Breaking Down a Market’s Heartbeat

There are many different analysis techniques taught in the work of WD Gann and of David Bowden, and many different ways that they can be applied. For example, there are many applications of Time by Degrees, and many students will apply this technique in different ways. For some, like David, it is their most profitable trading tool. For others, it is less important.

When I was first learning the techniques of WD Gann, and building my own trading systems and processes, I was influenced by those who placed Time by Degrees at the very top of the list of tools. That wasn’t a bad thing, it meant that I missed taking good trades more so than taking bad trades. The intent in discussing this is to allow you to understand your road is the most important one rather than attempting to follow the exact footsteps of those who have come before you.

You may notice that I use seasonal time a lot when it comes to Crude Oil, and I am really talking about the most basic version whereby the 30 degree and 15-degree dates often given me more than enough dates to work with and allow for a confirmation tool that aligns with the other techniques I am applying. For reference I am extracting this work from the Ultimate Gann Course in Chapter 4.

The birth of contract (BOC) date on Crude Oil can help but has been less of a technique I use given its success rate. For reference the BOC on NYMEX for Crude Oil is 30 March 1983, which means that we have just ticked over the 40th anniversary of its trading but remember that Oil has been a commodity and therefore exchanged (bought and sold) considerably longer. If we pick up from last month’s articles, I was discussing the 7th of November as a potential anniversary date and the September 30 degree date as a marker for how the market may pan out.

For reference if we average the two tops formed in September on Crude (Double tops) we could agree that the 23rd of September has been a turning point.

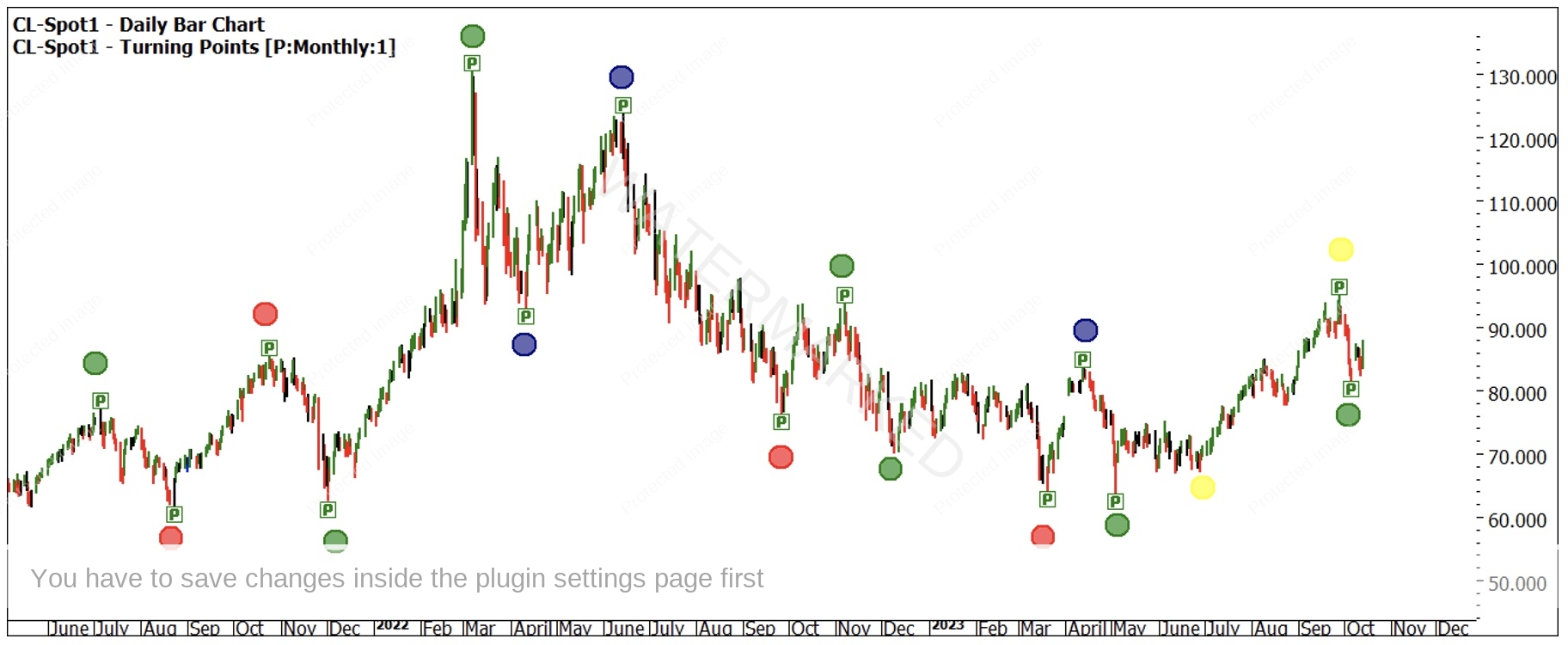

You’ll recall that David colour coded times of the month to watch that aligned with his Time by Degrees dates. This is a very simple way to see the heartbeat of a market, especially if we see lows and highs aligned to colours. Chart 1 looks at the last 18 months or so on Crude Oil. We have the three colours of green, yellow and red from David’s work and I have also added a 4th colour (blue) for dates that align but do not relate to the BOC or 15/30-degree seasonal dates.

Chart 1 – Daily Bar Chart CL-Spot1

If we look at the frequency of each date around significant tops or bottoms as derived from a 1-month swing chart (I have added a couple more turns that did not align with the turning points in the swing chart) we see:

| Green | ||

| Yellow | ||

| Red | ||

| Blue |

In the chart above we can see the Green seasonal times acting as the best indicator of a change in trend when compared to the other colours, with bottoms slightly more likely than tops. .

We can continue to follow this cycle and add some other analysis over the top. Given the current geopolitical crisis in the Middle East the fear regarding the premium of oil may continue to grow. Chart 2 combines the Time by Degree tool anchored to our heartbeat date of 7 November. Added is a premise that perhaps this market has had two moves up and a small picture 3rd section could be unfolding? Finally using day counts and some range projections of prices running 100% I am looking for a price target around $99.00.

Chart 2 – Daily Bar Chart CL-Spot1

The global concern over conflict in multiple regions is a major concern on so many levels. The ability to look at cycles from small to large can provide a greater deal of certainty to our trading. And of course, we need to be on top of our swing trading in order to take advantage of these setups. If you are not already booked in, I’d highly recommend that you sign up for Mat’s Swing Trading Mastery webinar coming up in December, before the early-bird pricing expires at the end of this week. It’ll be a great day for those new to swing charting and for the rest of us a fantastic refresher!

Good Trading

Aaron Lynch