Coffee Break

The main constituents of the soft commodities sector are Sugar, Cocoa, Coffee and Cotton. From the charts it’s apparent that strong moves in one of these markets often coincide with strong moves in at least one of the others. This year so far Cocoa has been the ring leader, which begs the question have any of the other softs followed suit with some volatility of late? While this form of intermarket analysis is almost as simple as it gets, it’s enough reason for a change this month, so it’s back to the Coffee market.

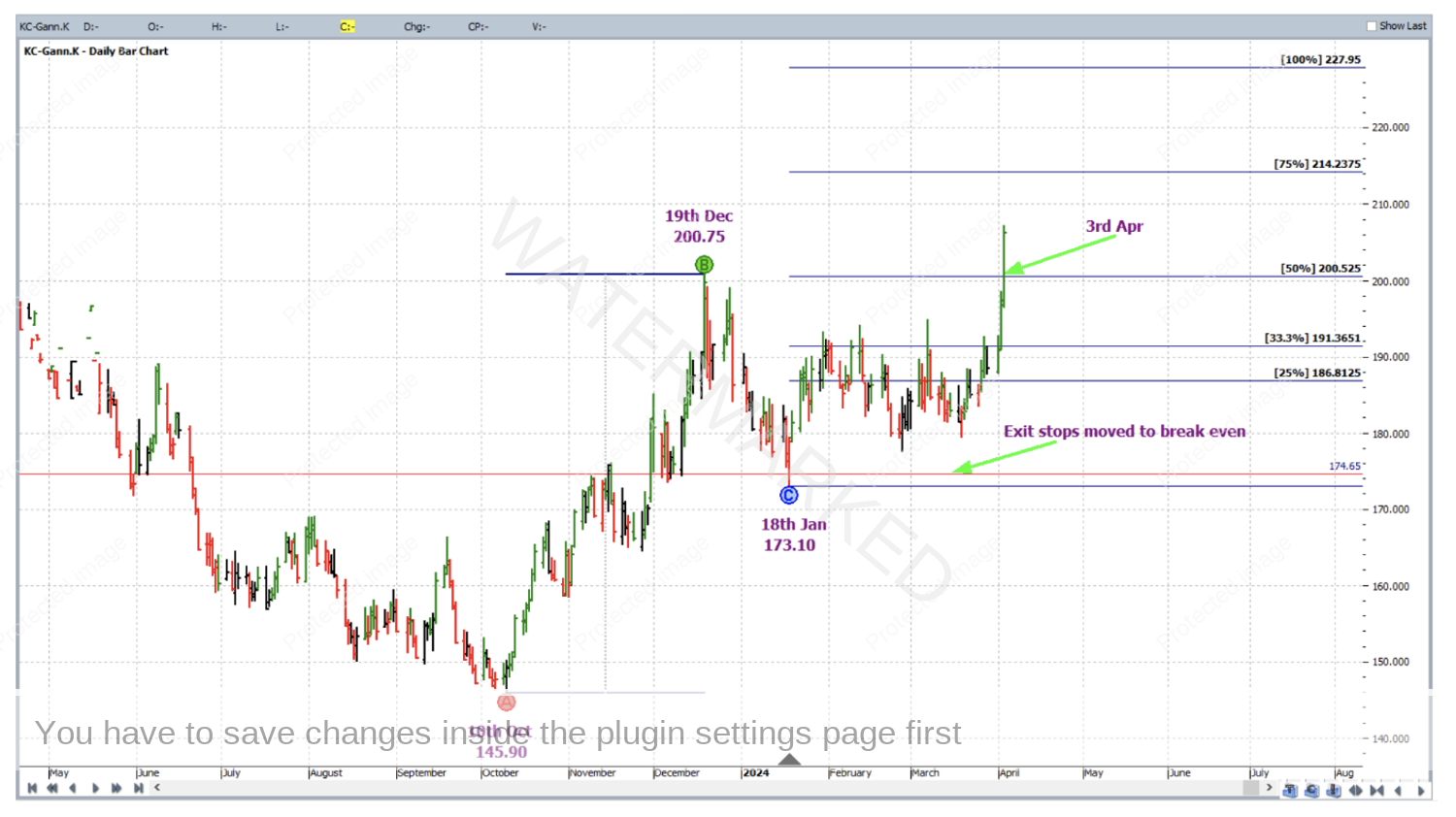

Getting straight into the analysis, as at 18 January 2024, Coffee’s May 2024 futures contract had made a low of 173.10 cents per pound. This low false broke a price cluster that averaged 173.15 by only one point (point size in this market being 0.05). This is illustrated in the screenshot below from ProfitSource, chart symbol KC-Gann.K in Walk Thru mode.

To recreate the price cluster using the above chart, here are a few hints:

Apply a Ranges Resistance Card from the October 2023 low to the December 2023 high

Apply a Ranges Resistance Card from the 2019 low to the January 2024 high

Apply a Lows Resistance Card to the October 2023 low

If you’ve managed to reproduce the above analysis fully and correctly, you will notice its simplicity, symmetry, strength and accuracy. In light of this we afford a look at the intraday chart, ultimately in pursuit of a high reward to risk ratio. Shown below is the 30 minute bar chart of the May 2024 contract from barchart.com; a first higher swing bottom entry out of the 173.10 low would have had you long coffee at 174.65 with an initial exit stop loss at 173.50.

As for managing the trade, the last monthly up swing was used as reference range, with points A, B and C applied as shown below (with the aid of the monthly swing overlay), stops to be managed Currency style as though in a large ABC trade.

Patience was required to begin with as it took until 3 April 2024 for the market to break through the 50% milestone at which point stops were moved to break even.

Then things got going as it only took another 5 calendar days for the market to reach the 75% milestone and stops were moved to one third of the average weekly range (approximately 3.60 cents) behind the 50% milestone to lock in some profit.

Then on 12 April 2024 the market reached the 100% milestone and profits were taken at 227.95.

To breakdown of the rewards, first of all in terms of Reward to Risk Ratio:

Initial Risk: 174.65 – 173.50 = 1.15 = 23 points (point size is 0.05)

Reward: 227.95 – 174.65 = 53.30 = 1066 points

Reward to Risk Ratio = 1066/23 = approximately 46 to 1

Given that the entry parameters only spanned across the small range of an intraday bar, let’s assume that only 1% of the account size was risked at trade entry. This means that after trade exit, the percentage gain in account size would be as follows:

46 x 1% = 46%

Each point of price movement changes the value of one Coffee futures contract by $18.75USD which means in absolute USD terms the risk and reward for each contract of the trade was as follows:

Risk = $18.75 x 23 = $431.25

Reward = $18.75 x 1066 = $19,987.50

In AUD terms at the time of taking profit this reward was approximately $30,750. This market is also accessible with much smaller position sizes by means of a CFD.

Work hard, work smart.

Andrew Baraniak