Be Nimble

The month of September is often written about and discussed as a month for crashes and turmoil and that can certainly be the case, but like all things, the details are more important and the why and when are critical for us as traders.

Any market participant is more than likely tracking the fate of interest rates and the backdrop of inflation with many meekly starting to suggest that it has been tamed. Interest rate movement will always have a theme behind it, currently it’s inflation but there is always a narrative that could push them higher or lower. In this newsletter I have been tracking the fortunes of financial stocks and the US is home to big names and individual indexes. You can familiarize yourself with the previous articles as this will build on that commentary and analysis.

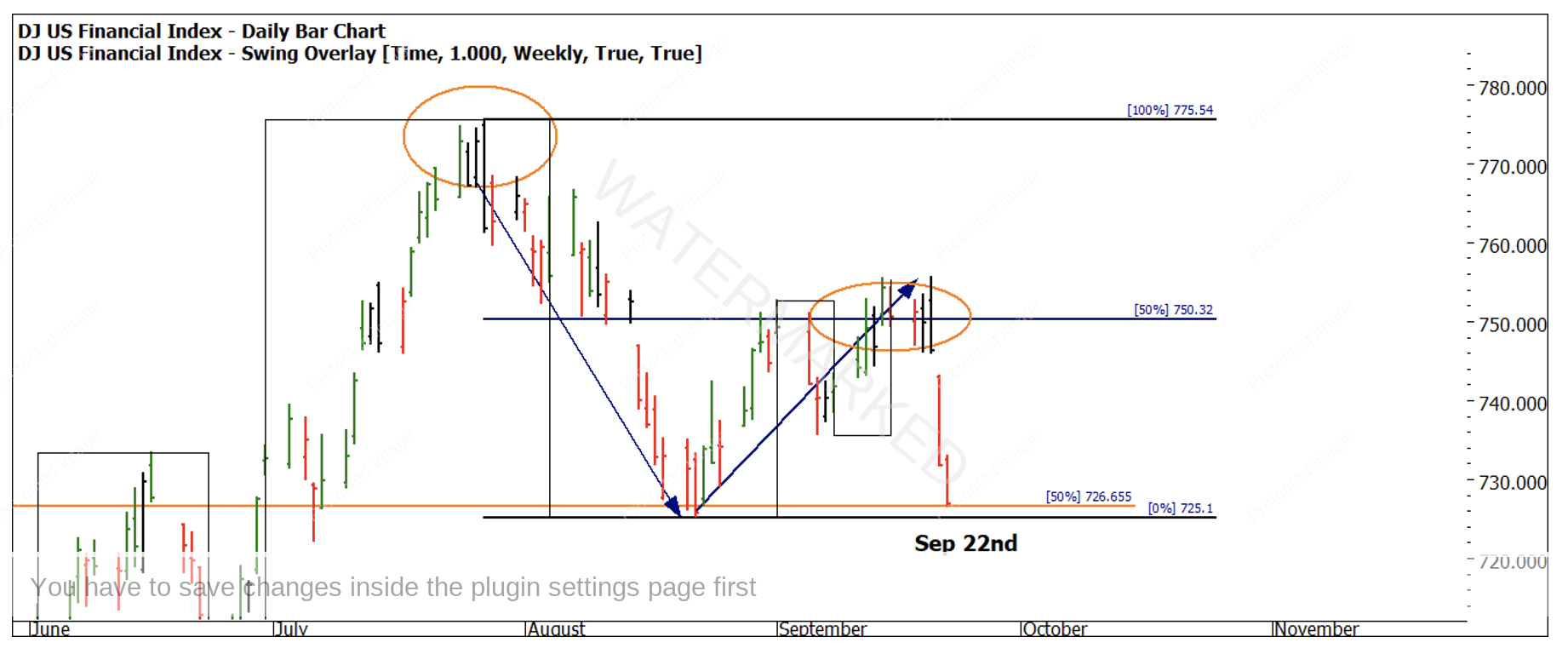

A review of Chart 1 brings us up to current day on the DJUSFN, this index measures the relative movements of major financial stocks. The analysis suggested a top would complete in July around 773 points. The good news is that the change in trend delivered a tradeable short move, but it did not produce as swift and violent reaction that might be a confirmation of a more major shift in sentiment.

Chart 1 – Daily Bar Chart DJUSFN

The concerns for me in this move can be summed up by the weekly swing chart and the lack of definitive change in its reading. The weekly trend was up, and the daily trends became down, the broader sentiment has not confirmed that a significant swing top is in place. There is a case that we can make for a continuation of the uptrend or if there is a failure at the current price levels, we may get the second leg down and if that is met with an acceleration of price, I may be able to write a different narrative next month.

Chart 2 drills into the smaller pattern, the Wheels Within Wheels concept is well at play here. The move up from August 22nd to mid-September has been quite orderly and approximately 50% of the July / August range. As mentioned, if the bears were truly in control, I would have expected a more sustained sell off and less buying support.

Chart 2 – Daily Bar Chart DJUSFN

What we do find is a strong sell off into the 22nd of September with price landing at exactly 50% of the yearly price range that occurred in February (high) and March (low). With multiple price points clustering around this level, we can be on alert for support, if this is not apparent and support fails to hold, then we could see some downside acceleration.

The skill set of being able to assess what the market is doing, as opposed to a forecast you may have put extensive work into, is one that takes time and patience to deliver. We need to be nimble in our views and see all possible options for movement with a solid confirmation framework when it comes to executing trades. This comes to mind for me as the shape of the market and its current position are not consistent with the view I had back in June. That is not to say that there haven’t been opportunities for profit, but it can be hard to shift gears in terms of expected moves.

Now would be a good time to view the major constituents of this index and see how they are positioned. You may find a bullish or bearish case for them soon. This can be used as some consensus analysis as to where the index is poised to move. I found that exercise gave me some strong ideas as to what may be coming next.

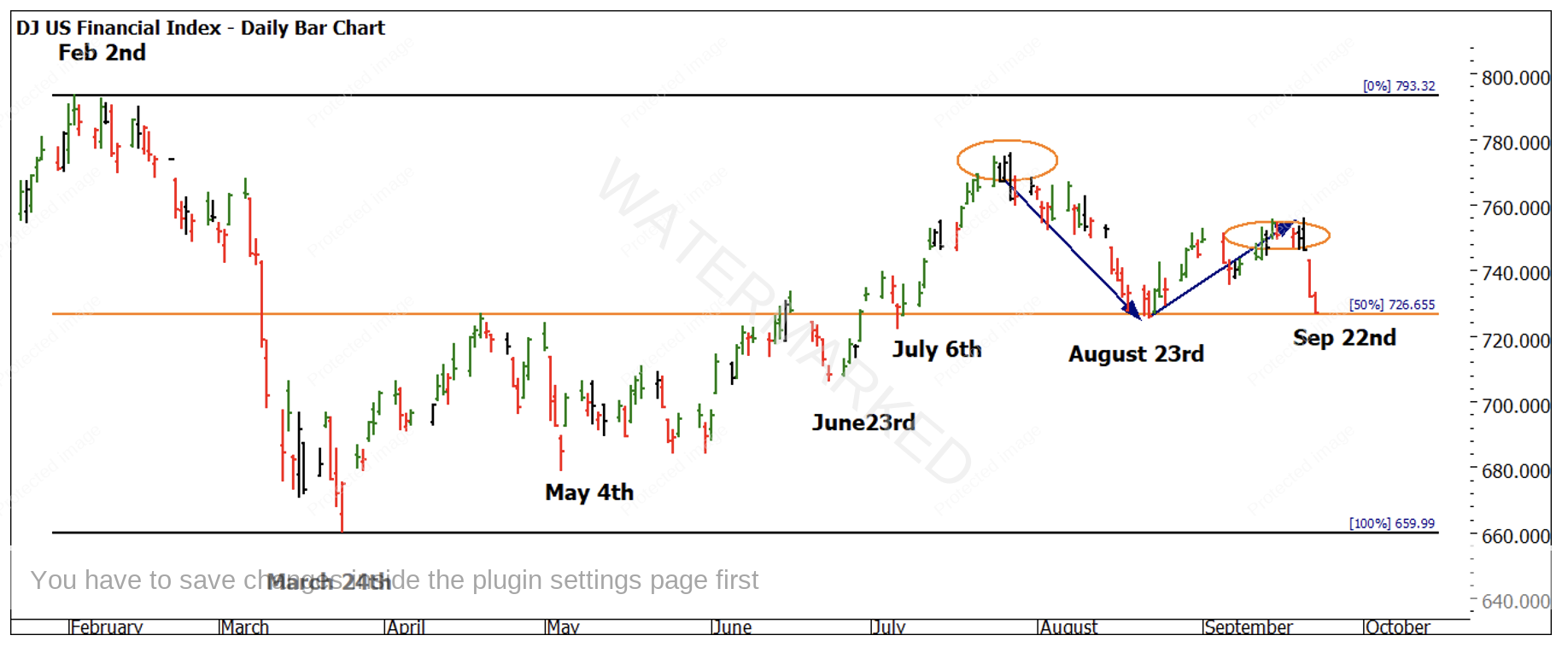

Finally, Chart 3 adds second dimension analysis to the frame, I have noted the dates of major lows for the year. We can use these as hints as to what the market has been doing and if there are any relationships.

Students of the Ultimate Gann Course should see some harmonies straight away. This all leads us to the next few days of price movement which can call the tune in the short term.

Chart 3 – Daily Bar Chart DJUSFN

The basis of price and time repeating is the foundation of the way Gann traded, once you can identify the footprints a market leaves then we can build a system around that, remember, a market will always do what it wants, and we should adjust that view in a methodical way.

Good Trading

Aaron Lynch