Futures is an agreement between two parties (the buyer and the seller), for a trade at a future date. Futures are derivatives based on the underlying instrument, ie – Gold futures are based on the price of gold.

There are many sectors that use futures to hedge against risk:

- Fund managers use index futures

- Airlines use oil futures

- Importers/Exporters use currency futures

- Lenders and borrowers of money will use interest rate futures

- Producers and manufacturers use commodity futures

For example, Qantas will sell you a ticket for nine months in advance, not knowing what the price of fuel will be at the time of your flight. They will then protect themselves from any price increases in fuel during that nine-month period by hedging in the Oil futures market.

Speculators, like students at Safety in the Market, will trade futures to obtain profit from movements in price, both up and down.

There are quite a number of future markets available:

- Stock indices: S&P 500, NASDAQ, Dow Jones, Nikkei and the SPI in Australia,

- Energies: Crude Oil, Natural Gas,

- Meat futures have Live Cattle, Live Hogs etc,

- Currencies which include the Euro, Aussie Dollar, British Pound, Japanese Yen,

- The financials which include U.S. Treasury bonds, 10-year bonds, Euro Bund,

- Commodities: Soybeans, Wheat, Coffee, Sugar, Corn, Cocoa,

- Metals which include Gold, Silver, Lead, Aluminium & Copper,

All of these markets can be traded using David Bowden’s system taught in the Active Trader Program at Safety in the Market and the software that we use. As far as trading futures, it isn’t too different to trading a currency in Forex or a stock or commodity with CFD’s.

However, there are some things that you need to know when trading futures. Some futures contracts are cash settled, which means you must close out your position the day before the expiry date. Others are deliverable which means you must close out your position before the 1st notice day which is normally about four weeks before expiry. Imagine waking up in the morning to find 5,000 bushels of wheat have been delivered at your door! Your broker will let you know well before either of these events take place.

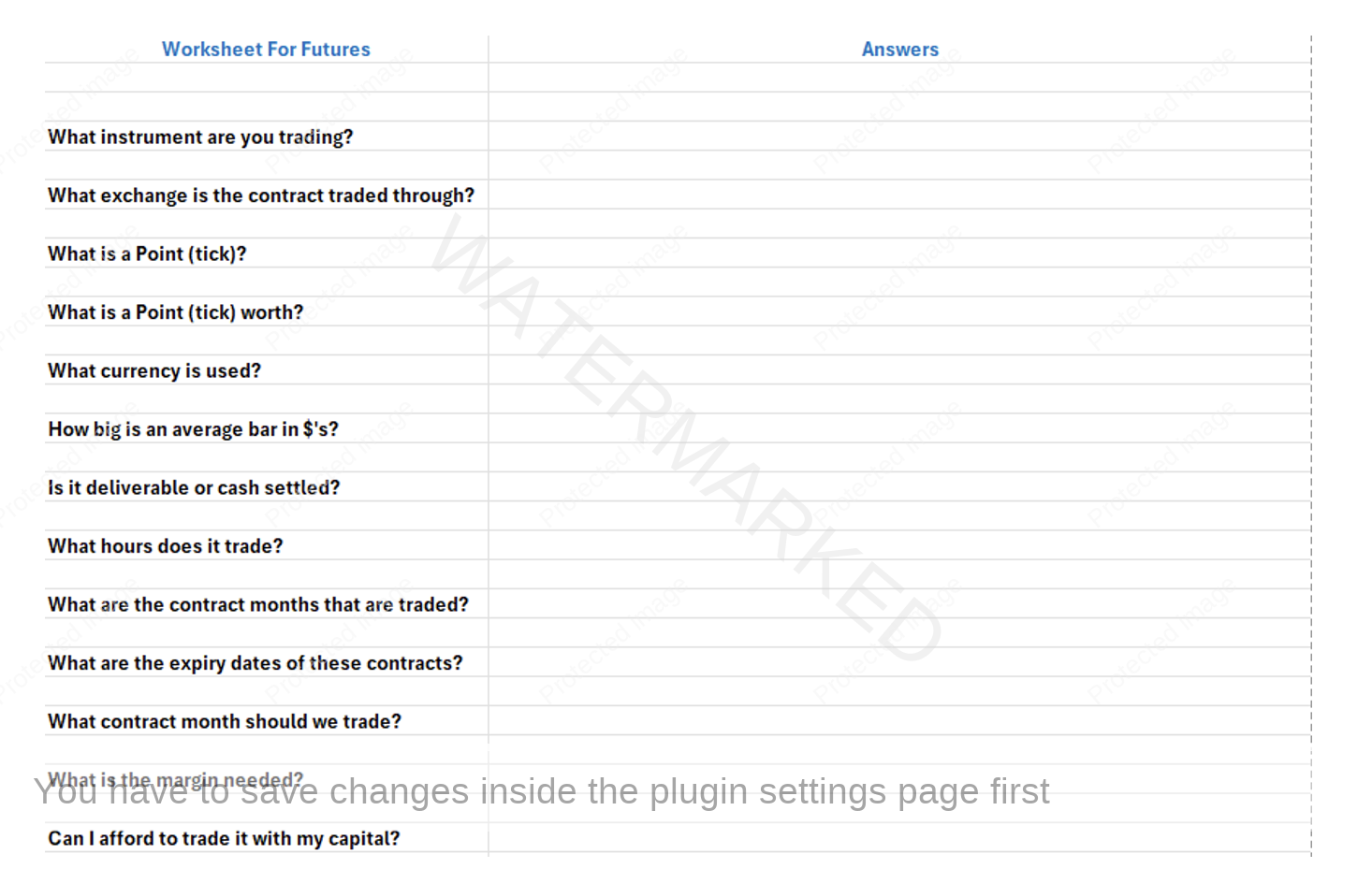

In our Active Trader Program, we teach our students what they need to know before trading futures:

Many futures contracts now have a ‘mini’ futures contract also, which is of smaller size and requiring less margin and thus less capital to trade.

One of the benefits of trading futures is the narrow spread (which is the difference between the buy & sell price), which in futures is closer together compared to the spread in CFD’s.

Futures require a margin which is basically a deposit, put down by both parties (the buyer & the seller) to cover any risk for the exchange.

The exchange sets the margin which is normally between 2% – 5%. They take it out of your account and hold it until the trade is closed.

When you trade a futures contract your position is leveraged which allows you to hold a bigger position than your capital would normally allow, which can be great when successful and not so great if your trade is unsuccessful – so you need to ensure you only risk one unit of risk and ALWAYS use a stop loss.

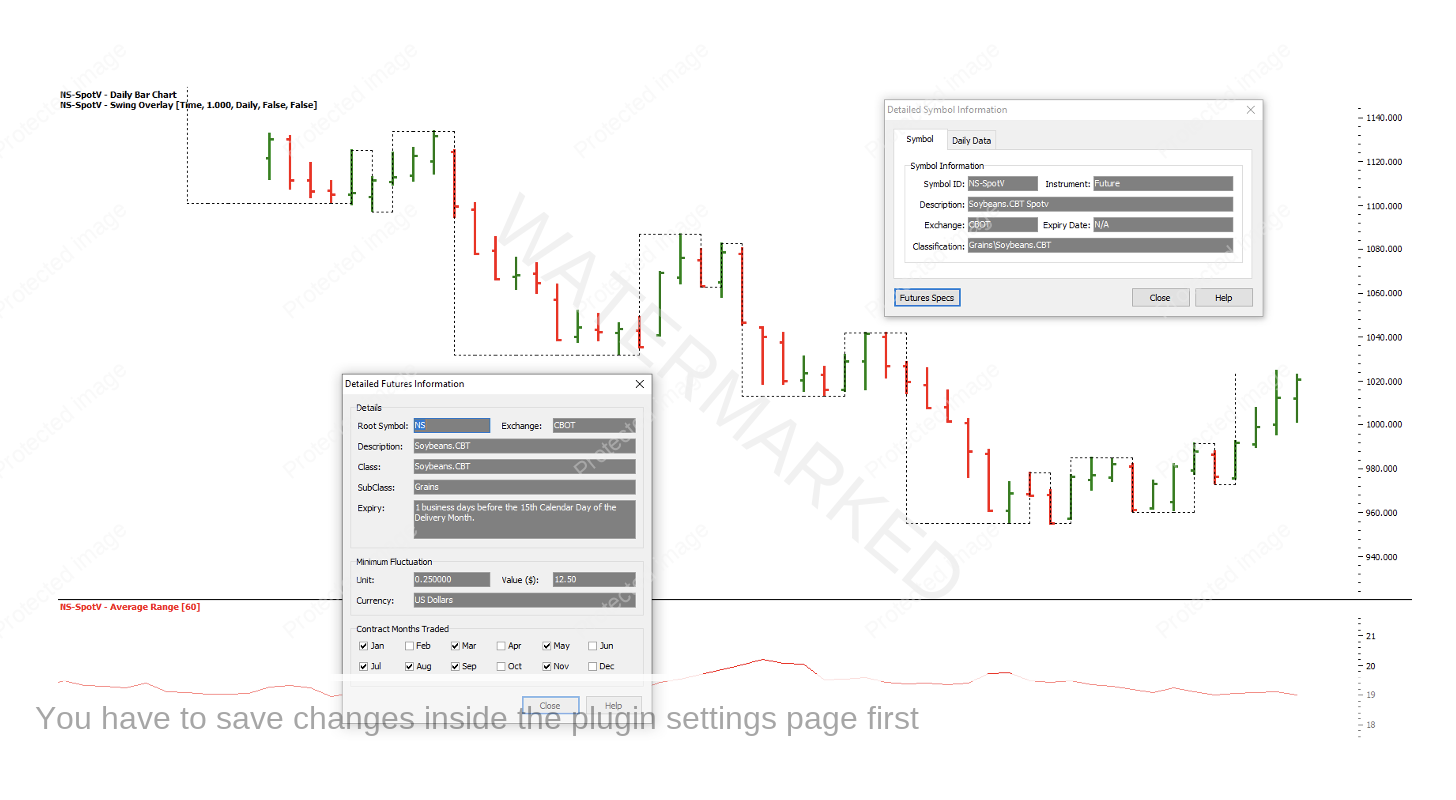

Let’s have a look at Soybeans in the chart below so we can see leverage in action:

The margin (deposit) on Soybeans is currently $2,100.

1 x tick (.25) = $12.50

4 x tick = (1 whole point) = $50

Average daily range currently = 19

Multiply $50 x 19 = $950 to find out how much your position can change each day on average.

So with a deposit of $2,100 we can control a product that can move $1,000 per day. With stocks we would have to pay the full amount of the share price. But with leverage you can control a larger position with a smaller account. So as quoted before, using a leveraged product can multiply your results for good or for bad!

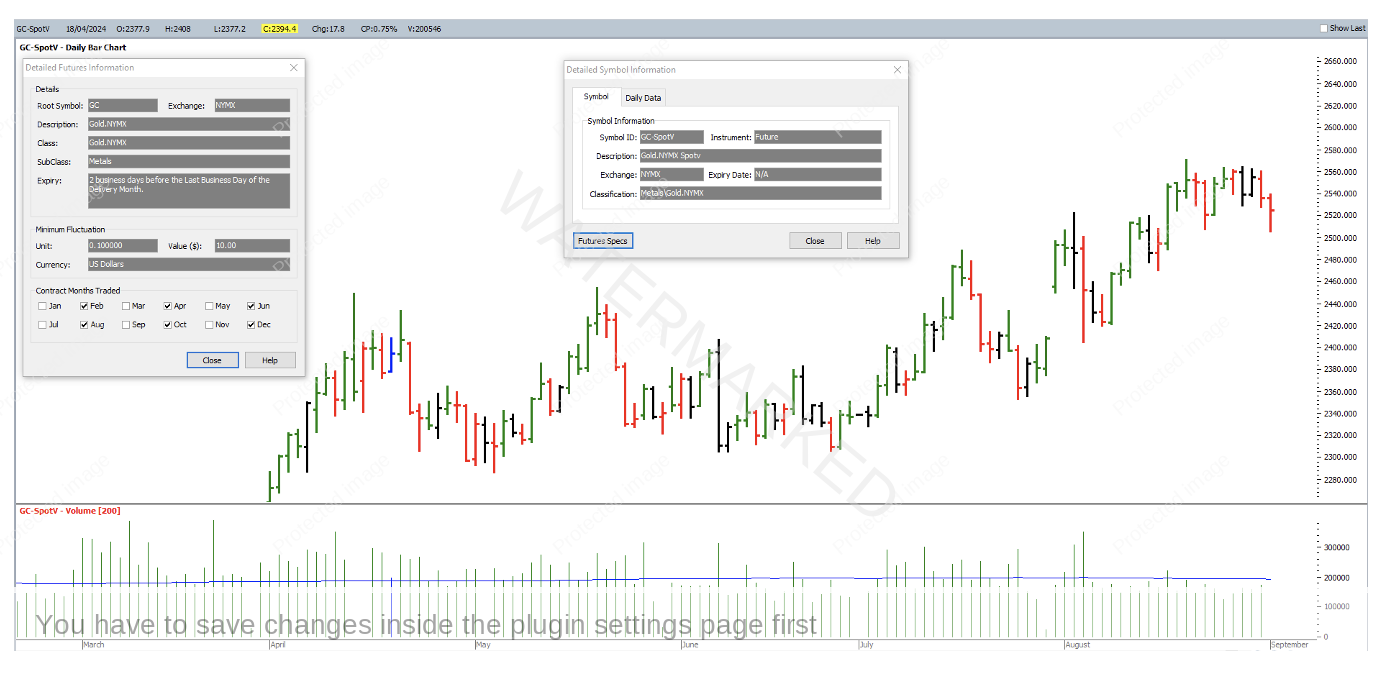

The chart below is the current Gold futures contract.

Amongst many other uses and attributes, our software can highlight details of each particular contract that you as a trader will need to know during the life span of your trade. Here we can see the daily volume at the bottom and the contract ‘specs’ in the pop-up boxes that are at your fingertips.