Gann wrote how the 50% rule was the one rule that he believed would see consistent success in market analysis provided there was strong money and trade management around it. He said that this one rule alone was enough to make you a fortune. I recall reading this thinking I can understand and implement one rule so maybe this was my “shortcut” to success. Time was to prove I needed some more strings to my bow, but as technical analysis goes, applied correctly there is a good chance you will be on the right side of markets.

In my opinion there is no better market than crude oil that demonstrates this, the added benefit is 50% retracements are well understood and applied in many styles of technical analysis so whether traders give credit to Gann or not, many market participants are watching these levels, so they can be quite consistent in producing tradeable signals.

The problem with 50% retracements is understanding which ones to watch and use and this mainly comes down to what time frame you are trading on. You can sit and watch 1 min charts and see 50% retracements in the same way they work on yearly charts. The key is starting with the right anchor points. There is a challenge in choosing what points are working and, in the following examples I will zoom out from the small picture to the big picture.

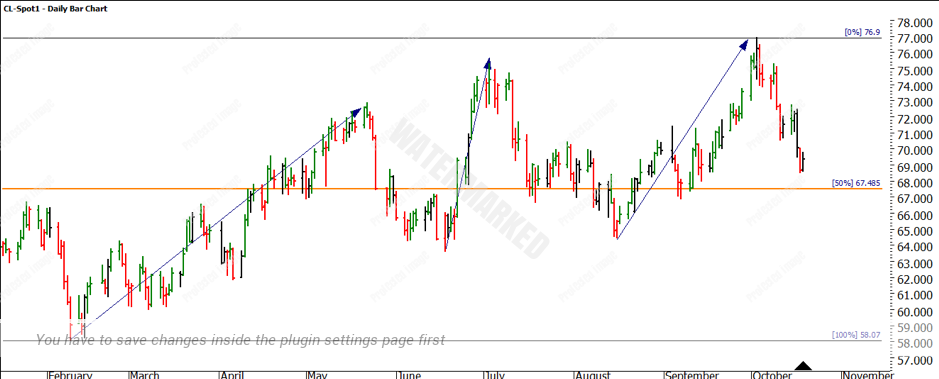

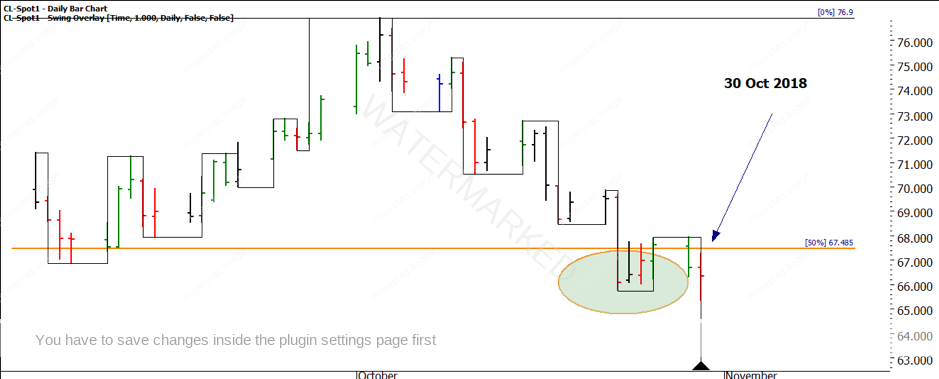

Chart 1 shows the anchor points as the 2018 low in February (note the date) and the high of the year 3 October. There is certainly a case for using other highs and lows but this one made sense on the smaller picture to me as the low in February came after the largest percentage decline we had seen in a while, also there were three clear sections to reference in the pattern.

Chart 1 – CL-Spot1 Daily Bar Chart

Applying the 50% rule we would have been watching $67.49 as a point of potential support and also the area of previous lows where support had been found. Whilst you would have been short of the top using swing charts alone you would be cautious as to whether you are trading a with the trend (Major) or against the trend move. In simple terms are you trading from A to B here or from B to C using ABC theory, it’s fair to say at that point on the chart you would not have been 100% sure as the weekly trend was up.

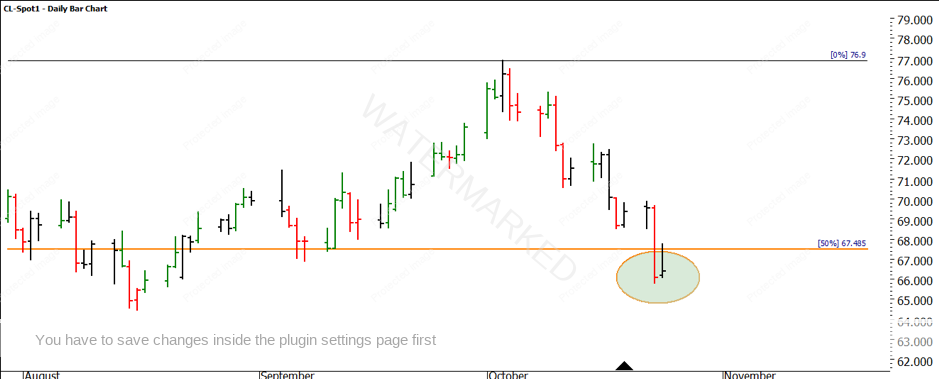

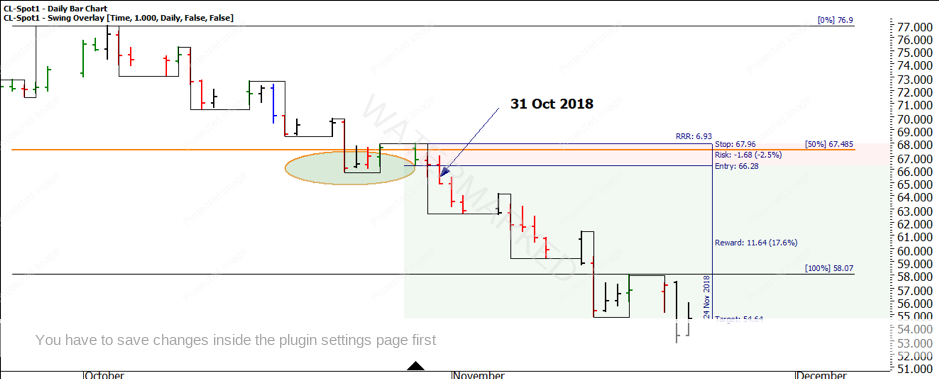

Chart 2 – CL-Spot1 Daily Bar Chart

Chart 2 shows the price action breaking the 50% level quite strongly ie closing below $67.49 and the large bar with low close signalling a weak thermometer. The inside day after also confirmed the market’s indecision especially for a bullish cause. It’s around this time the notion of being long crude started to seem the weaker hand, as we know the 50% can be seen as support we must also counter with the fact it can be resistance.

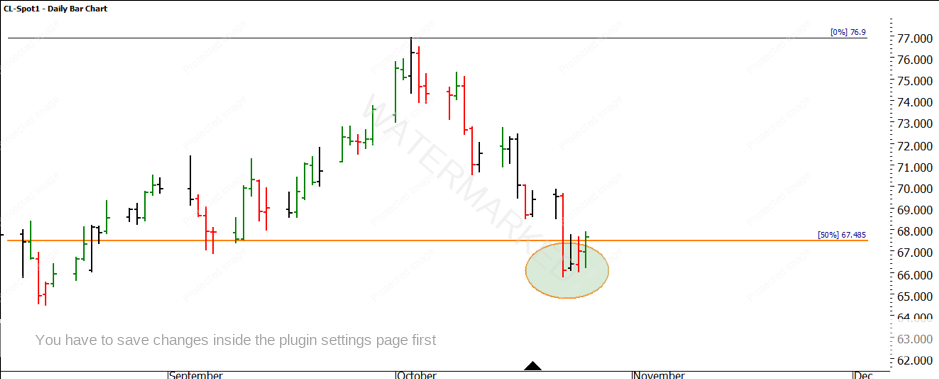

Chart 3 – CL-Spot1 Daily Bar Chart

With the addition of two more trading bars, we can see the bullish hand has improved with a close above 50% so potentially the next up leg is on. Of course, we would like to see volume and a strong price bar back this up, that wasn’t yet present. The trading options to us here could be broken into 4 choices.

- No orders placed, wait for more confirmation

- Get long on the breaking of the previous day’s high (very aggressive but high risk to reward if correct)

- Wait for first higher swing bottom above the 50% (support)

- Get short if it breaks back under and confirms a lower swing top under 50%

To be fair to a new trader this may seem like having all bases covered to avoid being wrong. The question here amongst these choices is what strategy would you place orders for? For the more advanced trader, there is a part 5 to my summary which could mean you place a stop and reverse strategy around this order to change directions if confirmed wrong.

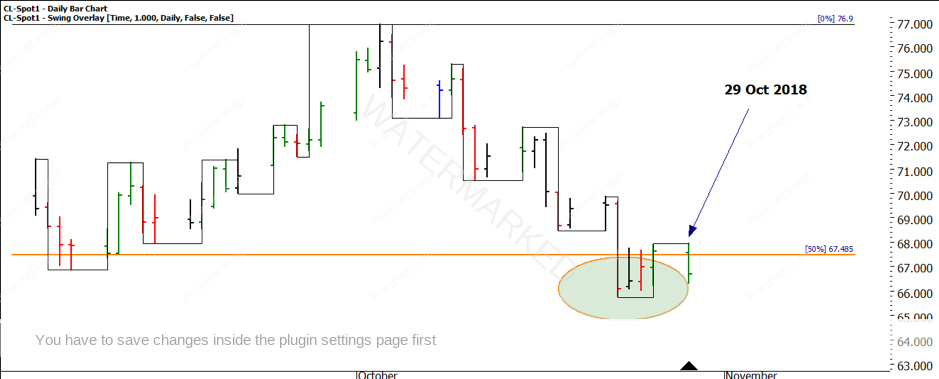

Chart 4 – CL-Spot1 Daily Bar Chart

Chart 4 shows that we would have been filled long had we attempted strategy 2, however, the close of the day would have left an unsure rather sinking feeling as the close was well back under the 50% level.

Chart 5 confirms the lower top has been formed under 50% and there is still indecision in the bar, often the day you get filled on market moves can be the hardest one to hold as there is often not overwhelming confirmation that you are set the right way. As a reminder, this is why we have stops and money management.

Chart 5 – CL-Spot1 Daily Bar Chart

The rest, as they say, is history as we see in Chart 6 the price of crude has declined in an orderly fashion (lower tops and bottoms) with a risk to reward of around 7 to 1 if you are still holding the position. Another study on the small picture would be to measure the swing ranges on the run down from the October high and see how many are close or around 50% of the previous swings. You should see what worked on the bigger picture working on the small.

Chart 6 – CL-Spot1 Daily Bar Chart

Finally, we can now use the same process to understand where to next, in terms of price support or potentially resistance. Chart 7 looks at the major range from the 2016 low to the 2018 high. $51.48 is the 50% point of that range and it would make sense to watch that for some activity. If you can combine other price forecasting and overlay time techniques this area may be ideal for a bounce. The price of $51.48 has some harmony around it, especially for students of David’s Master Forecasting Course.

Chart 7 – CL-Spot1 Weekly Bar Chart

Many oil traders have been shocked by the recent bearish trend and volatility, the last big picture chart shows the all-time low to all-time high at $78.51. We could never truly regard this market as strong until it retests and breaks the all-time 50% level. As you can see the recent October highs fell short at $76.90.

Chart 8 – CL-Spot1 Monthly Bar Chart

For those traders still around who are old enough to have attended some of my lessons on oil, you would not be surprised to hear I had a laugh to myself when the recent high of $76.90 fell exactly $1.61 short of the major 50% at $78.51.

As I said at the start, there is nothing new under the sun.

Good Trading,

Aaron Lynch