Golden Times

For those who follow the political and news cycles, overlaid by markets, it never ceases to amaze me how often events, tension and political decisions all seem to arrive at points in time that align with time and price pressure points. The most recent one that comes to mind is the G7 meeting and the postponed attendance of President Biden to Australia as the US battles the debt ceiling discussion. This event (the need to raise the US credit card limit) is one that I have seen before, and I recall being in the US twice previously as the same discussion unfolded.

Will the US allow the debt limit to be increased or will the Government be forced to “shut down” as they attempt to find new solutions? The names of the politicians have changed but the same old song is being played, good for us traders though. If this game of football is played in the world’s largest economy with the dominant reserve currency, then any assets traded in that currency may offer some opportunities. In the case of the USD this means that commodities as I have discussed before are well in play.

Gold has been a market I have discussed ad hoc for the last 12-18 months; I noted the potential for tops coming up in last month’s Platinum article and we can now discuss that the high, at least in the short term, has come in.

Chart 1 uses a Lows Resistance Card as a price tool to look for support and resistance. In this case we can see the orange line as a full multiple of price and the lighter blue a 25% milestone. Approximately 8.25 times the lows of $253.20 shows resistance and the case for a double top.

If we use the lows card as a market square, we can see that the 3 tops are all in the weak part of the square which is ideally were we would like to see tops.

Chart 1 – Daily Bar Chart GC-SpotV

As the price action fails to the upside and falls under the orange line (full multiple of the low) we can be more comfortable with a short position.

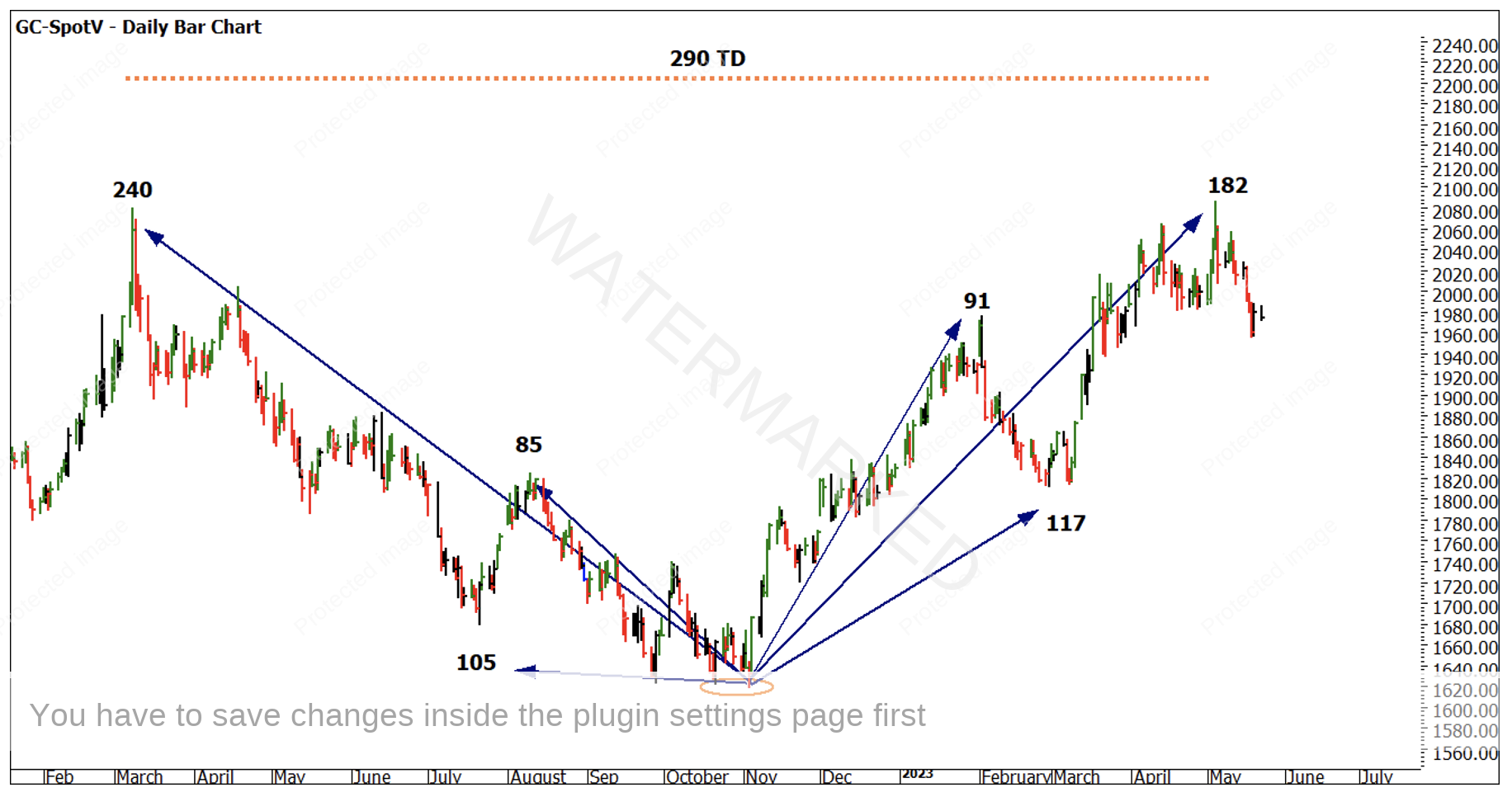

Chart 2 shows predominately calendar day counts running backwards and forwards from the November low. I have marked below the count between the two tops, we can see there are 290 trading days, this is close to two multiples of 144, a natural time frame that Gann talks about.

Chart 2 – Daily Bar Chart GC-SpotV

Chart 3 embraces a wider perspective and if we zoom out to see the 2020 high, that could be said to be the 1st top of the double tops, they are 143 weeks apart. This is how we can combine harmonies of smaller and larger cycles. I would also suggest you review your Time by Degrees theory as we are seeing a number of significant areas around what the Druids called “Cross quarter days” they are effectively the midpoints between solstice and equinox dates. They can be folded into our understanding of seasonal time.

Chart 3 – Weekly Bar Chart GC-SpotV

There are numerous examples of time and price coming together in recent weeks so you should dig deeper into that as you analyse this market.

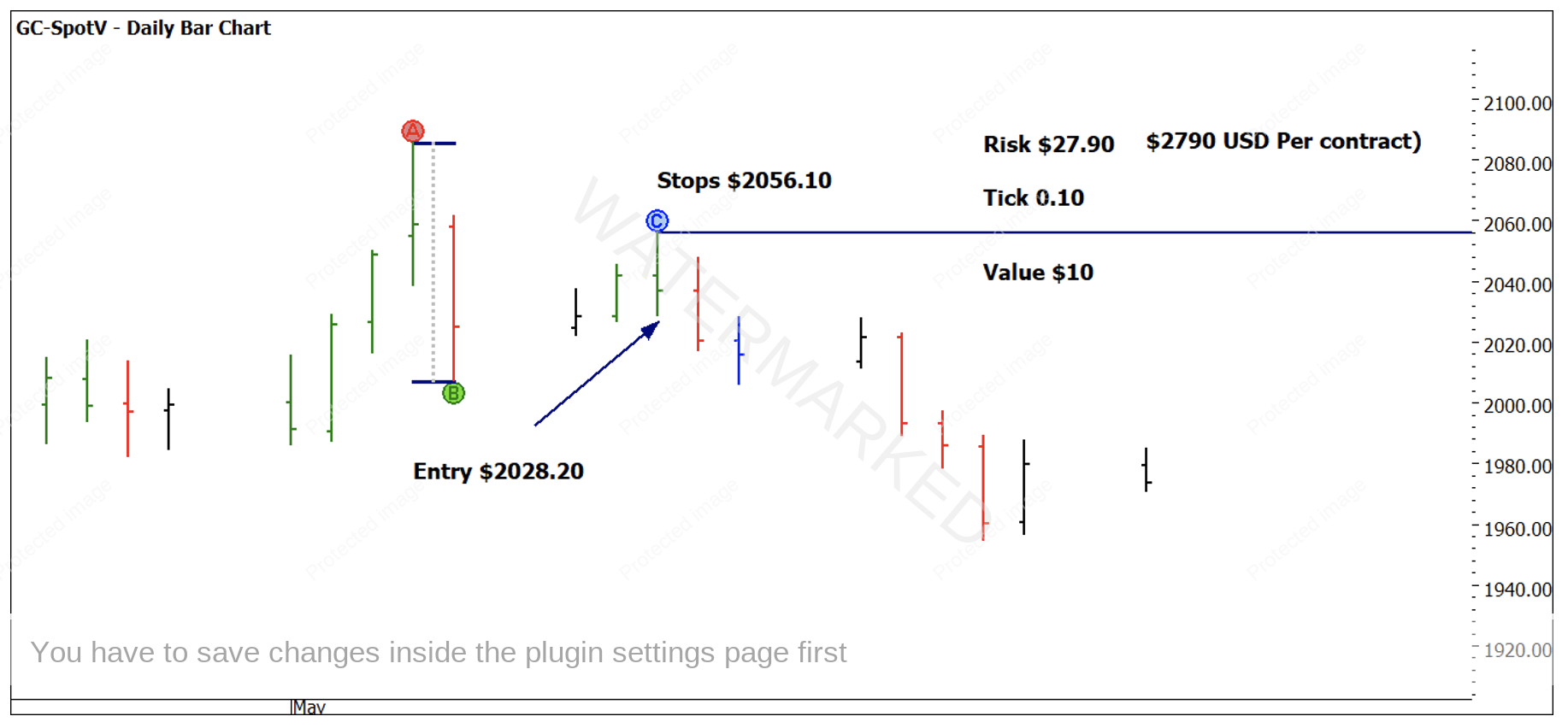

The simplest and safest entry in this example is the first lower swing top of what we thought would be the high. Chart 4 shows a basic entry strategy that could have been executed with approximately $2,790 USD risk in each contract.

There are also CFDs and mini contracts that could be utilised to mitigate or reduce risk and capital requirements.

Chart 4 – Daily Bar Chart GC-SpotV

For those who are looking for a tighter entry using intraday data, using a 4-hour swing chart and entry could have been achieved with the same techniques (first lower swing top) for a reduced risk of approximately $1,700 USD per contract. In this case using an intraday chart did not dramatically reduce the risk of the entry.

The position would still be active in most cases depending on the management you are implementing; we cannot yet be certain this is a significant double top. I am looking to the end of July as my next major date range and that might tell us about the broader structure of this market.

In the meantime, the usual stories, news, speculation, and opinion about the US dollar and whether the debt ceiling will be lifted will rage on.

Good Trading

Aaron Lynch