Cocoa Part 3

The run of the Cocoa bull continues and as at the time of writing, the Cocoa futures market sits at a high of $11,722 USD per metric tonne. This is more than quintuple the value of the last major low in September of 2022. This is shown below in the weekly bar chart from ProfitSource (chart symbol CO-SpotV) as well as the positions that Cocoa was at when discussed in the previous two SITM monthly newsletter articles. Since then, even the natural psychological resistance level of 10,000 has not been enough to scare away the bulls, and the up trend has continued strongly.

As discussed in last month’s article, volatility in this market has been so high of late, that intraday bar sizes have become large even in relation to average daily bar sizes in the history of this market . Therefore, much of this article focuses on the intraday charts.

As for a recent trade, here was the analysis prior to trade entry:

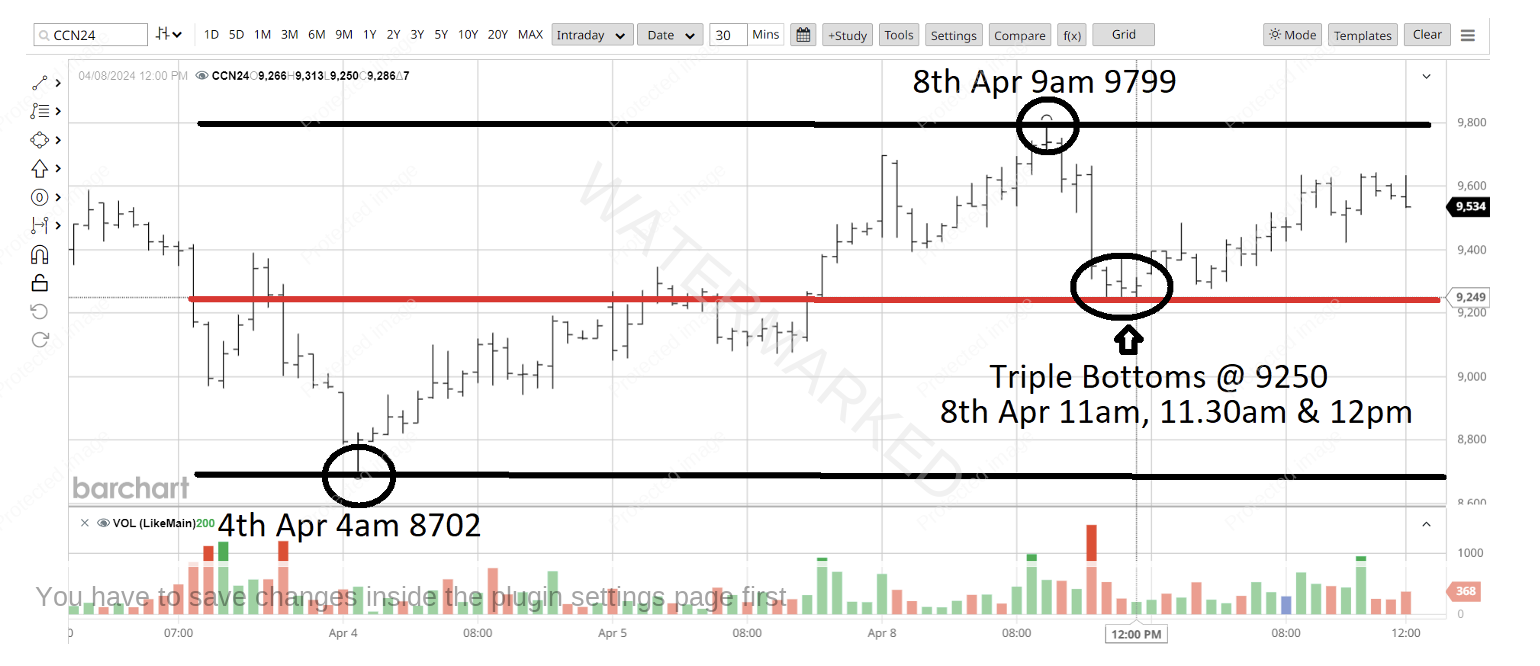

On the 30 minute bar chart of the July 2024 Cocoa futures contract from barchart.com, a Ranges Resistance Card when placed from the 4 April 2024 4am low (8702) to the 8 April 2024 9am high (9799) had its 50% resistance level at 9,250. On 8 April 2024 at 11am, 11.30am and 12pm (all times US Eastern Standard Time) the market gave 3 triple bottoms, each at exactly 9,250! Astute readers will have noticed that last month’s article spoke of something rather similar – two exact double bottoms, also on the 30 minute chart which also sat at 50% on a Ranges Resistance Card. In other words, volatility can certainly breed consistent Gann behavior in a market!

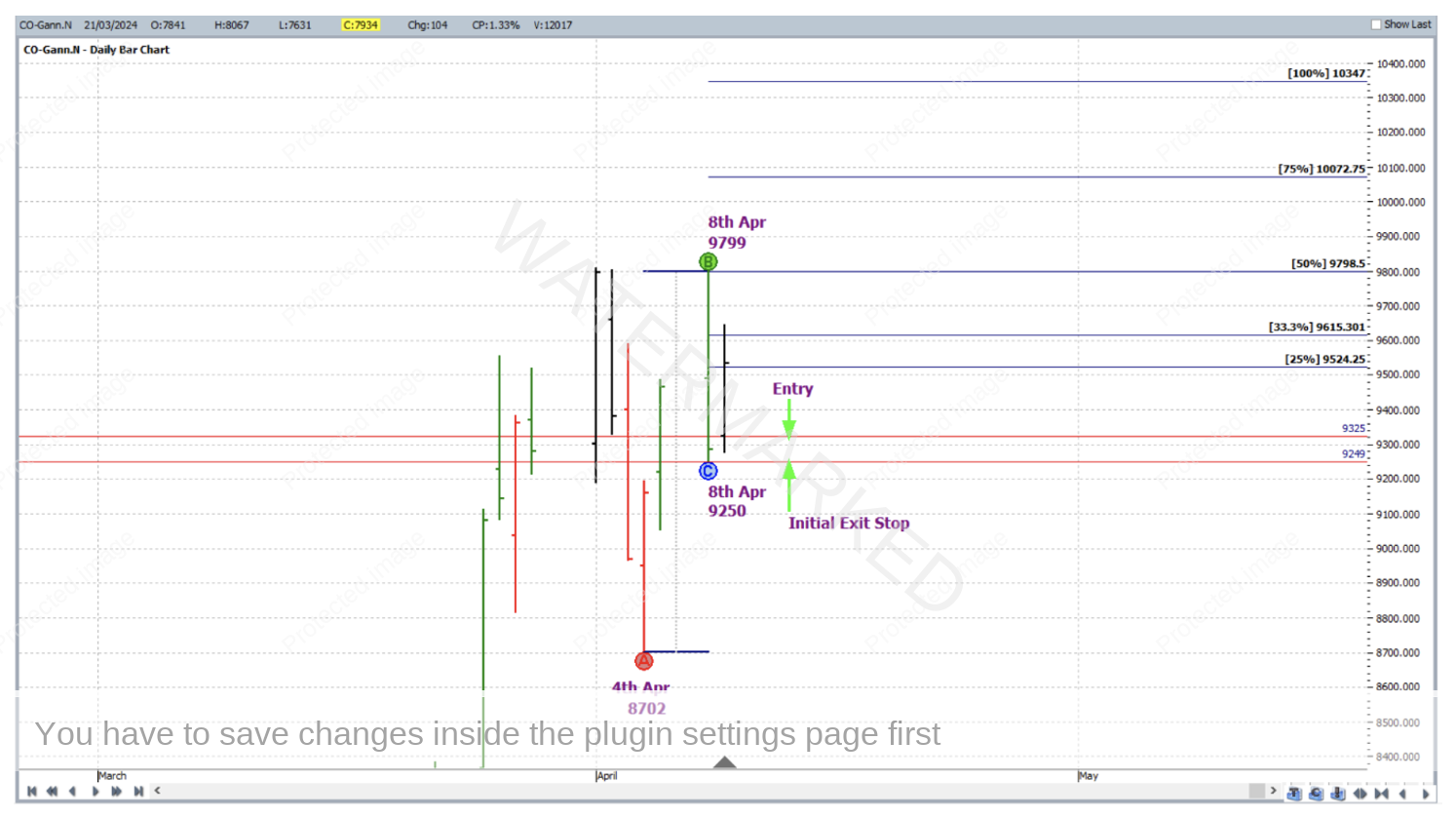

The next 30 minute bar was up, getting you long the July 2024 Cocoa contract at the confirmation of a swing low in the 30 minute swing chart. Entry was at the opening of this bar at 9,325 with an initial exit stop at 9,249 i.e. 1 point below the cluster of the triple bottoms and the 50% resistance level on the Ranges Resistance Card. The up bar that triggered entry in this case was the first 30 minute bar of the next trading day – that of 3am Eastern Time 9 April 2024.

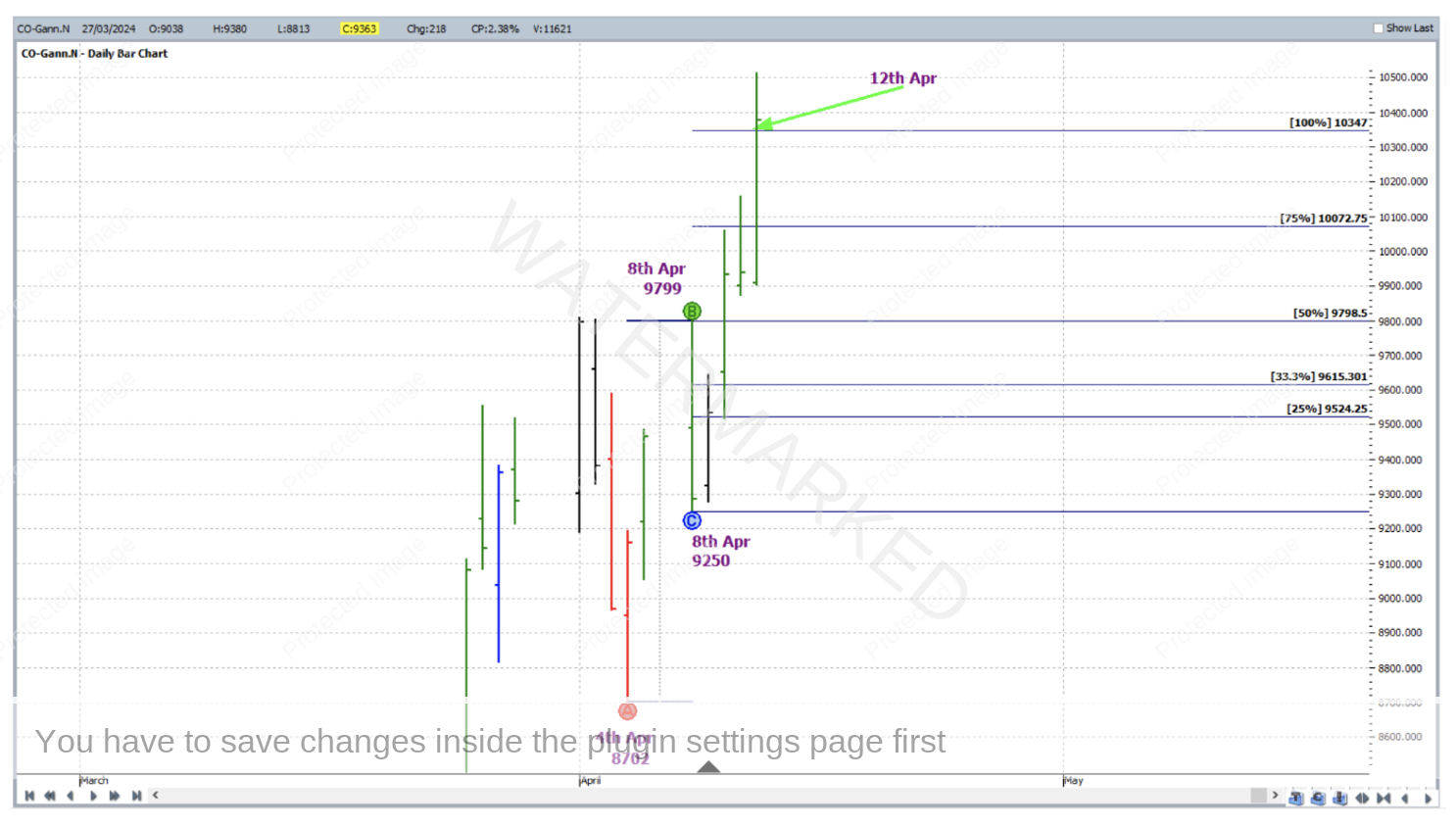

The last daily upswing in the direction of the trade was chosen as a reference range, with Points A, B and C as follows:

Point A: 4 April 2024 8,702

Point B: 8 April 2024 9,799

Point C: 8 April 2024 9,250

These are shown in the chart below along with the entry price and initial exit stop loss. The trade entry in this case study occurred very close to contract rollover, so instead of using the SpotV chart for trade execution, the continuous Gann chart for the July contract is used, symbol CO-Gann.N.

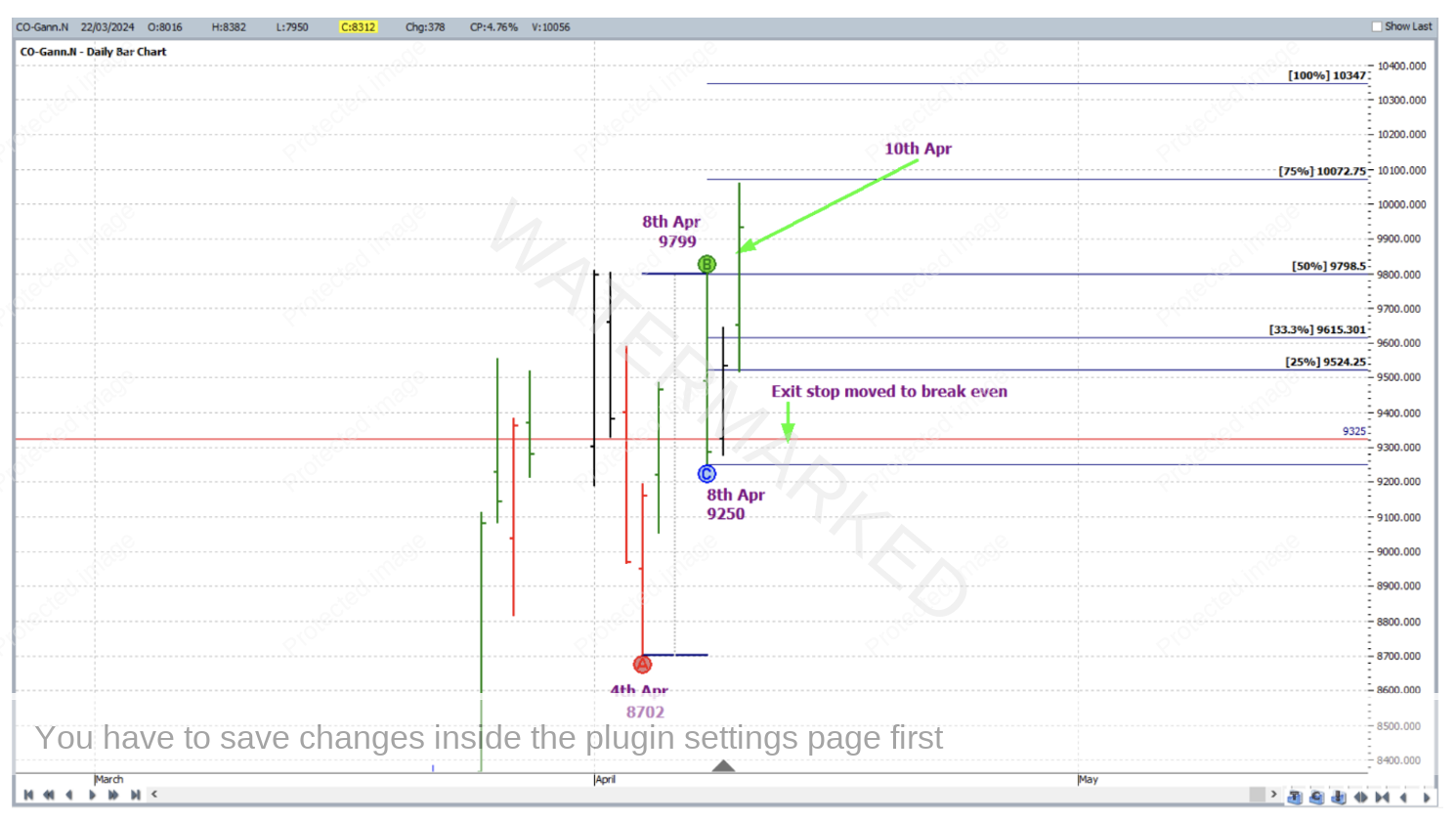

Stops were managed currency style as though in a standard ABC trade, and the daily bar chart will be used to demonstrate the trade management that was. On 10 April 2024, the market cleanly broke through the 50% milestone and exit stops were moved to break even.

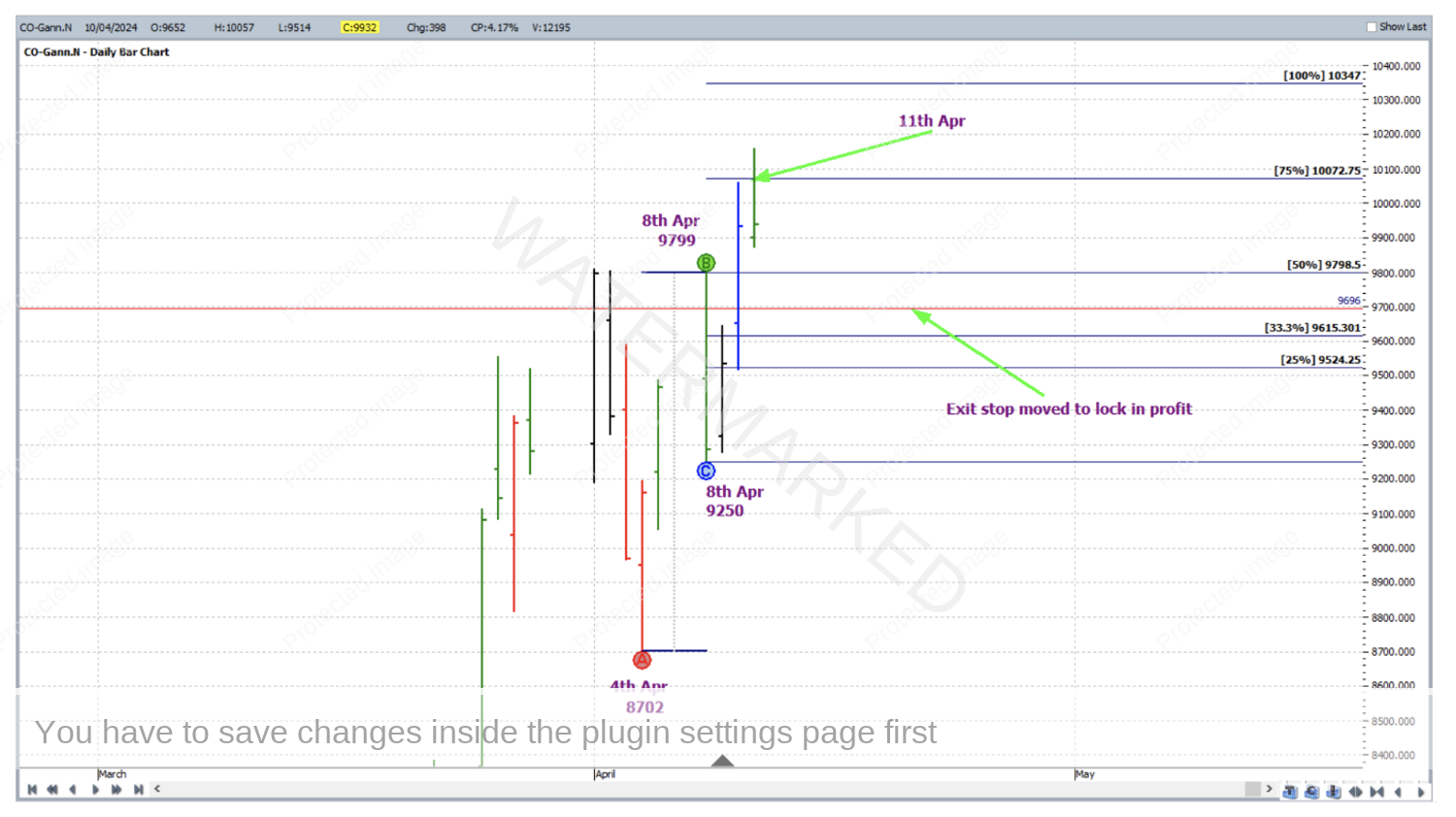

A day later, the 75% milestone was reached and exit stops were moved to lock in some profit at one third of the average daily range (approximately 102 points based on the last 60 daily trading bars) below the 50% milestone.

Then on 12 April 2024, the 100% milestone was reached, and profits taken at 10,347.

For a breakdown of the rewards let’s take a look at the Reward to Risk Ratio:

Initial Risk: 9,325 – 9,249 = 76 points (point size is 1)

Reward: 10,347 – 9,325 = 1,022 points

Reward to Risk Ratio = 1,022/76 = approximately 13 to 1

Assuming that 2% of the account size was risked across the range of a 30 minute bar (plus a small gap up at open) at trade entry the gain in account size would be as follows:

13 x 2% = 26%

This increase was within the space of a week, which is indicative of the steepness of the moves currently underway in this market.

Each point of price movement changes the value of one Cocoa futures contract by $10USD, therefore in absolute USD terms the risk and reward for each trade of the contract was determined as:

Risk = $10 x 76 = $760

Reward = $10 x 1022 = $10,220

At the time of taking profit this reward was approximately $15,723 AUD. One can also access this strongly trending market via CFDs where much smaller minimum positions sizes are available.

Work hard, work smart.

Andrew Baraniak