Numbers have their own psychology surrounding them. We often gravitate towards some and shy away from others. Within the markets, understanding certain numbers gives you greater meaning to the psychological outcomes likely to present. By taking these outcomes it can be effectively applied to trading strategies. It is not really the case that every time a market hits a psychological number it will do ‘X’, but more so understanding the underlying market sentiment is a very wise move in order to understand human traits and tendencies.

To give you an example, the number 100 is officially the end of the double-digit journey. It’s the first number that uses a combination of three numbers for it to form. It offers a sense of completion or full-circle effect. 100 is also ten multiples of ten. We are all familiar with the human hands that typically have 10 fingers and the human feet, having 10 toes. 10 is the first number that uses a combination of two numbers to form the start of the double digits. Both 10 and 100, provide a sense of rationality and order. It seems to be a simple round number that sits well with the human brain.

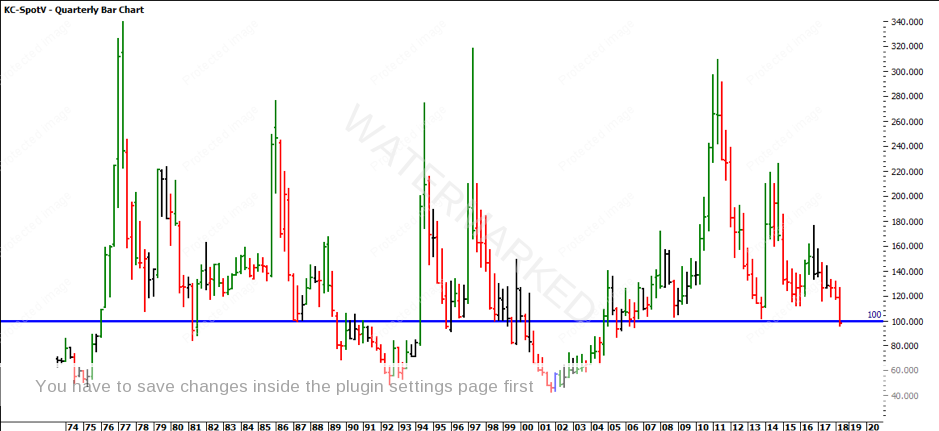

If you refer to the Coffee chart below (ProfitSource: KC-SpotV), you will see that there is a horizontal line through $100 that covers the history of the coffee market. It looks like coffee is a market that likes gravitating around the $100 level (maybe this has to do with a price of coffee in Sydney these days).

I am not suggesting that the break has failed just yet, but we are at the start of the beginning of a potential move in either direction. As David Bowden says we don’t want to be anticipatory stupid, so let’s monitor this set up over the coming weeks to see how the weekly chart closes in relation to the psychological level of $100.

It’s Your Perception

Robert Steer