BlueScope Steel

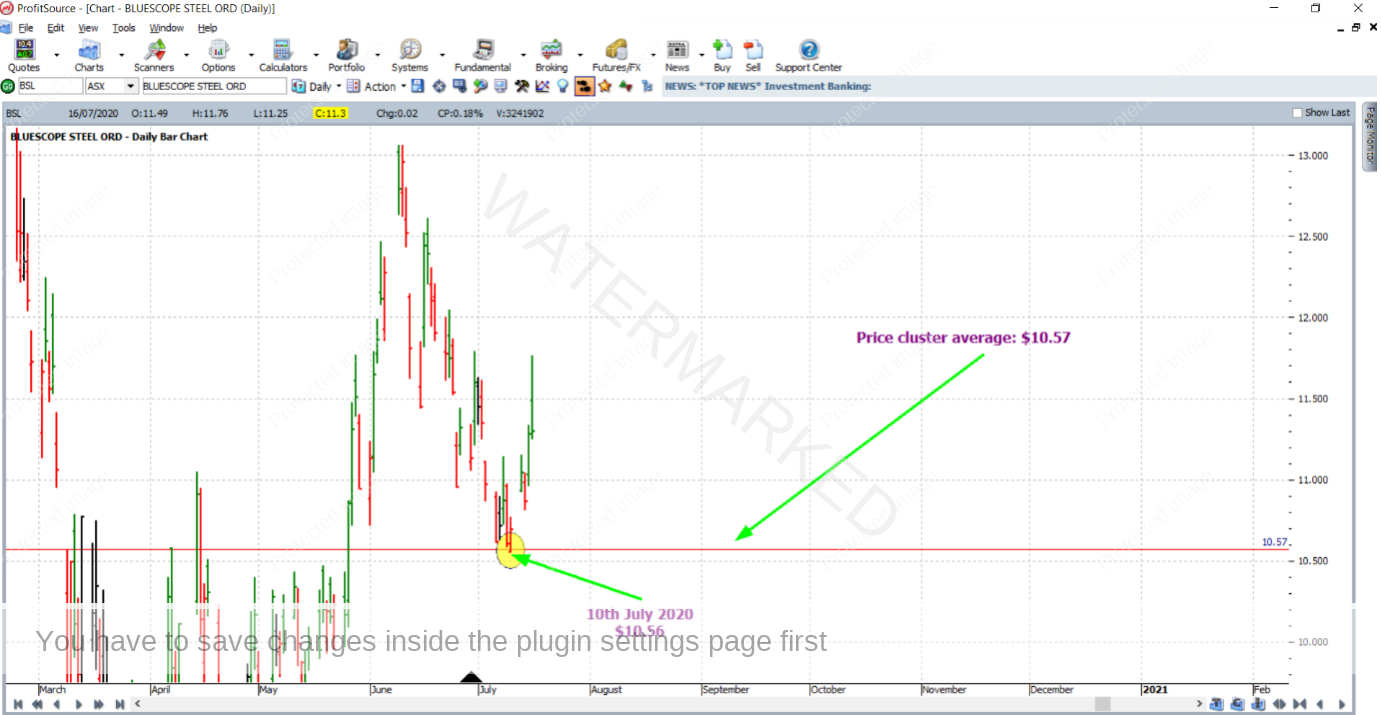

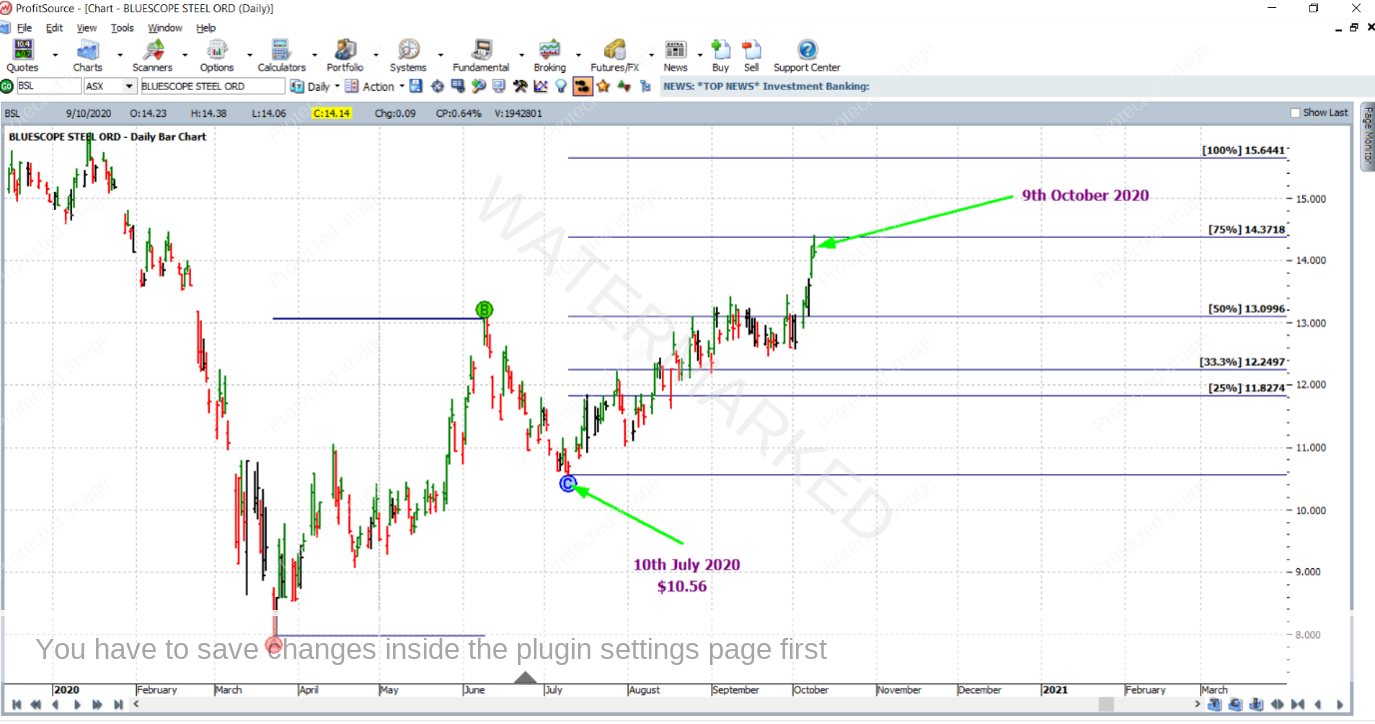

For managing the position, we will use the last monthly swing in the same direction and move stops “Stock” style, that is, just like a large ABC and taking profit at the 75% milestone. The AB reference range used is shown below with the aid of a few handy things from ProfitSource: The monthly Swing Overlay, the monthly Turning Points Hi-Lite and of course the ABC Pressure Points tool. So in other words the software offers a few options for us to be very clear about the reference range being used.

This trade was a bit of a grind, with patience required. On 25 August 2020, exit stops were moved to break even as the market reached the 50% milestone (13.0996 rounded down to 13.09).

And on 9 October 2020 the 75% milestone was reached and profits realised at a price of $14.37.

Now let’s take a look at the possible rewards on offer from this trade:

Initial risk: 11.05 – 10.80 = $0.25 = 25 points (point size is 0.01)

Reward: 14.37 – 11.05 = 3.32 = 332 points

Reward to Risk Ratio = 332/25 = approximately 13.3 to 1

If 5% of the account size was risked at entry, the growth in account size from this trade alone would be as follows:

13.3 x 5% = 66.5% (just shy of two-thirds!)

With 5% of a $10,000 account risked at entry, the reward in absolute Australian dollar terms would be:

13.3 x $500 = $6,650

Work Hard, work smart.

Andrew Baraniak