indicate lower prices and after a long period of time when they advance above old highs or old tops they are in a stronger position and indicate higher prices. This is the reason why you must have a chart a long way back in order to see just what position the stock is in and at what stage it is between extreme high and extreme low.”

WD. Gann, The Stock Market Course (P.4)

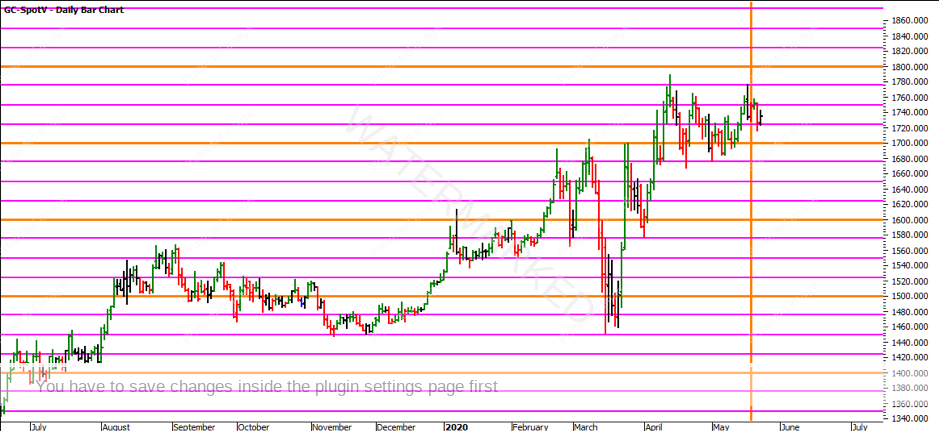

Turning to Gold Futures (ProfitSource GC-Spotv) the All-Time High (ATH) was on 9 September 2011 at 1,923.7. Currently at the time of writing, Gold is trading at 1,734.7 which is 189 points from its ATH which was made 9 years ago, so based on Gann’s fundamental laws we should wait to see if the ATH is broken as there might be some further upside. However, we don’t have to wait too long to see a potential price cluster which could dictate what the future might bring. After Gold made its ATH at 1,923.7, it created a triple top at around 1,800.

Gold’s ATL was at $100 on 27 August 1976. The triple top cluster is around 1,800% from the ATL or 18 multiples.

The 1999 low of 253.2 also clusters at 700% multiple of this low. These lows might have something to do with the three strong triple tops and also might be a sign that if these tops are broken there might be a re-test of the ATH and some further upside. Those who are patient will know.

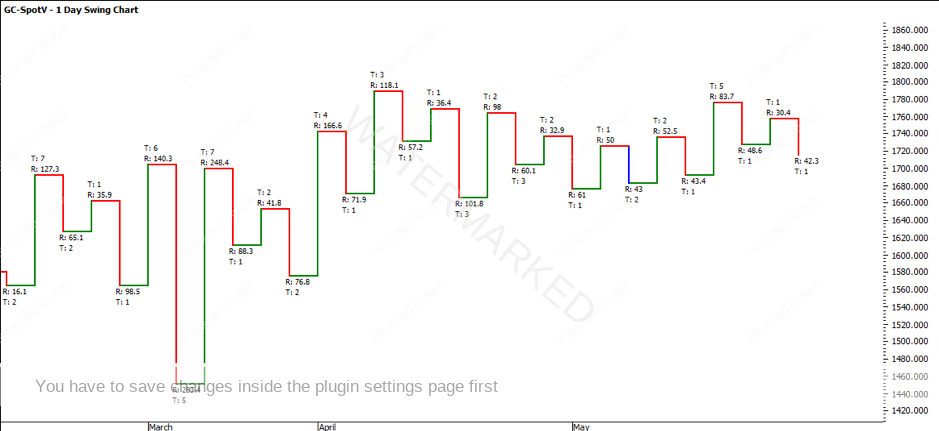

Turning to the daily swing charts, what is nice to see is that there is consistency in the ranges of the 1-day swing chart. The past four down swings have shown ranges of around 43, followed by the two ranges prior being 60 and then a range of 100 – which 40 + 60 is equal to 100. Therefore, we have harmony in our ranges. You will also note that there are no irrational ranges evident, by which I mean there are no abnormal ranges dominating the swings at the moment, which shows balance within the market.

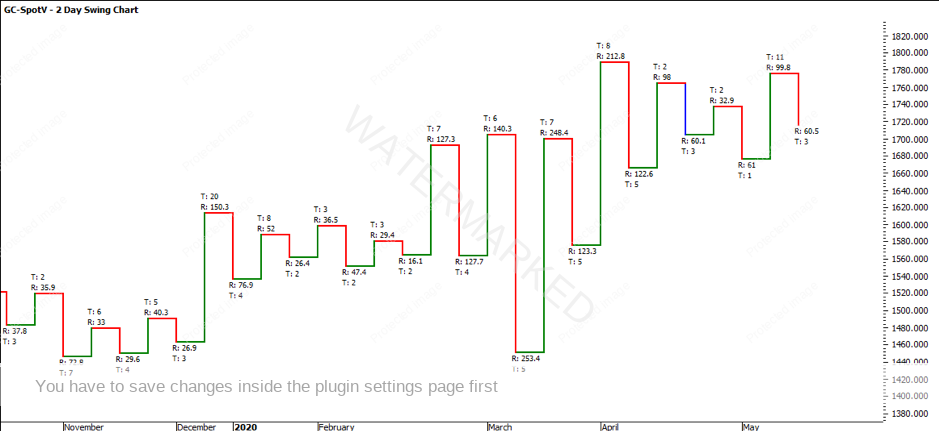

The 2-day swing chart is also showing signs of harmony, with the last three down swings having ranges of 60 and the previous being 120. This balanced nature provides some stability. Once abnormal ranges start to come, it will be a good sign that the market is starting to move and we could see some sharp movements.

The 3-day swing chart also shows signs of a balanced nature. The previous two down swings were around 122 and the swing prior to that was 250 which is close to two multiples of 122.

What does all this information mean? Well, we won’t know until the market provides each piece of the puzzle. Each day we could see the market move closer to the price cluster of 1800. If it breaks through there might be an opportunity to see the ATH get tested.

In closing, regardless of your trading results, remember as a Super Trader of Safety in the Market, you should trade from a plan and not react to the markets based off psychology. The foundations of knowledge, iron-hard discipline, courage and hard work are the requirements of skilful trading.

It’s Your Perception

Robert Steer