Friends and Enemies

In this article I want to focus on a paragraph taken from page 75 of my version of WD Gann’s book Truth of the Stock Tape. Gann says:

Any trader who has followed the market for ten years or more and has been an active trader, if he will carefully analyze his trading, will find that there were certain stocks which he was never able to make any profits in. He always seemed to get in too soon or too late. No matter if he sold them short or bought them, he always ended up with a loss, while other stocks always seemed to favour him, so much so that he would call them his pets. Now there must be some cause for this, as nothing just happens. Everything is the result of a cause. When you find that a stock does not seem to work well for you, leave it alone. Quit trading in it, and stick to the ones that favour you. I could explain to you the cause for this, but it is not necessary, and many of you would not believe it.

The first time I read this page, I at first dismissed it as coincidence, or Gann being superstitious! However, over a long period of time, both in my own trading and by observing the trading of other students, I believe this statement is worth your consideration.

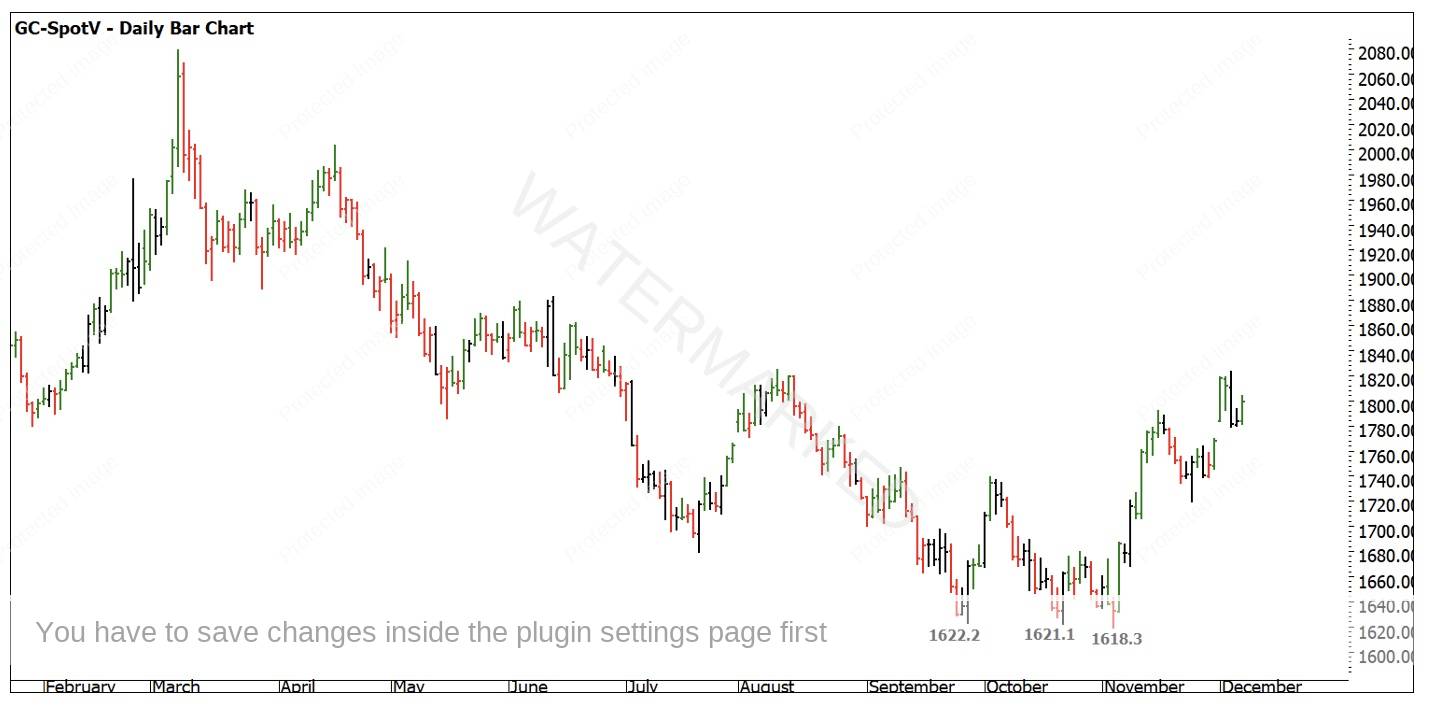

I’ll start with my own experience. As I mentioned to the students in coaching this year, when it comes to Gold as a commodity, I do not recall ever making a successful trade on this market, or even giving a correct opinion on it. When Gus found a cluster around 1620 on Gold in early September and showed it to me, I told him that I didn’t like it and that I thought Gold had further to go down. I also joked with Gus that I’m never right on Gold so he should probably buy as much as he could! Well, you can see in Chart 1 below how good Gus’s call was!

Chart 1 – Gold Triple Bottoms

Now, there can be many reasons that we get a call wrong. Sometimes, we just misread the market. Or perhaps our analysis is not good enough (for the record, I made the call on Gold before the first low was hit – if I had seen triple bottoms at this level, even I might have thought Gold would go up!). However, compare this with a call I made on the Nasdaq three months before the All Time High, where I saw within minutes that the Nasdaq was likely going to top at 16,700 and be a yearly top. Or another call from coaching this year on the Australian Dollar where I called an exact price (and posted it on the forum before it happened) and took a 57 to 1 RRR on the trade. Were those calls flukes? Or was the Gold call just me having an off day? Perhaps.

Let’s go back to the 2019 Interactive Market Outlook. We looked at 10 markets or so during that event, and I correctly called the February 2020 top of the S&P500 to within half of a percent in price, again a couple of months before it happened. I also called for Double Tops and a crash on the DAX, which came in spectacularly. I also made the case for Crude Oil to drop from $50 a barrel to single digits (Oil actually went negative, but I’ll still claim that one!). These were all terrific calls, and a lot of students made a lot of money out of them. However, at that same event, my outlook for Gold was wrong.

Are you seeing a pattern here? Now Gann says that he can “explain the cause” but that it is “not necessary” – simply stop trading that market! Students in MFC Coaching who are interested in discovering the cause might like to revisit our Reading List lectures from this year if they would like to delve into this topic in a little bit more detail. But for everyone else, as Gann says – if you notice that you can’t seem to make money out of a market, consider letting it go and trading something else.

As for stocks that are like your ‘pets’ as Gann called them, I can recall one such experience with Foster’s (the stock, not the beer!). The code was FGL on the Australian Stock Exchange, and I loved it (the stock, not the beer!) from the moment I saw it. In a six week period early on in my Platinum Year, I turned $2,000 into just under $50,000 predominantly trading this one stock. All I used were swing ranges, Ranges Resistance Cards and Geometric Angles. I have never been able to repeat that period of trading, in terms of accuracy, ease, or profitability since, despite gaining a ton of experience and knowledge since then. Could FGL have been ‘my friend’ or ‘pet’ as Gann would say? It certainly met the criteria. Sadly, the stock merged and was delisted shortly after this, so I never got to trade it again. I’ve also never found a market like it since, although I predominantly trade just a handful of currencies.

Now, perhaps it is just coincidence after all, however I do believe that Gann is giving us a terrific lesson. A mentor of mine told me that only about 5% of markets are our ‘friends’ as Gann describes them. He said a lot of markets will be mildly positive or mildly negative for us, and then about 5% will be our enemies. He said that you could tell over a period of time by comparing your results on a range of trades on different markets. It’s worth noting that so many Safety in the Market students decide that they will ONLY trade the SPI200 because that is the market that David traded – what if that market was their enemy? Food for thought.

I will give you one last example before I finish up. Those of you with a Master Forecasting Course will know about David’s final lesson that he teaches you in that course, on the sixth and final day of David’s last seminar. You will see how emotional he got in finally sharing that lesson, and how much it meant to him. When I went to apply that lesson on the British Pound, I solved the lesson almost instantly. However, when I tried to apply it to the Australian Dollar, it took me years and years to crack it (which I finally did, and it’s brilliant – but it still took me a long time on the Australian Dollar). My mentor told me that if a market is ‘your friend’ it is easier to crack. This can be another clue as to whether a market is our friend or enemy, or somewhere in between. Now, most of my best trades have come from the Australian Dollar (I doubt that I could bank a 57 to 1 RRR profit on a market that was my enemy), however I still miss a lot of turns on the Australian Dollar, and it does confuse me at times. So while it has been a profitable market for me, perhaps it is not as good of a ‘friend’ as it could be – at least not to me.

I have recently begun to pull apart the British Pound, keeping in mind that I have had some past success with it, and so far I have found every one of David’s techniques relatively easy to apply to it. Perhaps it is a better market overall than the Australian Dollar (it certainly makes MUCH larger ranges). Or, perhaps it is more of a ‘friend’ to me than the Australian Dollar is. Either way, I will be doing my best to test Gann’s theory in 2023 as I add the Pound into my trading arsenal.

My challenge for you is to look over the markets that you trade. On reflection, and after reviewing your profits and losses – can you see any markets that MIGHT be your enemy? How about a market that MIGHT be your friend? Do you think it might be worth experimenting in a few different markets to test them out and see? You never know, your best friend (or friends) might be out there just waiting for you to meet them and trade them!

Be Prepared!

Mat Barnes