Mind Your Business

The W.D Gann Stock Market Course opens with the foreword:

“Be ready for opportunities. Knowledge is more important than capital. To succeed in any business you must be prepared, and in preparing for a speculative or investment business you must look up the greatest advance or the greatest decline a stock has ever had and the greatest time period from the high or low. Most profits are made in active fast-moving markets.”

W.D. Gann, Stock Market Course (P.1)

Currently, we have been presented with one of the most aggressive market opportunities ever seen in the financial markets. For those who were prepared, they no doubt would have paid for their education many times over and over again. Gann made the following comment about making speculation and investment a profitable profession;

“Speculation or investment is the best business in the world if you make a business of it. But in order to make a success of it you must study and be prepared and not guess, follow inside information or depend on hope or fear. If you do you will fail. Your success depends on knowing the right kind of rules and following them.”

W.D. Gann, The Stock Market Course (P.3)

There is a clear message portrayed in both of Gann’s writings:

- Have the discipline to establish your own trading plan, and

- Do the work. Study!

You have to remember that the financial markets are made up of many diffrent types of investment strategies, instruments and players. You want to have a competitive advantage. Gann’s courses and Safety in the Market provide a foundation for you to build your investment strategy, using a combination of quality formulas and strategies to keep you ‘safe’ in the markets.

The rare series of events that have taken place in the markets could have looked fairly familiar, given you had studied previous crashes before, studied the content advised too and most importantly, actively engaged with the markets frequently. You wouldn’t have even known what was happening, but many major levels were broken across many markets that would have established a number of profitable trades. On page 5 of the W.D Gann Stock Market Course, Gann writes about sharp declines in a short period of time, and says;

“This usually follows a rapid advance and the first sharp declines which may last from one month to as much as seven weeks usually corrects an overbought position and leaves the market in position for a secondary advance. When you are able to catch extremes at the end of any great time cycle you can make a large amount of money in one year’s time trading in fast active markets. It makes no difference whether you catch the extreme low or the extreme high; the opportunities are great for making money providing you select the stocks that will lead.”

D. Gann, The Stock Market Course (P.5)

It isn’t as easy as just watching any market and waiting for a rapid advance. You want to be watching or even better, trading the advance. Though, even if you are late to the party there are some very healthy positions still to be taken. Take the ‘TESLA SERIES’ articles for example.

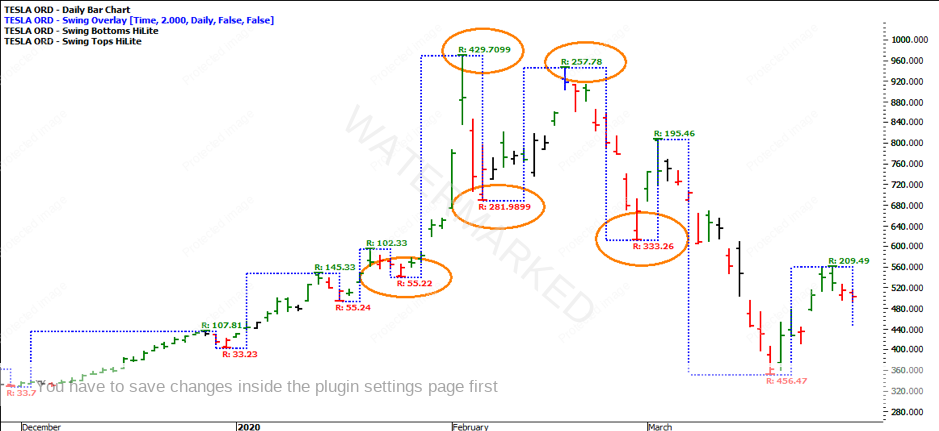

In 2019, there was a very rapid advance in TSLA. We realistically had no idea that the COVID-19 event would be the catalyst for a deep decline. Yet, Newton’s law of universal gravitation basically states (in non-scientific terminology) that what goes up must come down. The chart below shows the obvious 2019 advance, followed by an aggressive decline. I suggest you review other markets that have experienced aggressive advances such as the Bitcoin Crash in 2018, the GFC in 2008, the Cotton Crash in 2011; there are plenty of others.

As an interesting side note, currently COVID-19 has increased huge demand in medical supplies such as facemasks, gloves and sanitisers. The Australian government has spent enormous amounts of money ordering these products, which has sparked opportunity for smaller players to make margins and enter the market. Once a number of players have entered the market, competition will come with pricing to be competitive and at some stage the government will likely not need as much which will reduce demand. There will be an oversupply, and this is very likely to lead to a crash in this industry. It will send suppliers broke and bust. Once you know what you are looking for, the signs become more obvious.

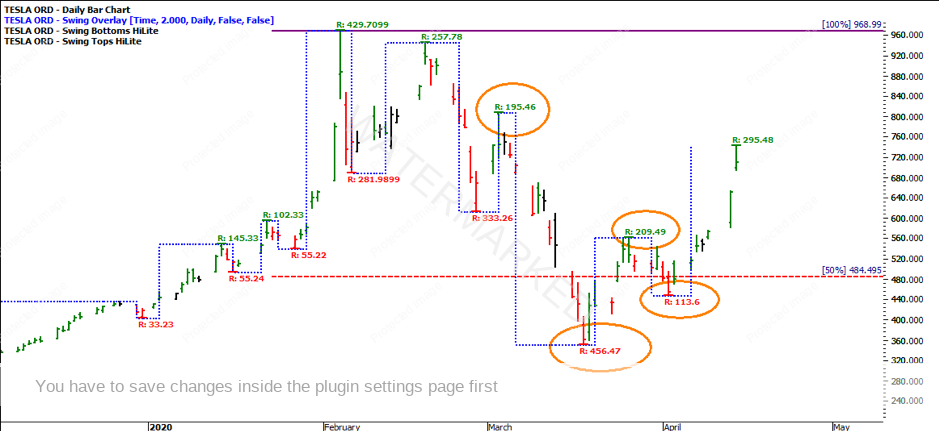

Moving on. If for whatever reason you missed the advance; what goes up, must come down, so waiting for an abnormal retracement would be the key to waiting for the decline. Studying the 2-Day Swing Chart, you can see that the majority of the pull back on TSLA were ranges between $33-$55. Early February showed a range of $281. While, the advance was relatively overbought and therefore, likely to see a balanced retracement, the real value of the picture is having the patience to watch the next advance, in which it produced a range of $257. The market failed at 59% of the previous range. It was then obvious that the market produced lower tops and lower bottoms that allowed you to be ‘safe’ in your strategies to ride the market down.

By simply taking the new All Time High (ATH) of $968.99, it would provide you a target level at $484.49 which was the 50% of the ATH.

Taking the exact same concept we explored on the 2-Day Swing Chart and applying that to the low on the 50% level provides some sort of confirmation that it might be time to be going long again.

Remember your trading plan is your competitive advantage. It should be a combination of strategies and formulas. The first few chapters of the Smarter Starter Pack provide a foundation for you to build your investment strategy to keep you ‘safe’ in the markets. Do the work and reap the rewards.

It’s Your Perception,

Robert Steer