Managing Markets for Outliers?

What next for Crude Oil?

Crude Oil has taken off again as we have seen the news of attacks damaging the Saudi Arabian production capacity. You would be hard pressed to find any market that has such sensitivity to production volumes as Crude Oil. Events that move prices like this are often impossible to predict like weather, wars and politics. It becomes a game of management after the event rather than predicting the event. In saying that, I do believe with events like this our time analysis can lead us to understand where we may see events, even if knowing what the catalyst will be is beyond my skill set.

Chart 1 shows the 1-day swing chart on Crude Oil, the trend is uncertain with higher tops and lower bottoms. We could easily draw a horizontal line around $58 and $53 and comment this market is sideways. The challenge of no apparent trend has been in play since July and has presented no solid trading opportunities unless you drop down the time frames into intra-day charts.

Chart 1 – CL-Spot1 1 Day Swing Chart

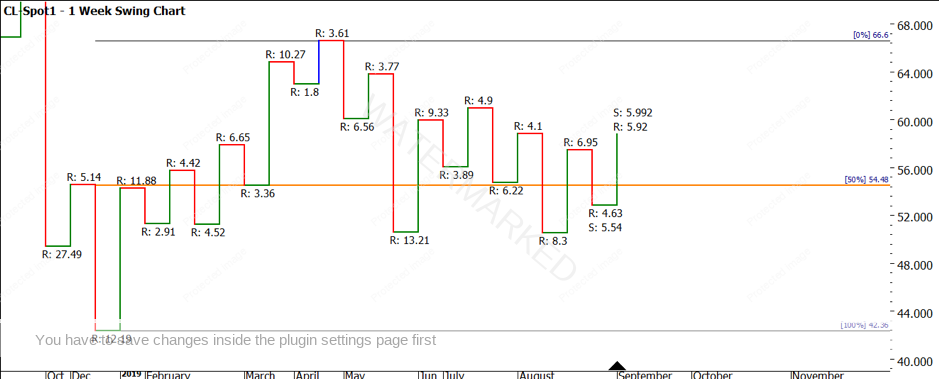

Chart 2 shows on a weekly swing chart, at the close of the week of 13 September, the weekly trend was up. However, the close of the week was low in the range and would likely have seen traders concerned about the week to come. Its worth noting how the price action broke the 50% of the range, then found support and pushed back higher. On this chart we see contracting downside ranges and expanding upside ranges. To use a David term ‘this is a potential overbalance in price’, trade on a weekly chart as laid out in the Smarter Starter Pack.

Chart 2 – CL-Spot1 1 Week Swing Chart

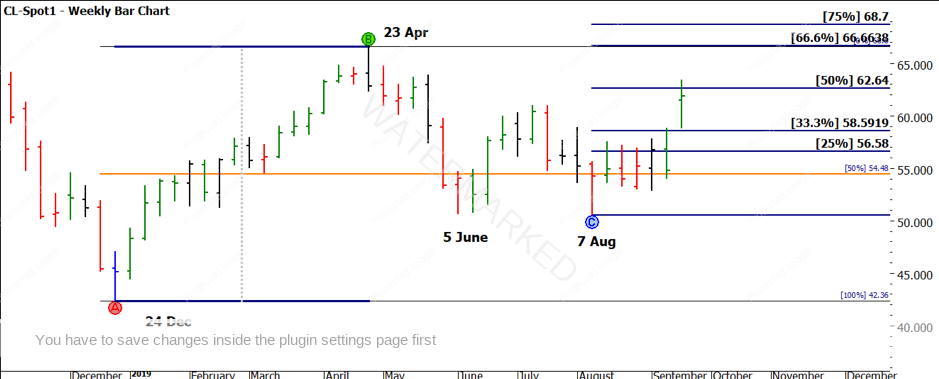

In Chart 3 I have included the data for the US session on the Monday where we see the markets have gapped to the upside by over 10%. It’s always worthwhile to step through the events with a focus on trends and signals. I am comfortable to say that whilst we may not have been long based on standard trading rules, we shouldn’t have been short either, therefore avoiding any pain the shorts felt with the gap up on Mondays session.

Chart 3 – CL-Spot1 Weekly Bar Chart

Chart 3 also allows us to step back and see the bigger picture. The $55 level of price has acted as a strong floor in recent times and projecting the December to April range from the August low, even with all the uncertainty of the bombing of facilities in Saudi Arabia, the market has respected the 50% level or $62.64 level.

To my thinking this confirms my long-held view that unknown events are completely random in terms of occurring. Once they have occurred, the market will often react around technical areas of importance. This brings me to what’s next? Well the positive for price action is that we have seen Crude Oil break out of its sideways pattern. The fundamentals suggest that the next moves will be based on how quickly supply can be restored.

Another point of note is that this random event that has driven price higher has occurred in the month of September which seasonally is an important month for major turns in oil, especially tops. A lesson I used to present many years ago at Gann Mastery on Crude Oil, looked at which months are historically most active for major turns. The last quarter of each year has always been an active time and the middle of the month time frame in September will have some harmony with the previous December and April turns.

The news headlines today on Crude Oil all talk about oil pushing to $80 a barrel. Obviously anything is possible, but a better guide would be to look at some price work from the Number One Trading Plan. Chart 4 shows the loose double bottom pattern that is much easier to spot on the swing chart than the bar chart for clarity. The 200% area takes us to $71.20, that area will need to be cleared before we can start to address the $80 per barrel question.

Chart 4 – CL-Spot1 Daily Bar Chart

Added to this some major old tops before $80 and you need to ensure you don’t get too excited about upside potential. Having experienced “excitable” times in markets before, there is no better advice than preparing your trading plan with even greater focus, managing risk with a fine-tooth comb and blocking out the noise of where pundits expect markets to go.

The only truth in markets is that the market sets the price. You can be in agreeance or disagreement with the market, but ultimately where it decides to go is always right and we look to hold on long enough to get our piece. Crude and energies overall have been a little quiet this year, we are starting to run into the right season for activity. There could be some strong opportunities to come.

Good Trading

Aaron Lynch