Meteoric Rise

Welcome to the new financial year, at least in Australia, there is a lot to digest and it’s likely we can all feel the social, economic, and political screws tightening as doom and gloom seems to be the mainstay. After the Covid period where society was forced to look at its norms and how to support the wellbeing of the masses, when push comes to shove those lessons are being forgotten and potentially reversed as we face new challenges.

There is no doubt inflation and interest rates are driving the narrative and the daily dose of TV and print media don’t often have a good news story to tell. But having lived through a few cycles of market and society ups and downs, to me there is no better time to be looking for the good news story and the trading opportunity, be it long or short, as there are plenty of great opportunities to capitalise on.

One of the market darlings that has bucked the inflation trend is Meta, formerly known as Facebook. This massive business created by Mark Zuckerberg has pivoted and reworked its business model many times over, to what now is mainly a data, rather than social media presence.

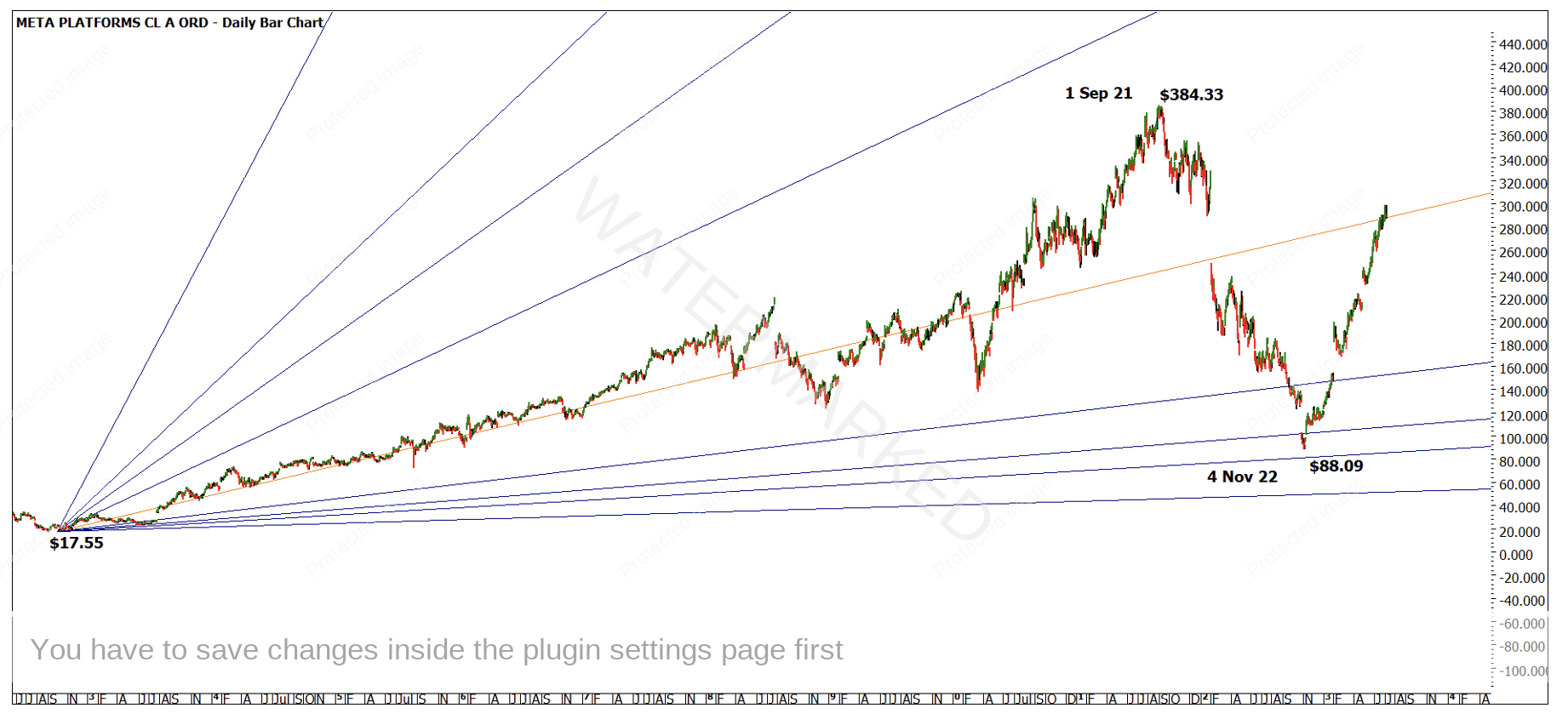

In Chart 1 we can see in the space of 2023 the price action has risen from a low of $88.09 to just under $300 a share. This move is over 300% in 6 months and bucks the narrative that economies under pressure can’t see asset prices move higher.

I see a particular pattern here that is not the standard 50% move we may see but is of interest. Taking the low of $17 in 2012 and the high of 2021 we can see the Ranges Resistance Card signal the 75% level as current resistance.

The low of last year at approximately $88 which commenced at the 25% level is now sitting at the 75% milestone, the price action has moved 50% of the all-time range which may be an area we can study in further detail.

Chart 1 – Daily Bar Chart Meta.NASD

Continuing our price techniques and using a Lows Resistance Card at $17.55 we can also see that the current price action is being resisted by a multiple of that low (I will leave you to create as the chart is a little messy).

There is also value is using the Lows Resistance Card from the 2022 low of $88.09 and applying to the current price action. Remember price work is a very good way of determining where we can expect support or resistance to come into the market. Finally, the use of the All-Time High Resistance Card allows for us to combine price action to develop clusters.

There are a number of small and larger-time frames that I encourage you to analyse in this stock, the challenge as I see it is the lack of history to measure. Given the stock is approximately 10 years old this does provide some of the long-range time frames that often anchor big moves but there is some smaller scale work that can be measured and reviewed. In markets like this, Time Trend Analysis from David’s Ultimate Gann Course can provide some insights.

Chart 2 moves us to the third dimension using a Gann angle from the All-Time Low. Using a trading day angle from the All-Time Low we can see the orange 1×1 angle has acted as a useful “mean” for price action and slices the gap down in 2022 that has been recently filled. Price action moving forward may potentially use this angle as support or resistance.

Chart 2 – Daily Bar Chart Meta.NASD

This stock has so much public focus that its price moves from a percentage perspective can be very large, picking up a small number of chunks in a year from this market can go a long way to underpinning a good year in trading.

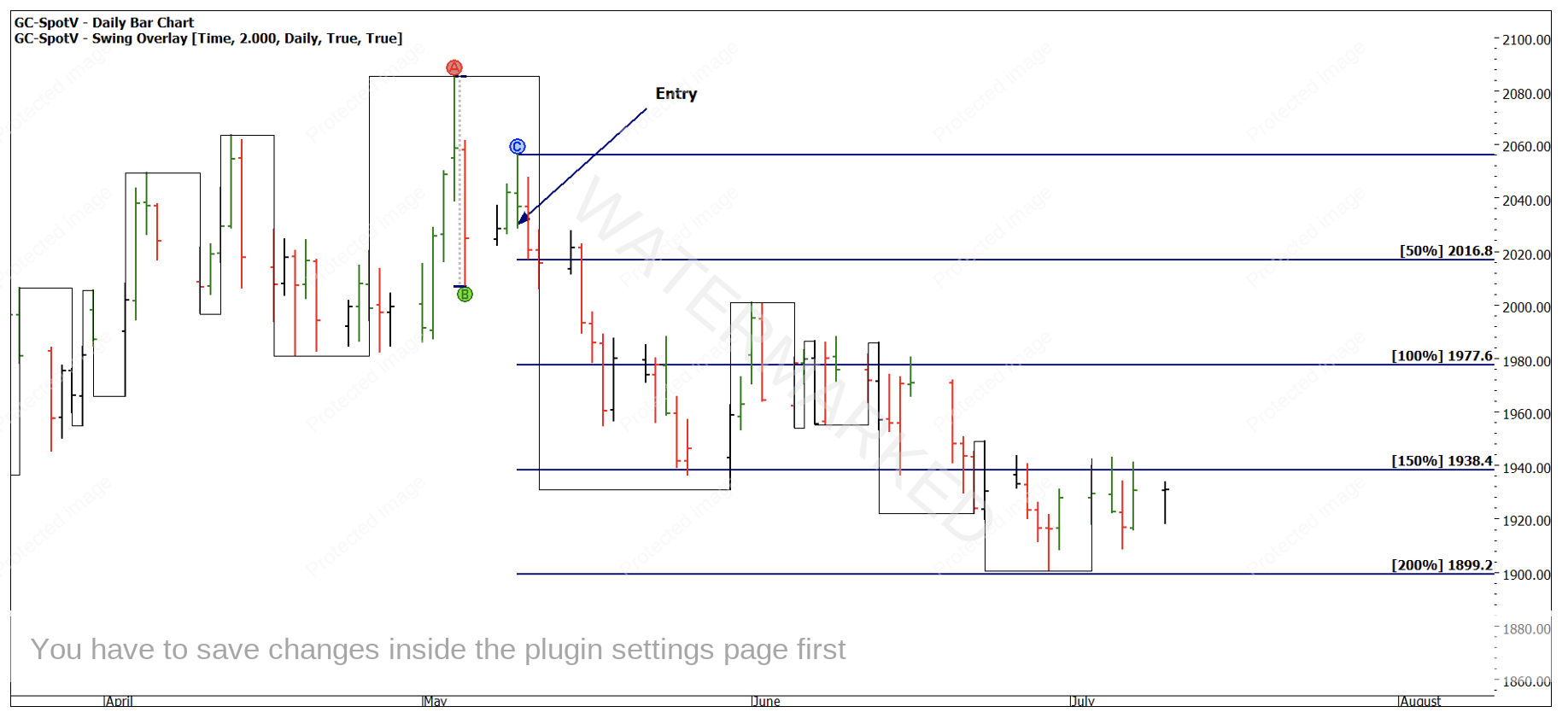

I will leave you with an updated Gold chart from my last Platinum article. Chart 3 shows the continued slide in price action. Using a 2-day swing chart as a trailing stop management, we can see the price action fell away from the May high and ran as far as 200% of the A to B range. This move was over $100 USD an ounce and represented a good opportunity for a profitable trade.

Chart 3 – Daily Bar Chart GC-Spotv

We are closing in on the end of July and the potential next date for a change in trend, now would be a good time to review the overall position to help plan for potential next steps.

Good Trading

Aaron Lynch