How to Find 12 Good Trades Per Year

In my introduction to this month’s newsletter, I spoke about the goal of finding at least one good trade per month, and in this article, I want to explore that concept in more detail. You will need to decide how many markets you will study in order to find these trades, and also decide what kind of setups are acceptable for you to trade. If you really wanted to, you could find some sort of reason to enter any market on just about any day of the week! We’re not interested in trading every day, though. We want to find good quality, high probability setups with a high Reward to Risk Ratio.

Now, it’s possible to find all twelve of your trades on a single market, however, keep in mind that generally speaking, the bigger turns are the easiest to find, and the most objective and clear to trade. They also usually give you the highest Reward to Risk Ratio. As an example, the 2021 All Time High of 16,767.5 on the E-Mini Nasdaq futures (EN-Spotv) was a terrific trade, which we called live in the August Live Session of Active Trader Program Coaching three months before it happened. For those unfamiliar with this setup, you can view it all in detail in your Active Trader Program Online Training (ATPOT) in the full-day Trading Essentials Webinar recording, which is now online. If I could just trade this kind of setup, every time, I would! The trouble is massive All Time Highs like this don’t come around every month. You’re lucky to get one trade this good every few years. So, you will probably need to broaden your search criteria to find 12 good trades per year.

David Bowden said that he saw around three to four really strong setups or turning points on a market each year, which gave him six to eight trading opportunities to trade both into and out of a turn. In other words, if you have a top, you can trade long as the market moves up into the top, and then trade short as the market moves down out of the top.

To find these setups, I use the Wheels Within Wheels spreadsheet approach from ATPOT, which might take you anywhere between 5 to 15 minutes per market for the first time you apply it, and then a couple of minutes each day to update it. If you follow four markets, that’s about an hour’s work to get started on four markets, and then perhaps 10 or 15 minutes a day to keep it updated. The question is, what exactly are these 12 trades going to look like, and how will we recognise them when we see them?

There are four kinds of setup that I look for when trading: Price Clusters, Double or Triple Tops and Bottoms, First Range Out Combinations and a pattern I call the “COBRA”. The first three of these are all clearly taught in the Active Trader Program Online Training, and the fourth is essentially a failed re-test of a major top or bottom that I discuss further in our coaching programs.

In the process of working through your Wheels Within Wheels spreadsheet, you will come across all four of these setups. The spreadsheet is designed to find strong Price Clusters, but you’ll also see each of the other types of setup as well, if you pay attention and know what you’re looking for.

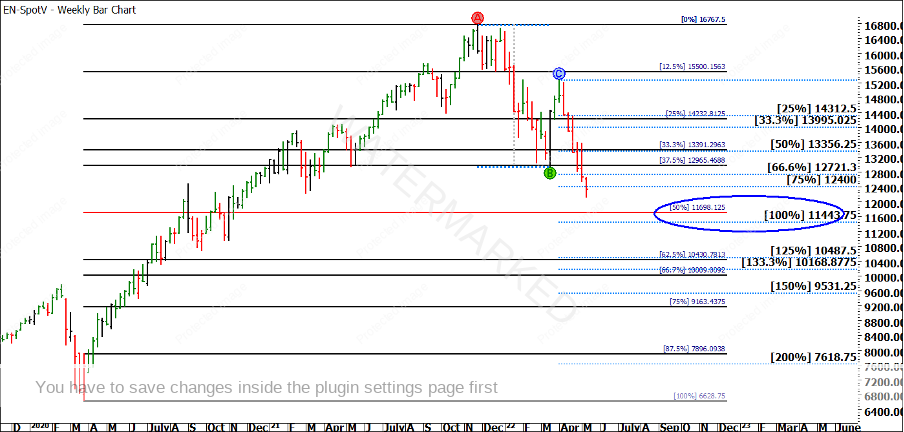

Let’s look at some examples of trading setups now. I’ll leave it to you to study the Price Cluster of the November 2021 All Time High on the Nasdaq, firstly because that’s come and gone, and secondly because it is covered in detail in ATPOT. We’re going to look at the next possible cluster. In Chart 1 below, you can see a potential price cluster forming around the 50% retracement of the quarterly swing chart range on the E-Mini Nasdaq futures (EN-Spotv).

Chart 1 – Nasdaq Price Cluster

This is not the tightest cluster you’ll ever see, but it is a starting point. You might like to study the other milestones on this Ranges Resistance Card, particularly the 1/8th levels, and see if you can combine one or more of those with your First Range Out lessons.

Now, is this going to be one of our 12 good trades? We’ll find out soon enough! Right now, we simply have a potential trade. If and when the market gets closer to this level, we can start looking at our smaller ranges and see if they are aligning to this Price Cluster. That’s all we can do for now, so while we wait, we can move on to look at other markets.

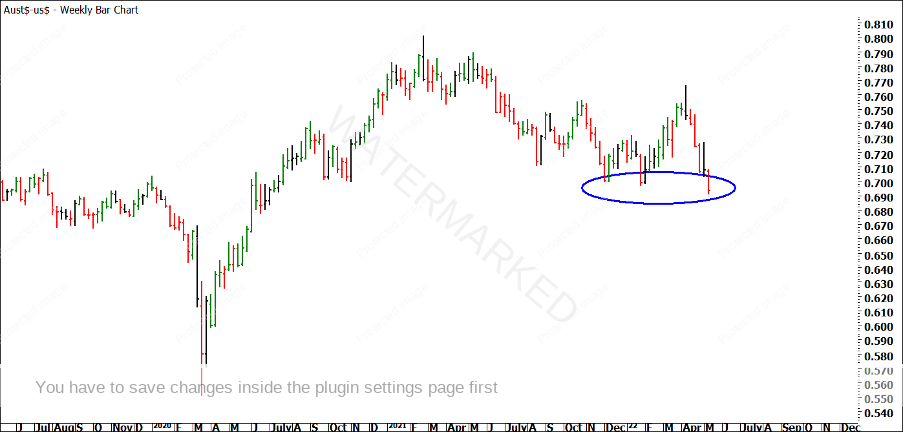

Another example we are looking at in our coaching programs is the Australian Dollar (FXADUS in ProfitSource.) As you can see in Chart 2 below, the Australian Dollar is currently sitting around potential Triple Bottoms on the big picture, trying to decide whether it wants to go up or down.

Chart 2 – Australian Dollar Potential Triple Bottoms

It will be interesting to see if the Australian Dollar can hold these levels, because if it can’t, there’s a lot of room for it to fall further. I’ll have a bit more to say about this in this month’s mid-month update for Active Trader Program Coaching which will go out this week, and of course in this weekend’s Master Forecasting Course Coaching.

Let’s review what we’ve discussed so far. We’re looking for 12 good trades per year. Of course, you may find more, but if you can average at least one good trade per month, it’s going to take a lot of pressure off you, and help you grow both your account and your confidence. Following a process such as the Wheels Within Wheels spreadsheet from ATPOT will give you a consistent routine each day and give you a good chance of finding high quality trades. To give you an example of the power of this spreadsheet, my call for the S&P500 top in February of 2020, the Oil crash of March 2020, the DAX Double Tops in 2020 and the Nasdaq All Time High in 2021 all came straight from the Wheels Within Wheels spreadsheet, and all took around five to ten minutes to put together.

Once you’ve got a routine like this in place, you can add more markets as required until you have enough setups to trade or until you can’t handle any more markets due to time pressure. You can analyze stocks, currencies, commodities, indices or even cryptocurrencies, but I believe currencies and indices are the best place to start.

Of course, another way that you can expand your horizons when it comes to following markets and hunting for trade setups is to join our live Active Trader Program Coaching sessions each month. For more information, email info@safetyinthemarket.com.au.

Finally, once you have your setups, you need to have a plan for trading them. For that, I’ll pass you into the capable hands of Gus and Andrew, who have both written articles about taking these setups and turning them into high Reward to Risk Ratio trades.

Be Prepared!

Mat