Copper – Looking Back

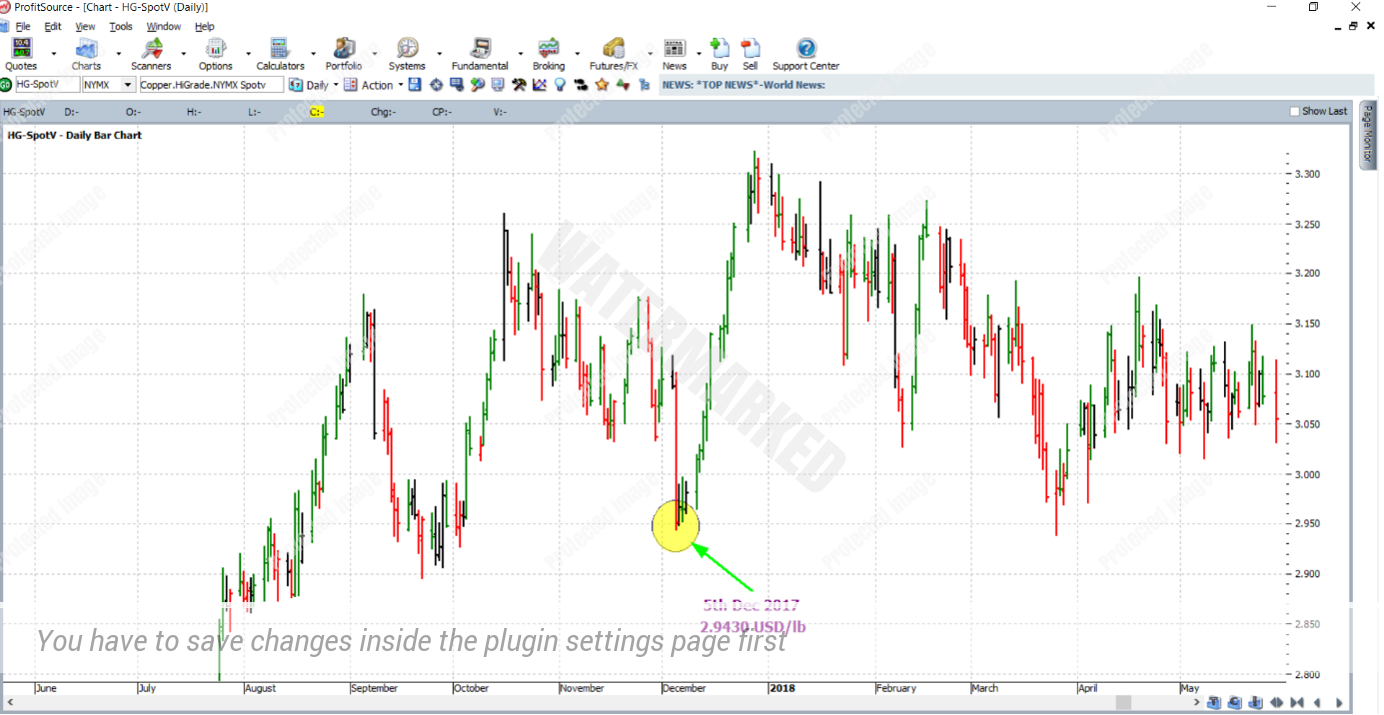

This month’s article goes back to December of 2017 to take a look at a trading opportunity that occurred in the High Grade Copper futures market. While this is looking back a little further than these articles normally might, the example is still worth discussing, especially if you reproduce the underlying price analysis. It’s a great example of how simply sticking to key milestones and resistance levels can yield some high probability trades. The turning point which resulted from the price cluster is illustrated in the ProfitSource chart below, symbol HG-SpotV.

The three main price reasons which lead to anticipation of a low did so at an average price of USD$2.9520 per pound. The low itself came in at 2.9430, only breaking the average level of the price cluster by a small amount. This is illustrated in the chart below. See if you can reproduce the analysis and come up with the same average figure. Remember, stick to key milestones/resistance levels like 50%, 100%, etc. and don’t forget the idea that old tops and bottoms (significant ones) become new support and resistance levels which we can add to our Price Forecasting.

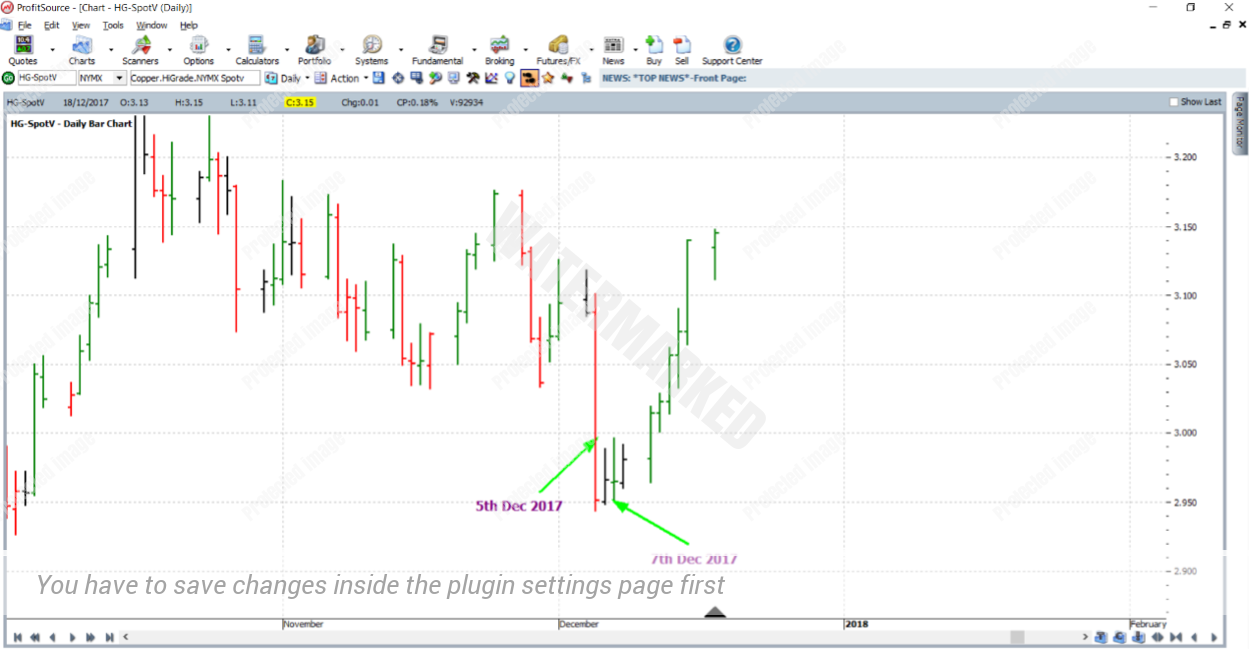

With our attention on the 5th of December 2017 low, let’s consider two possible alternatives for market entry. The first and more aggressive will be based upon the intraday chart. The screenshot below is from barchart.com, zooming in on the low in question, on the 60 minute bar chart of Copper’s March 2018 futures contract. Had you traded the first higher swing bottom from this chart, very soon after the final low was in place, you’d have gotten yourself long in this market at a price of 2.9665 with an initial stop loss at 2.9500 during the up bar of 9pm on the 5th of December 2017, Chicago time. Sometimes stalking out an intraday chart entry can be a little “red eyed”, especially given that it requires many of us to get up at strange hours of the night, when a lot of the commodities traded through a US exchange are at their most volatile. This one was a little easier for some in that department however – the entry itself came early afternoon AEST on the 6th of December.

A second, and more conservative alternative to trade entry in this case came using end of day data. That is, the simple daily bar chart. Entry in this way was achieved with the up day which was the 7th of December 2017. Entry was at 2.9890, with initial stop at 2.9425 – one point below the low itself.

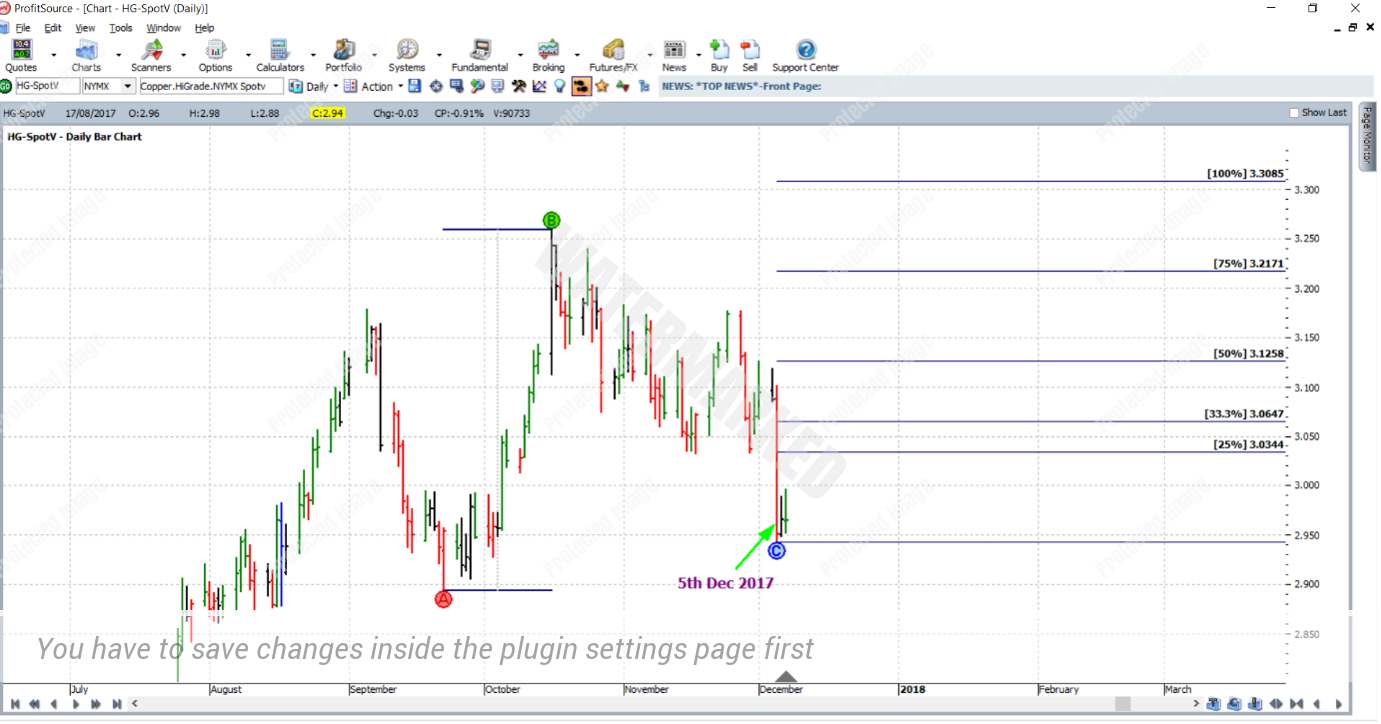

Having detailed the trade entry, let’s consider using a reference range for the purpose of trade management. In this case we’ll use the range from the September 2017 low (2.9840) to the October 2017 high (3.2595). While this range was not taken directly from the weekly or even monthly swing charts (one’s reference range was too small, the other’s possibly a bit large), it was taken by simply observing the bar chart, and picking a recent, clearly defined range in the same direction as our trade – one which, as you will see, still delivered some healthy rewards to the trading account.

And in this article let’s stick to the trading plan of managing the trade from here on as though it were a normal ABC trade managed “Currency” style. On the 15th December 2017, the market reached the 50% milestone – and stops were moved to break even.

Then on the 21st of December, the market reached the 75% milestone and all stops were moved to lock in some profit. One third of the average daily range of the last 60 trading days was approximately 0.0185; so exit stops were moved to this distance behind the 50% milestone.

And after a nice steep, strong run (as a commodity like this can often deliver) on the 28th of December 2017 the market reached the 100% milestone and the trade was exited at a price of 3.3085.

And finally we begin the analysis of the rewards in the usual way. Having used two different entry techniques, there will be a breakdown for each. Firstly, having taken the intraday entry:

Initial risk: 2.9665 – 2.9500 = 0.0165 = 33 points (point size is 0.0005)

Reward: 3.3085 – 2.9665 = 0.3420 = 684 points

Reward to Risk Ratio = 684/33 = approximately 20.7 to 1

High Grade Copper futures are traded through the CME Group. According to the contract specifications on the exchange’s website, each point of price movement changes the value of one Copper futures contract by USD$12.50. Therefore in absolute dollar terms the risk and reward (in USD) for each contract of the trade is calculated as follows:

Risk = $12.50 x 33 = $412.50

Reward = $12.50 x 684 = $8,550

In AUD terms this was approximately $10,988 at the time of taking profits. Assuming that 2% of an account was risked upon this intraday entry, the account size required would be USD$20625, so in terms of a percentage change to the account size after closing the trade, trading one contract would result in the following:

$8550/$20625 = 41% (to the nearest whole percent)

Secondly, having taken the more conservative end of day chart entry, here are the calculations:

Initial risk: 2.9890 – 2.9425 = 0.0465 = 93 points

Reward: 3.3085 – 2.9890 = 0.3195 = 639 points

Reward to Risk Ratio = 639/93 = approximately 6.9 to 1

While not as high as in the first case, this is still a respectable reward to risk ratio.

In absolute dollar terms the risk and reward (in USD) for each contract entered in this way is calculated as follows:

Risk = $12.50 x 93 = $1,162.50

Reward = $12.50 x 639 = $7,987.50

In AUD terms this was approximately $10,254 at the time of taking profits.

Assuming that 5% of an account was risked upon this entry, the account size required would be USD$23,250, so in terms of a percentage change to the account size after closing the trade, trading one contract would result in the following:

$7,987.50/$23,250 = 34% (to the nearest whole percent)

Like for many other commodity markets, there are brokers out there who will make this market tradeable with much lower margin and lower absolute dollar risk via a CFD.

Work Hard, work smart.

Andrew Baraniak