Habits – Good, Bad or Indifferent?

As I re-read last month’s article, as I always do before jumping into the current, I am struck by my optimism and positive language in terms of how I felt about the opportunity that was forming in Crude Oil. That optimism was not based on hope but experience over many years. As I comment now that optimism could be a little dented as the market “misbehaved” and did not follow the plan.

I am presented with a challenge to my trading plan, for all the reasons I outlined there was a signal to enter the market and I will explain some of my rationale. It was triggered and led to the move not eventuating. I went back over the analysis and looked for what I had missed? Would I enter the same scenario again, yes as I have an ingrained need to follow my plan. You may note the term “need”. In a world where we have so many needs and wants it’s sometimes hard to differentiate between the two. Experience helps us understand the true difference between them, but having worked so hard to get to a plan that I like, I can follow and works more often than not, it’s critical I follow the path. That does not mean it also doesn’t sting.

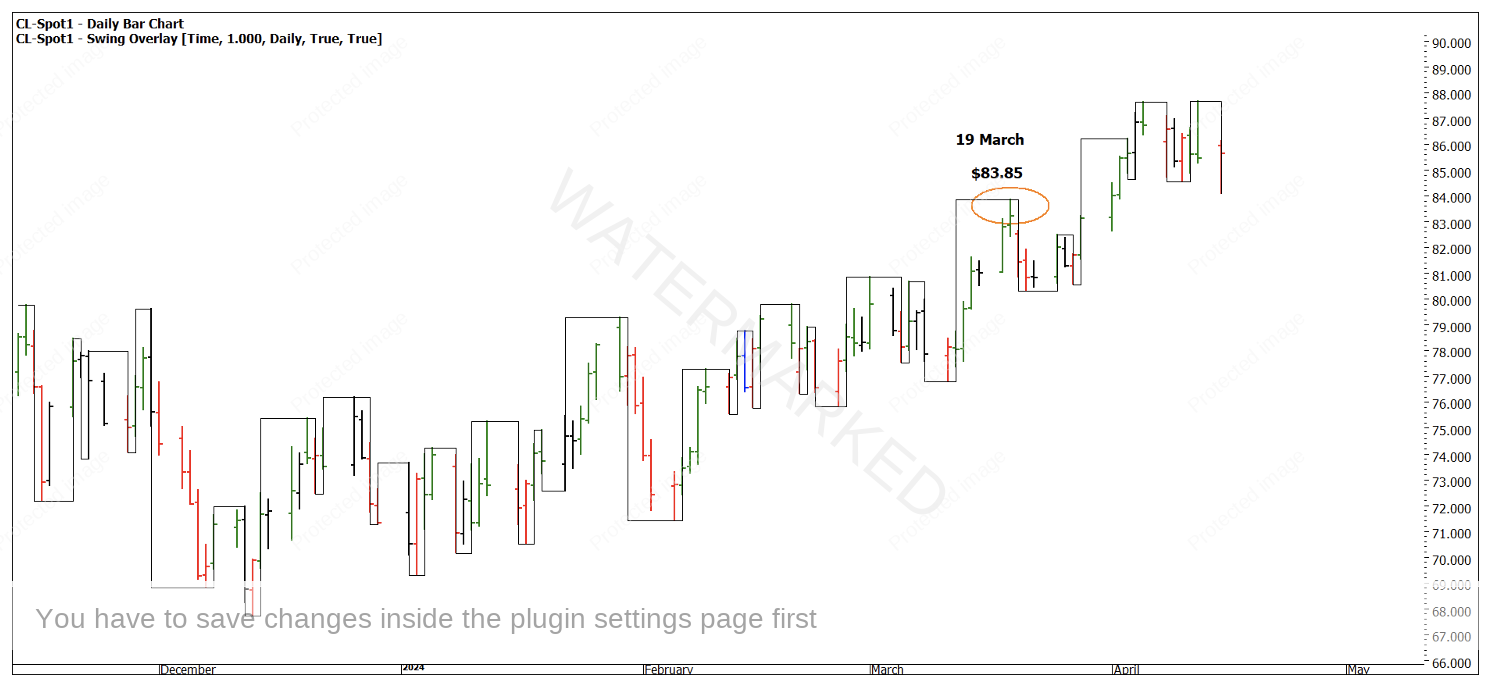

The synopsis was a short move from mid-March into April based on so many previous examples of this, it’s one of my favourite setups and one I am tuned to each year. Feel free to review the analysis from last month. Chart 1 provides an update on the current position of Oil.

The area around 19th March was the place I was looking for a turn, now it’s important to look at the facts around the trade. It’s against the daily and weekly trend so it automatically places us at a higher risk of failure and is not a setup that would be entertained by a newer trader using the rules from the Smarter Starter Pack alone.

Chart 1 – Daily Bar Chart CL-Spot1

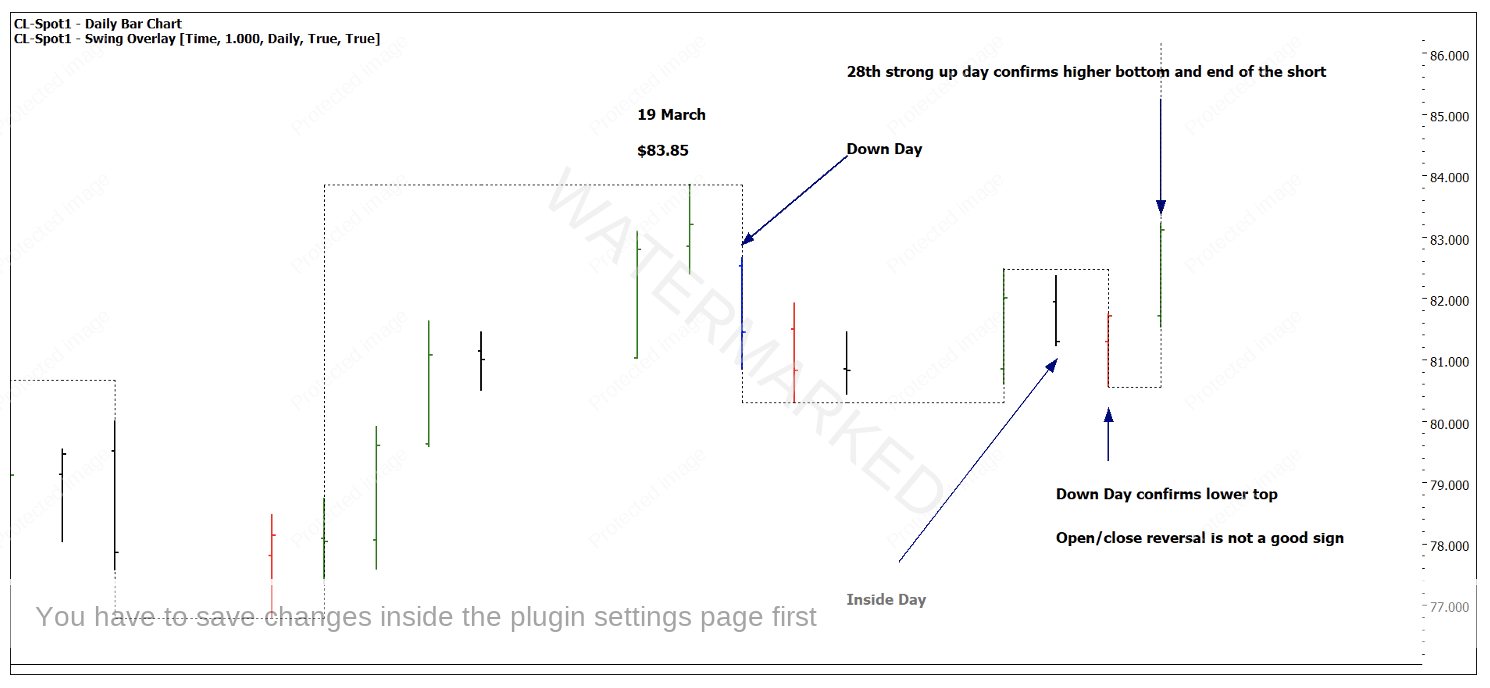

If we zoom into the price action, we can see a few form reading elements that initially stood out on the daily bar chart.

Chart 2 – Daily Bar Chart CL-Spot1

The 20th of March gave us a strong down day and turned the swing chart down, that was followed by what was the first sign that the direction may be wrong. There was no real acceleration away from the 19th, more of a pause to the upside rather than a new move. The inside day followed by confirmation of the lower swing top was the second possible way to enter on the daily chart.

All legitimate entries, in saying that I always found it strange when students said they found entries hard. Opening a position is to me the easiest of the parts of a trade as we can manufacture them sometimes to our detriment.

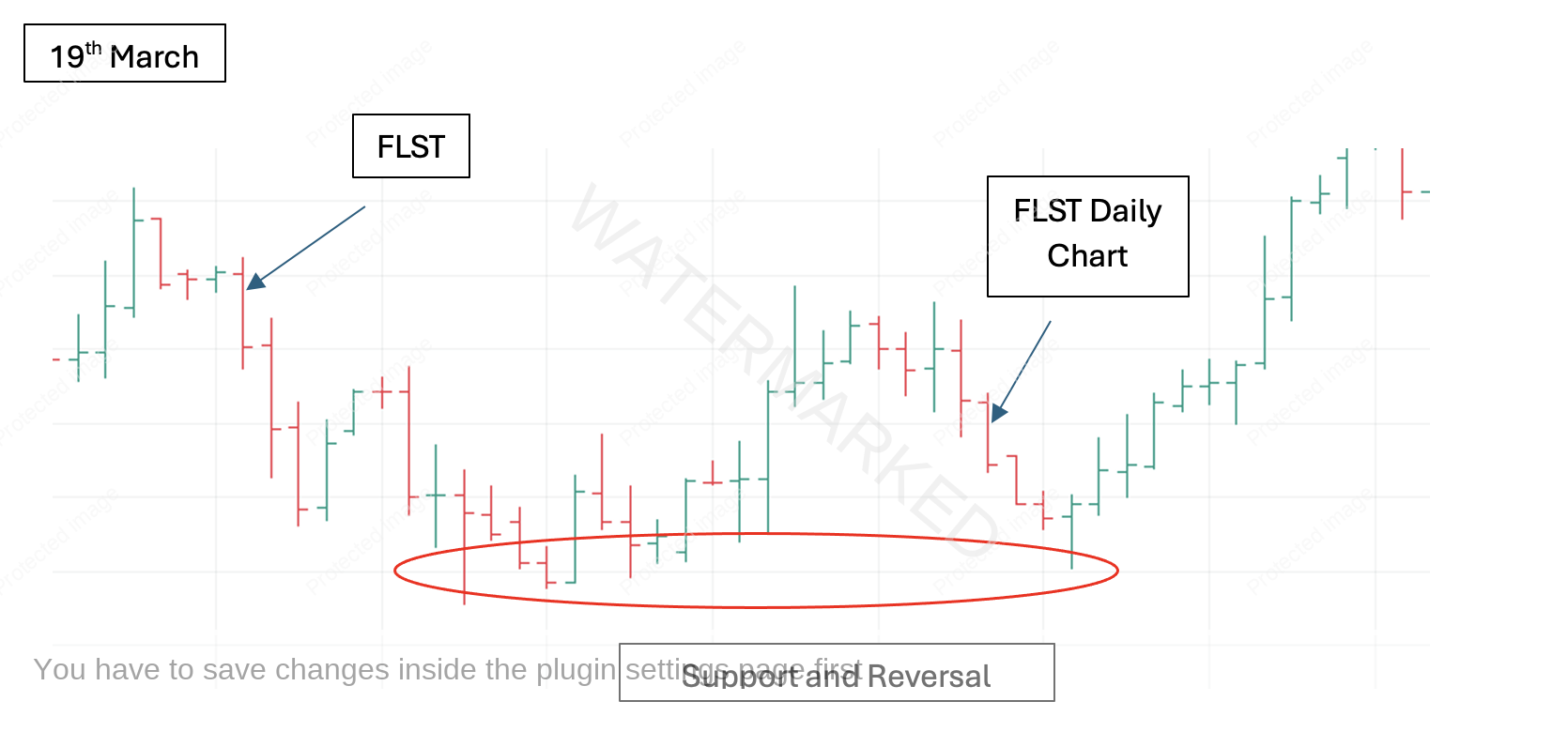

Chart 3 – 4 Hour Bar Chart CL-2024.K

Overall, a losing setup and we can pick over the bones to understand the final position, however, the market confirmed very quickly that any short campaign was not to be. There was a case for a classic stop and reverse, but for a variety of reasons (mainly external pressures as opposed to a trading plan omission) I did not take it. The move higher has been orderly but a little slow and anaemic if we consider the previous bullish range in Chart 4. Time and Price tells us this range is decidedly slower than the previous one, but none the less trading with that boring up trend has been the best outcome.

Chart 4 – Daily Bar Chart CL-Spot1

As I continue to reflect on this period of Crude Oil, in most cases the best results have been lows rather than highs at this time of year, nonetheless, good habits means that you execute your plan when the conditions are met. The results will take care of themselves.

I reflect that the analysis on the US Dollar index was correct in that we expected support, and it has taken up strongly to the upside. However, it has not forced commodity prices lower. This can occur but all our aspects did not fall into place for Crude this time round. There is always next time.

Chart 5 – Daily Bar Chart DX-SpotV

Good Trading

Aaron Lynch