My Plan – Part 2

Trading as a profession comes with many challenges, but one of the biggest is learning to live with uncertainty. You never truly know where your next profitable trade will come from. And in that uncomfortable space of not-knowing, emotions creep in. That’s when discipline gets tested and the Fear of Missing Out (FOMO) hits hardest. To me, an undisciplined trade is one taken outside the boundaries of your written trading plan or worse, in the absence of a plan altogether!

Experience has taught me if I take a trade that ticks every box in my plan even if it ends in a loss, I feel calm because I know I acted with discipline and professionalism. If that same trade wins, it builds real confidence, because I know I can repeat it.

But when I take a trade that doesn’t meet my plan criteria, the emotional fallout is very different as the loss feels heavier, almost hopeless. And if that trade happens to win? It doesn’t feel like skill it feels like gambling which has no place in a professional trading mindset.

So, it does beg the question, why would you ever trade without a proven trading plan? Sometimes, it just feels easier to wing it. No one’s holding you accountable. Maybe you haven’t done the back testing or research to build a plan you trust. Or maybe you’ve convinced yourself that it’s too hard to start.

Either way trading without a plan is doing it hard!

Let’s be honest: we’ve all taken trades just because it’s a Wednesday, and you think the market’s going up or down, and you get that itch – you just want to be in. But then you look back, reflect, and wish you still had the capital you started with.

This leads me to something I believe is seriously underrated in trading: protecting your capital. Just keeping your money safe is a skill, a mindset, and a strategy. Waiting for the right setup requires patience, restraint, and discipline, but why can that be so hard?

I’m not a psychologist, but from my own experience, it’s often because we’re trying to fast-track our lives. We’re chasing the “When-Then’s”:

When I have more money, then I’ll be happy. When I quit my job, then I’ll feel free.

Maybe the answer to this lies in appreciation. Appreciate where you are right now. If you’ve got a $1,000 account, treat it like it’s the most important capital in the world, because it is. Instead of thinking, “It’s only $1,000,” flip the script. That $1,000 is your opportunity, your stepping stone. And you’re just one disciplined trade away from changing your trajectory.

The positive momentum of one disciplined, well-executed trade can compound into something bigger than you imagined.

So here’s a challenge for those still without a written trading plan:

Write something – anything – down.

Start simple. Then refine it. Shape it into something you’d trust a trading friend to use on your behalf. Push past the fear of not getting it “right.” Because there’s no such thing as the perfect plan. There’s only a safe plan. A profitable plan. A plan that keeps you grounded when the market tempts you to drift.

Perfection isn’t the goal. Progress is.

Let’s take a quick look at where the SPI200 is trading right now.

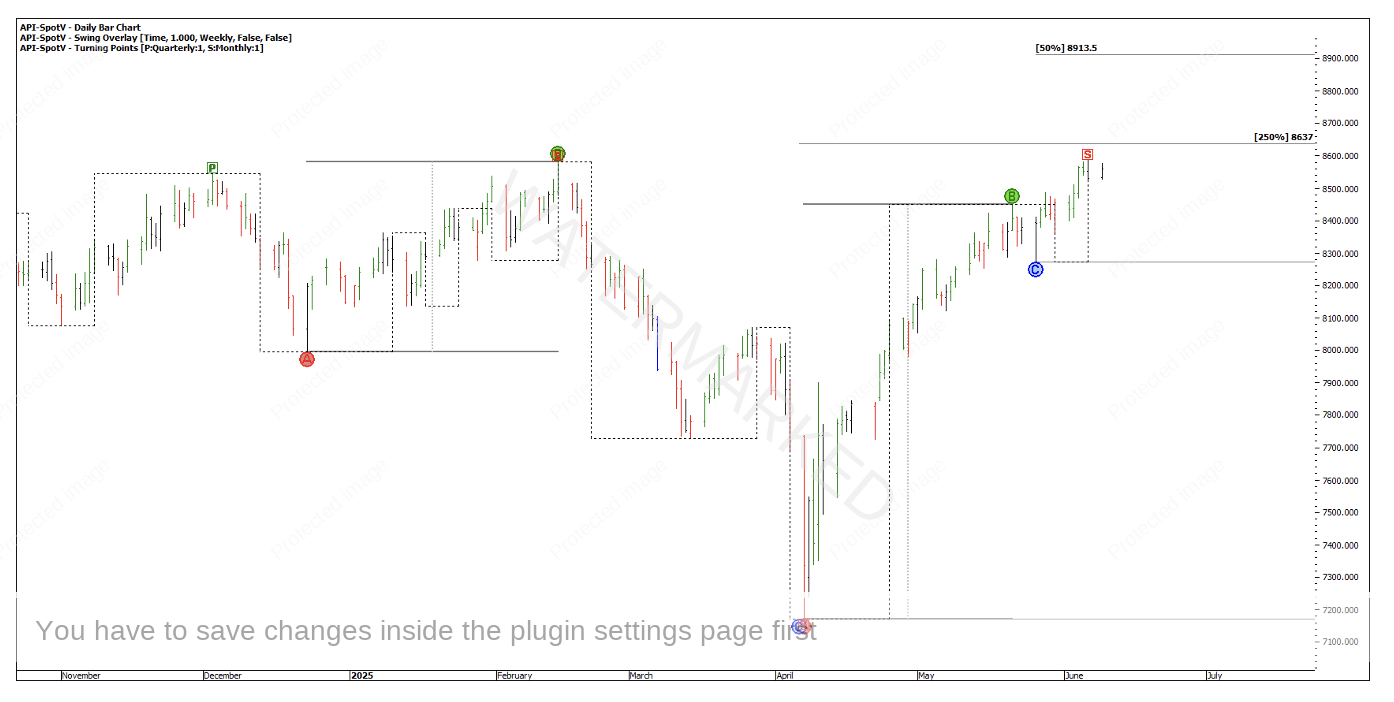

Amazingly, the market is back testing its previous All-Time High of 8581 and presenting what could be a potential Double Top on the API-SpotV continuous chart.

But is it the kind of Double Top with the same price resistance as the 14 February top?

Looking ahead, the next major price milestone on the monthly swing chart is the 250% level at 8637, and the 50% weekly swing milestone is up at 8913. Not exactly a tight cluster by any stretch. See Chart 1 below:

Chart 1

The June contract (API-2025.M) shows the previous All-Time High at 8622, which does align with two multiples of the daily First Range Out at 8630, and also the 250% monthly swing milestone at 8637. But is this enough to meet the criteria of your plan?

Chart 2

At the end of the day all you can do is plan your trades and trade your plan! Here’s to staying disciplined, protecting your capital, and building your confidence – one solid trade at a time.

Happy Trading

Gus