While this month’s article ultimately points towards a nice price cluster, a few software basics first, for those still getting familiar with ProfitSource.

So, once you’ve opened ProfitSource, how do you know you are getting up-to-date data and access to the market you want?

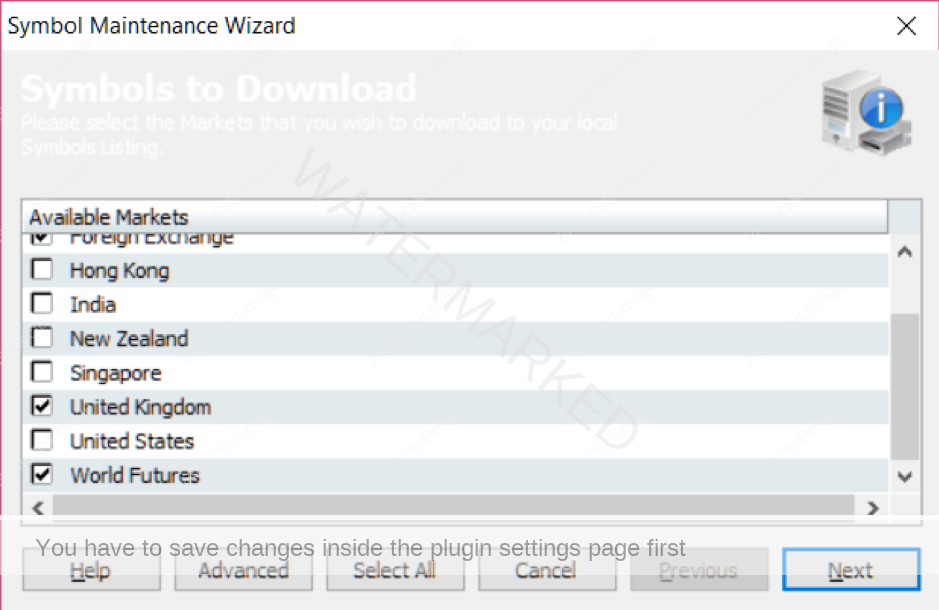

Tools -> Maintenance -> Symbols Maintenance Wizard

If you see something like the diagram below, you know you’re in the right place. Check the boxes which cover the markets you are interested in. In particular, for today’s example, you would scroll down to and tick “World Futures” as we will be using the chart for Platinum Futures. Then click Next and follow the wizard prompts. This is usually done as a one-off when first using ProfitSource. No need to repeat it every day. However subsequently, to keep your data up to date on a daily basis, Ctrl+U will run the Update Manager.

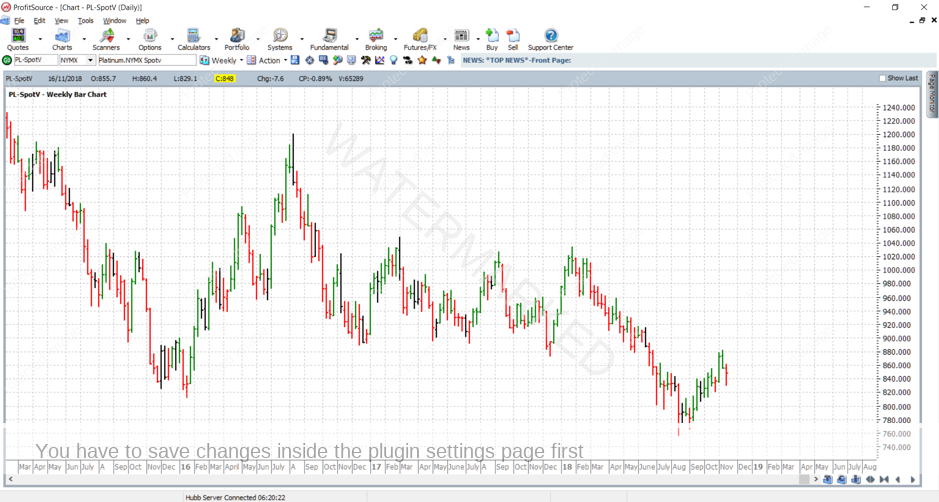

Charts -> New Price Chart; then enter symbol PL-SpotV and click OK.

So far so good? Here is what you should see:

Work hard, work smart,

Andrew Baraniak