Whether you are specialising in a market or looking to take a one-off swing trade in a new market, it will help you plan your trade if you know how that market has behaved before.

It is vitally important that you go back and test all the strategies and methods within the courses you have purchased and further back-test them on your markets. The aim of this article is to assist your trading by getting you to look at what your market has been doing.

We have covered back-testing ABCs in previous articles and I suggest you go back through to review these – you might consider this your homework. This exercise is to get you thinking about what else you might like to back-test. To start, think about the bigger picture and some of the patterns that you like to trade.

I have used ASX/SPI200 (API-SPOTV) to illustrate the process but this can be applied to anything you trade, be it stocks, commodities or even currencies.

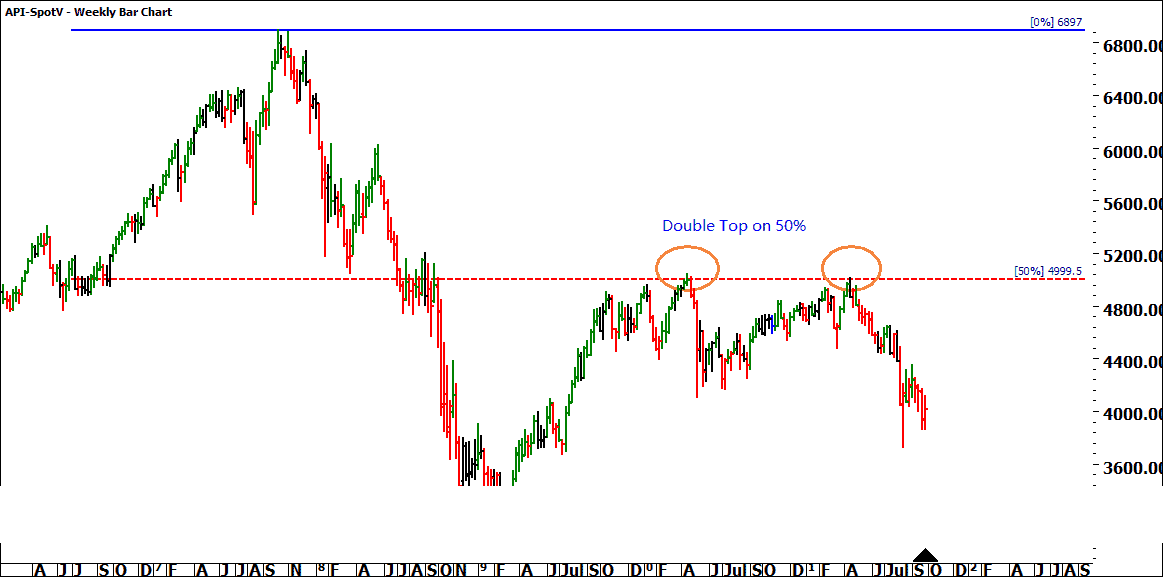

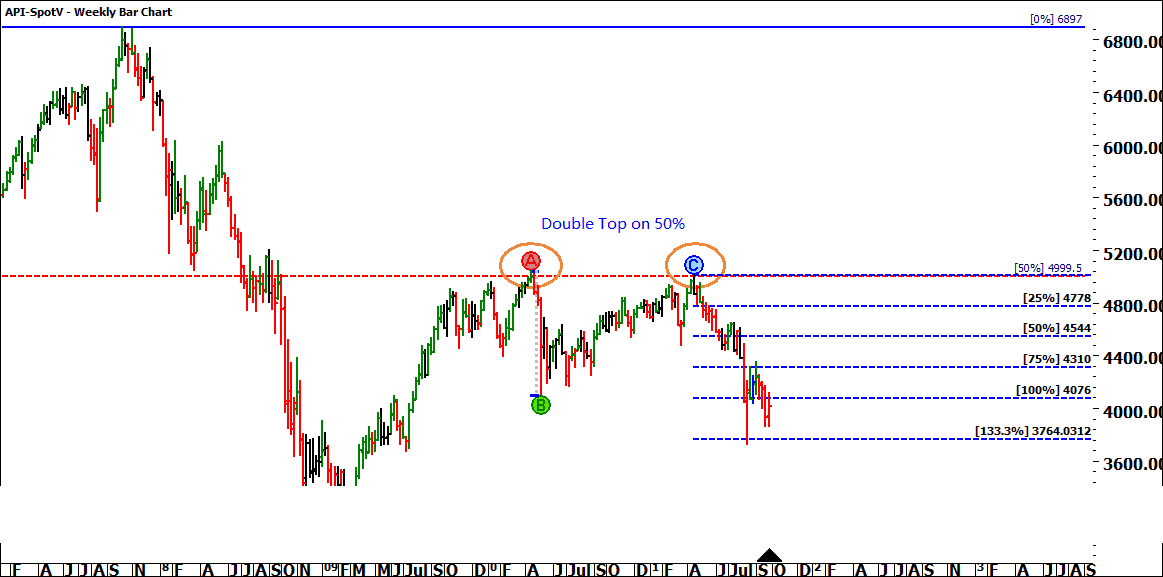

One of my favourite setups is a double top or double bottom on a 50% level, so I have chosen a market and reviewed the entire history of the price chart looking for double tops and double bottom setups. This is best done on the weekly chart. Take note of the setups and where they are on the current range or as a percentage of the current high.

I have illustrated this in Chart 1 with a double top that is sitting at 50% of a bigger range.

Keep a record of your findings to refer to in the future. There are many other areas that are also worth back-testing, including but not limited to; Triple Tops, Triple Bottoms, Breaking into New All Time Highs, Breaking into New All Time Lows.

It’s Your Perception

Robert Steer