More on ANZ

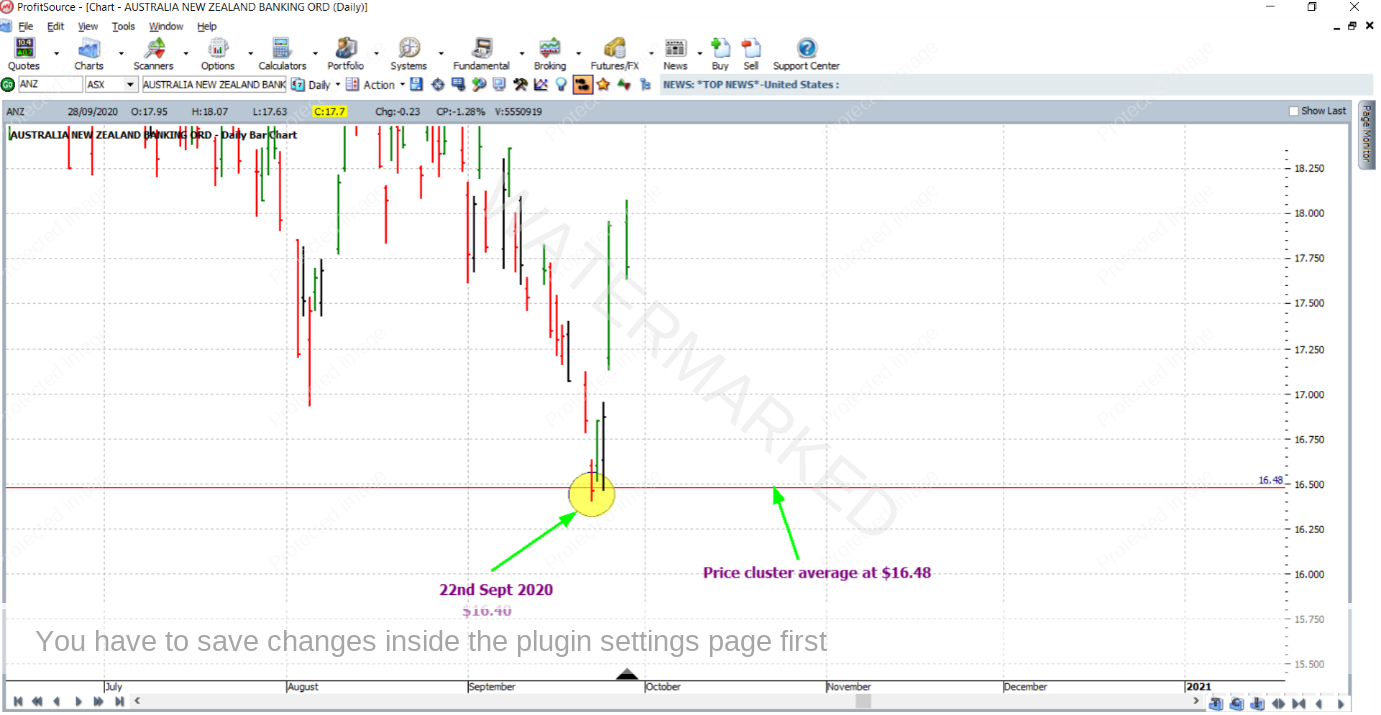

Welcome back to all! At the Trading Tutors desk, we’ll start the year off by keeping it simple and applying the same techniques to the same market as we did in the last article of last year, for another trade on ANZ:ASX. The setup we’ll be looking at occurred in this market in late September of 2020. As the 22nd of that month approached, three solid price reasons had clustered together at an average $16.48; so, as a technical Safety in the Market trader, you would have been on the lookout for a reversal to the upside.

A strong reversal did come after the market lowed at $16.40, breaking the price cluster average by 8 points. This is illustrated in the ProfitSource chart below.

As usual we look for strong reasons to take an advanced trade in the market. If you wish to reproduce the analysis and come up with three good price reasons – send them in to the team via tradingtutors@safetyinthemarket.com.au and we’ll be more than happy to give some constructive feedback. Remember – stick to significant turning points and key milestones.

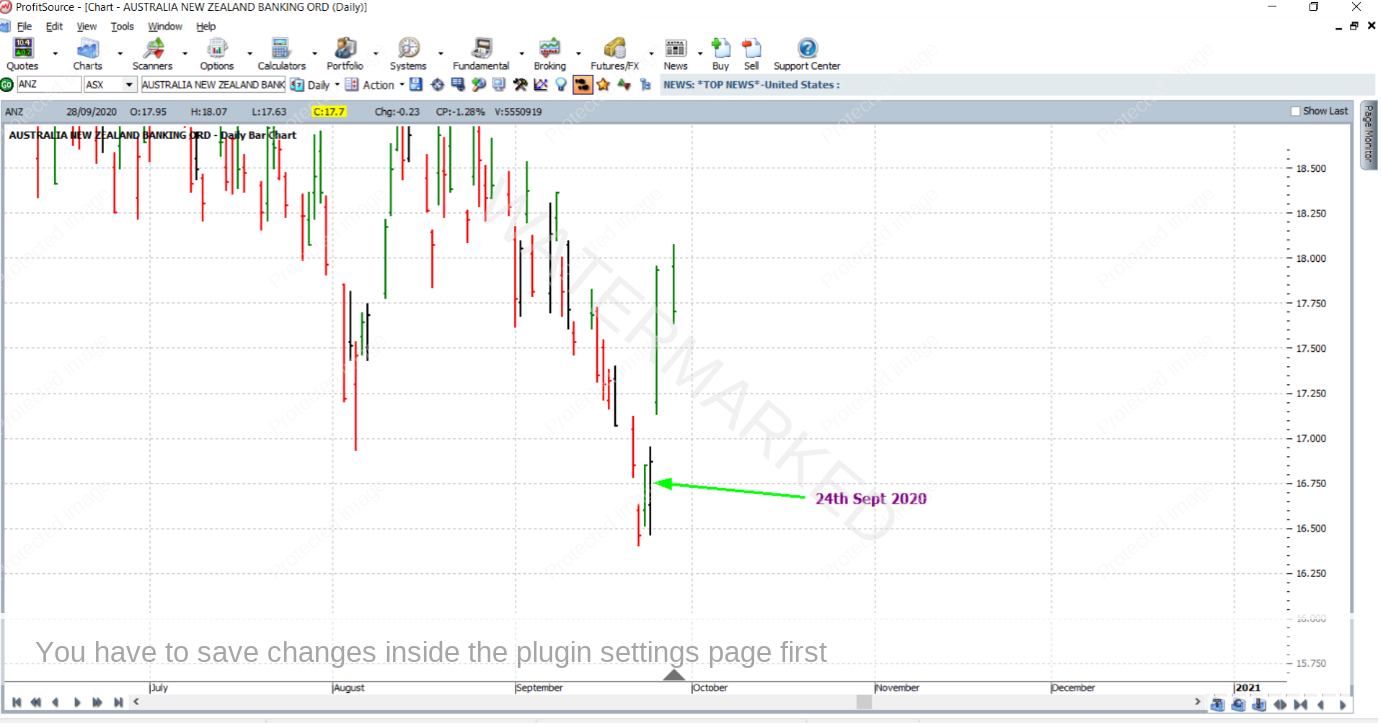

An outside continuation day entry signal presented itself on the 24th of September. It would have had you long in the market at $16.86, with initial stop loss placed at $16.45.

Since we’re long ANZ, for trade management, the last monthly swing to the upside will be used as a reference range, and stops will be managed currency style.

It was off to a slow start. Basically, a month later, on the 26th of October 2020, the market finally reached the 50% milestone and stops were moved to break even.

On the 17th of November, the market reached the 75% milestone and the exit stop was moved to lock in some profit, by placing the exit stop 44 cents below the 50% milestone. 44 cents was approximately one-third of the average weekly bar size at the time, based on the last 60 weekly bars.

The run certainly steepened – with the 100% milestone being reached on the 25th of November.

So how could we have been rewarded for such a trade? In terms of the Reward to Risk Ratio:

Initial Risk: 16.86 – 16.45 = $0.41 = 41 points (point size is 0.01)

Reward: 23.51 – 16.86 = 6.65 = 665 points

Reward to Risk Ratio: = 665/41 = approximately 16.2 to 1

And let’s assume that 5% of the account size was risked at entry. In this case the gain in account size would be as follows:

16.2 x 5% = 81%

Assuming that 5% of a $10,000 account was risked, i.e. $500, the reward in absolute Australian Dollar terms would be:

16.2 x $500 = $8,100

Work Hard, work smart.

Andrew Baraniak