A Year Like No Other?

History tells many stories, often written by the victors and always with an unconscious bias of the writer. No doubt that 2020 will be remembered for COVID-19 and the global ramifications that followed and are still present in many countries. We in Australia can again state the virtue we are the “lucky country” and many around the globe would agree with us when viewed through the current lens of society.

For all the struggle and strain, we must be careful not to think that the current times are worse than ever before. I would imagine if we could chart the humanity index we would see a dip in value in 2020 compared to other parts of history. We might say that the humanity index is priced higher now when compared to the Great Depression, global wars and countless other history-making events. The good news is that if you are reading this, you are still here, in the game, and therefore the potential for upside is still possible.

One of the most important parts of the trading puzzle is human capital, that is your knowledge, your energy (effort) and intent (goals) for the year ahead. Now is the time to plan out that 2021 roadmap and set some achievable goals and signposts for when you will achieve them. You could be forgiven for becoming derailed in 2020 as the bumps in the track were hard to jump, but that excuse will not hold into next year. We are getting a real-time lesson in the new “normal” and we must be prepared for that.

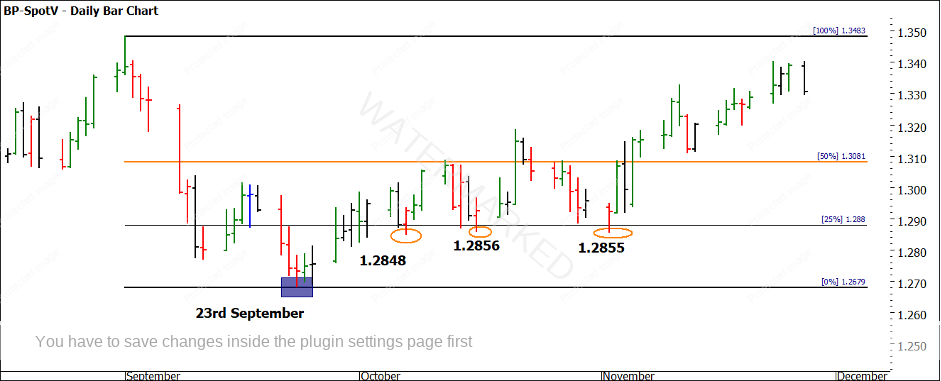

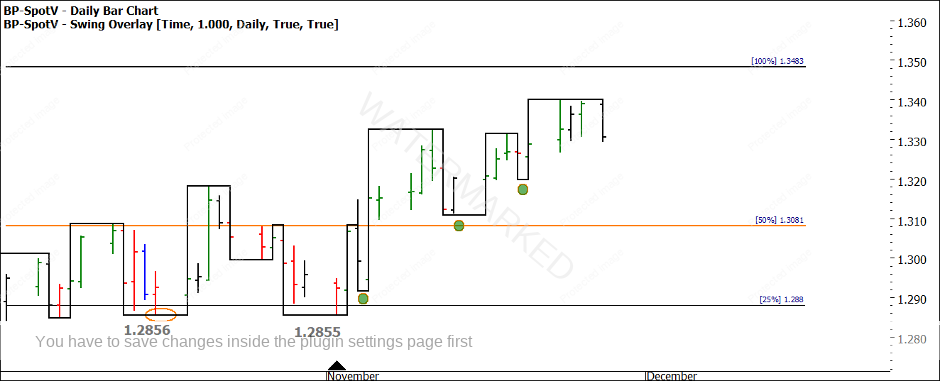

In September I wrote about the British Pound and it is time to revisit the price action that has occurred. As the analysis showed, a low in September may lead to some upside and this has occurred. In Chart 1 we see the low in September and the subsequent rise in price action that followed.

Chart 1 – Daily Bar Chart BP-SpotV

Of note is that the 50% in orange was initially resistance and then once broken has highlighted good areas to add to positions.

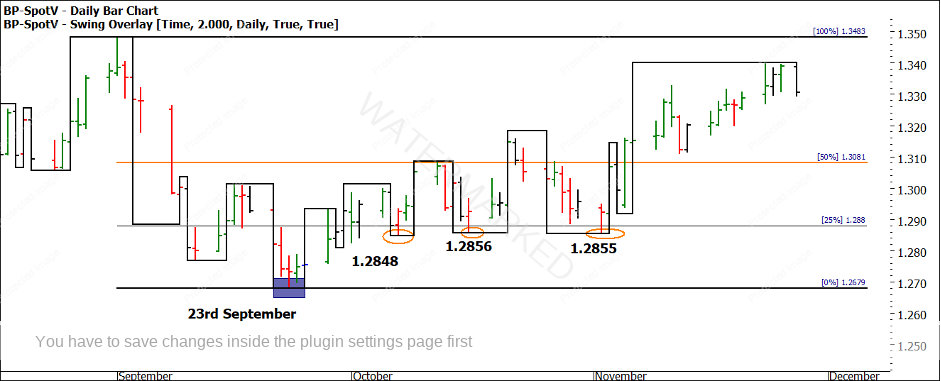

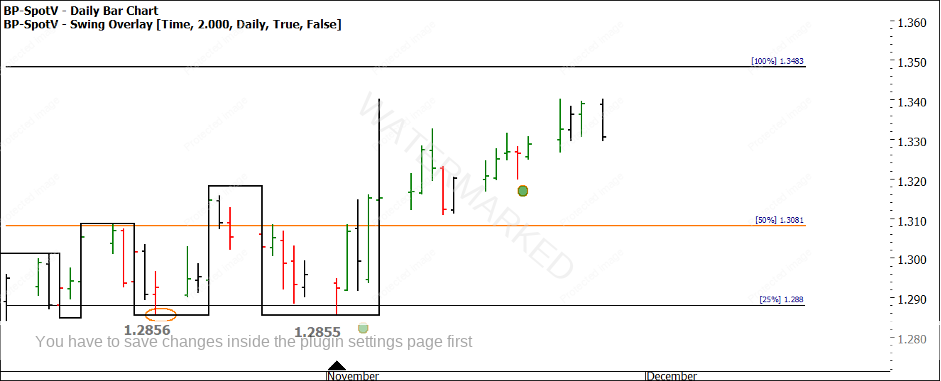

Chart 2 adds the benefit of the swing overlay, in this case, I have used the 2-day swing chart, this can provide a good way to hang into moves once set as the volatility on a shorter time frame can be hard to absorb. We see how the swing bottoms have all sat just below the 25% level on the Ranges Resistance Card on the small picture.

Chart 2 – Daily Bar Chart BP-SpotV

By trailing stops behind swing bottoms, we can see that patience was rewarded as the original low in early October at 1.2848 was not taken out (in this case on the futures chart.)

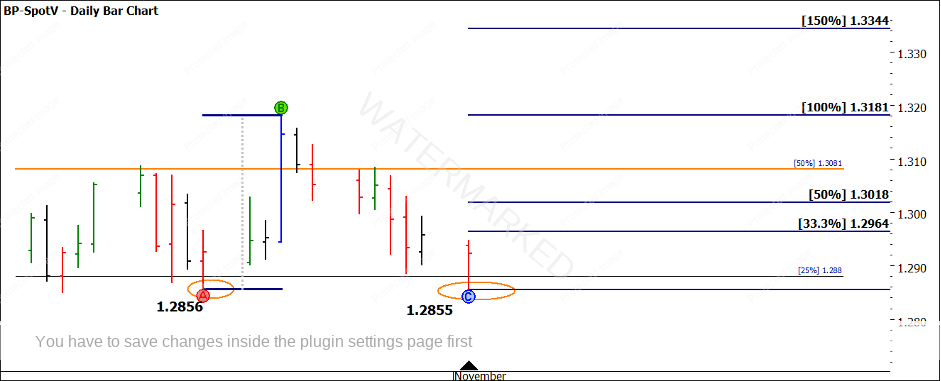

Of more interest to me is looking at the double bottom that formed and the subsequent move higher. Chart 3 shows the ABC pattern, it would be fair to say it is not the most symmetrical pattern of double bottoms with the B to C time frame being twice the A to B. The key reversal on the Point C bar is a positive sign there could be a reversal to come.

Chart 3 – Daily Bar Chart BP-SpotV

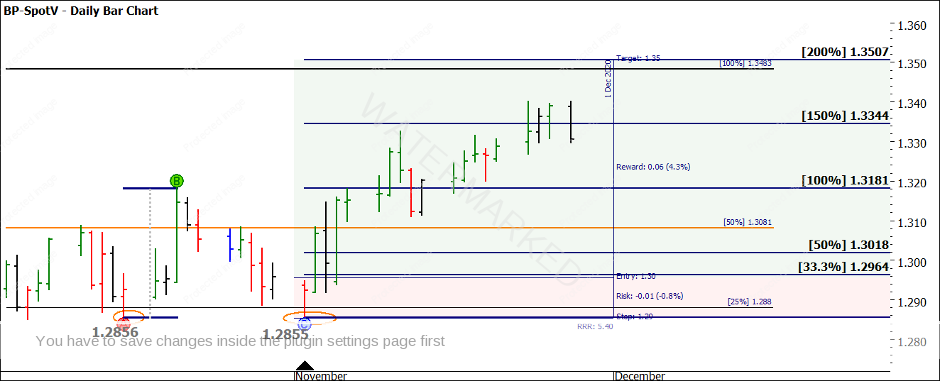

Chart 4 displays the price action the day of entry on November 3rd, using the 200% milestone as a price target projects a risk to reward ratio of over 5 to 1.

Chart 4 – Daily Bar Chart BP-SpotV

The management of trailing stops always presents an inexact science, as the best strategy to use will only become apparent a good amount of time after the trade is closed. Chart 5 shows the one-day swing chart as a method of trailing stops.

Chart 5 – Daily Bar Chart BP-SpotV

We can also use the 2-day chart, however as this sits currently, this leaves our stops below the initial swing bottom and subject to loss if the market retreats. There is a strong case for a hybrid system of managing parts of the position different ways.

Chart 6 – Daily Bar Chart BP-SpotV

If we review the Pounds futures contract specifications, we see each contract controls 62,500 British Pounds. Each tick means a $US6.25 move for or against you with an approximate margin of $US3,000 per contract.

Risking 94 ticks per contract we see a dollar risk of 94 x $6.25 USD = $587.50 USD

The potential profit based on the exit target of 200% is 535 ticks x $6.25 USD = $3,343.75 USD per contract.

There are also numerous other instruments you could access including FX pairs and CFD’s over FX.

As a recap, this market jumped into my radar as I saw several of my usual markets moving sideways. It was a time to change perspectives. These opportunities are regular and abundant in markets, it’s all a case of being ready for them before they happen, I still hold the view that the end of the year will see some exciting times for the Pound. This could be one that you watch over the relaxing break many of us will undertake over the Christmas / New Year period. Could be a good market to set some goals around into 2021.

On that note, I want to wish the Safety in the Market community a relaxing and rejuvenating break over Christmas and New Year, however, you celebrate it. I also want to thank Di and Mat for the platform to communicate trading ideas and ramblings to you all, I do hope you find them useful.

Good Trading

Aaron Lynch