A Platinum Trading Plan

Like an F1 racing car approaching the final bend and last straight to the finish line, we also approach the last quarter turn and last straight into Christmas. The year has gone so fast, and the Christmas rush will be here before we know it. Now is a great time to assess the steps forward you’ve made in your trading (or potentially lack of). There is always more we can do, and there is no time to waste!

Some will be happy with their results, others maybe not, but that could fuel your motivation to take action right now, as you could totally change your results in three months!

Firstly, you could look at your trading system of finding and executing trades. Is it fine-tuned or does it need a tune up? Does it need some big adjustments or need to be written for the first time? Is it complex or not detailed enough?

In the September Safety in the Market Newsletter, I wrote Decide, Design, Execute, which was primarily around designing a trading system and utilising ProfitSource to find more trading opportunities. The main points were:

- Decide what setup to target

- Design the exact trading strategy

- Execute that strategy

With the above article in mind, let’s look at the stock RIO listed on the NYSE. Would this fit the parameters for a Weekly ABC short? I think this is a good example because even though the weekly retracement was greater than 50%, there was a good setup.

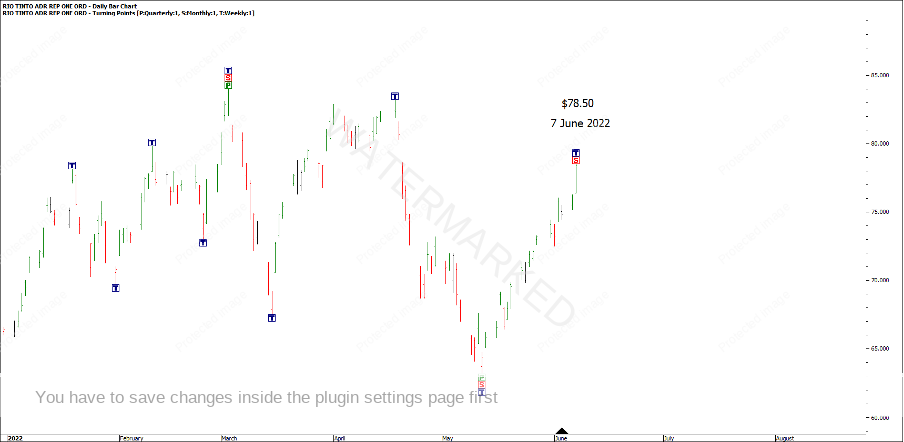

Chart 1 – Number One Trading Plan Cluster

Using the Number One Trading Plan techniques, can you identify the following points that make the 7 June 2022 top a cluster?

- ……………………………………………. = $78.415

- ……………………………………………. = $78.49

- ……………………………………………. = $78.36 (Ranges Resistance Card)

The real question is, could this combination of techniques/milestones form the basis of a trading system?

Since we are Ultimate Gann Course students, we’re also able to add more techniques to validate a high quality cluster. Some of which include:

- Position of the Market

- Balancing Time

- Gann Angles

With these three techniques above, could they add to the cluster to give you more confidence of a high probability trading opportunity?

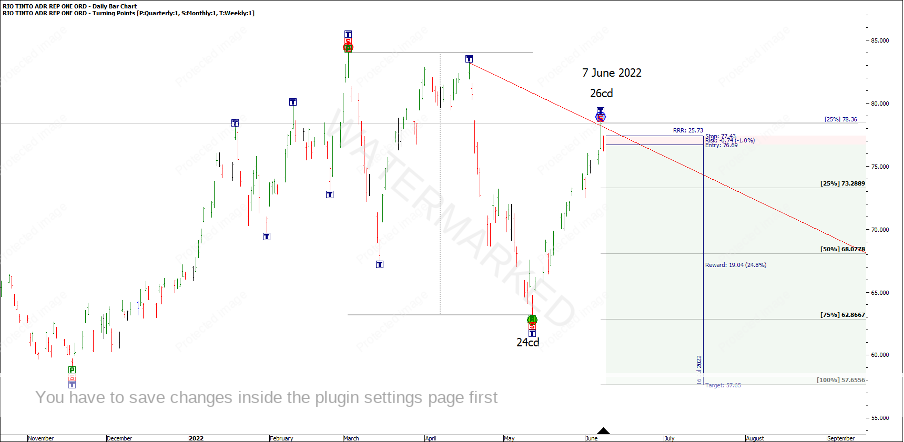

Chart 2 – Ultimate Gann Course Techniques

Now that the analysis is done, what would be your means of entering into this trade or any trade? What time frames would suit your personality?

Using hindsight, one form of entry after the top could have been the 1 hour First Lower Swing Top. This gives a risk of $0.74 cents for this trade and a potential 25:1 Reward to Risk Ratio trade if the monthly swing repeats 100%.

Chart 3 – Small Risk on Entry, High Reward to Risk Ratio

How could you run stops? There isn’t going to be one perfect system for this, but you could list all the ones you know, then spend a bit of time testing them on these types of setups. For example, running stops:

- Behind ABC milestones on a bigger picture time frame using the Stock, Currency and Stock Index strategy

- Trailing behind swing tops on a certain time frame

- Exit at or before a strong cluster

- Exit at market if you are in a windfall profit

So how can you now condense this all into a written trading strategy? You could break it down into the below headings:

Analysis

- Perform weekly scans on………….. (Certain days)

- Must have:

- ……….% or ……….% of a daily FRO

- 3-4 daily swings/sections

- With a combination of one or more of the following:

- Technique……….

- Technique……….

- Technique……….

- Cluster points less than 1% apart

Trading Plan

- Risk ……….% of account balance

- Maximum of ………. attempts

- Entry when………. Or………. Or………. Or……….

- Move stops to breakeven when………. Or………. Or………. Or……….

- Trail stops when………. Or………. Or………. Or……….

I’ve left a lot of blanks, but hopefully this is enough to provoke some more thought about a trading system and how to implement it. The idea is not to trade every move on every market but to find and trade high probability setups with high Reward to Risk Ratios.

Happy Trading,

Gus Hingeley