Platinum Cluster

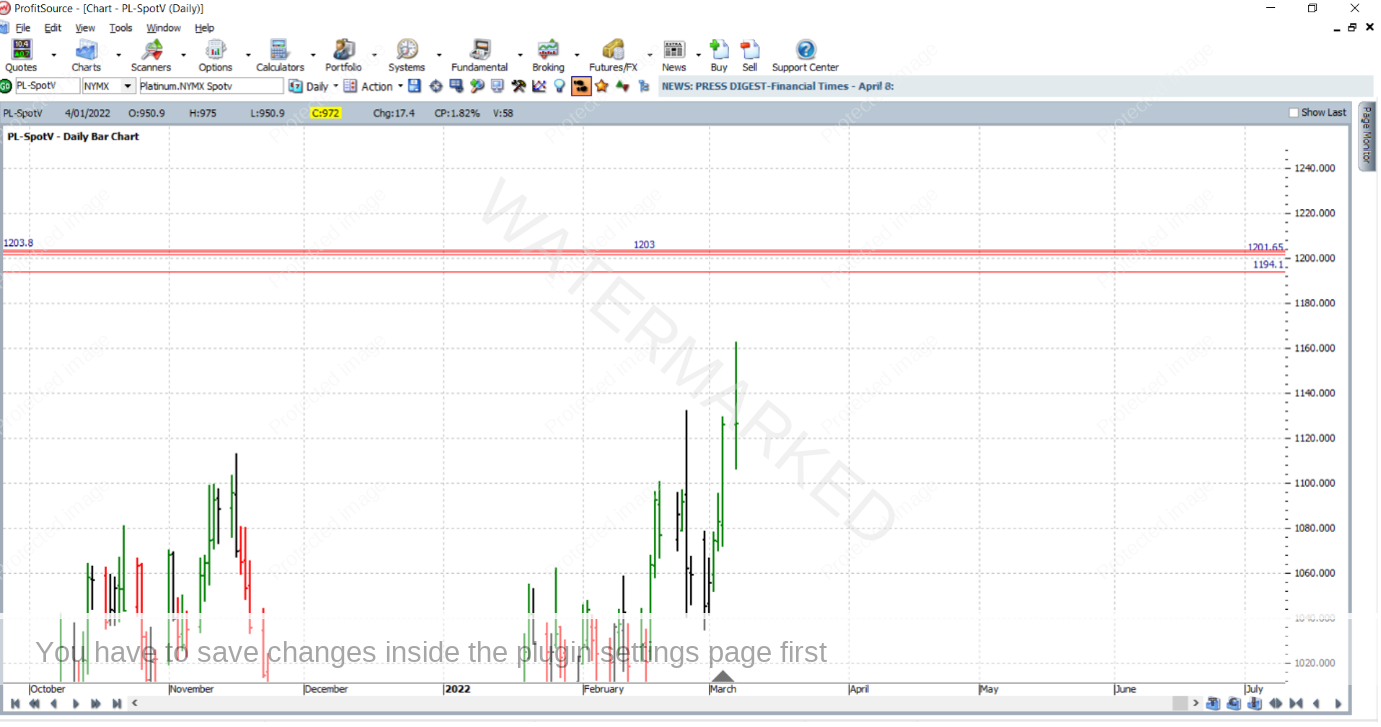

In this month’s article we’ll be taking a close look at an advanced trade that occurred in the Platinum futures market back in March of this year. As 9 March 2022 approached, this market was heading up towards a cluster of four solid price milestones. In the chart below, just for a change I have placed a line for each price reason. One is at 1203 USD per troy ounce; another at 1201.65, another at 1194.1, and the final one at 1203.8; this is to show how closely the four milestones “clustered together” with each other. As for the analysis that actually produced each number – that part is up to you to attempt as an exercise.

The point of the chart above is to show that even if a cluster averages out really close to a top (or bottom for that matter), we still want the inputs to that cluster to be reasonably close to one another. And in this case, in relation to the size of an average daily bar, they certainly are.

Now that being said, the four prices had clustered together at an average of 1200.6, and as a Safety in the Market technical trader with a good price forecasting routine in place you could have been on alert for a reversal to the downside. And a strong reversal did come after the market topped at 1197, just shy of the price cluster. This is illustrated in the ProfitSource chart below using Walk Thru mode, chart symbol PL-SpotV.

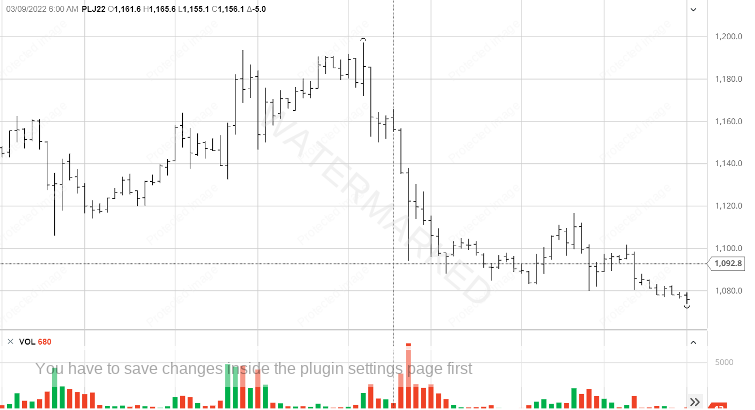

A first lower swing top entry was offered on the hourly chart in the early hours of 9 March 2022, and this would have had you in a short position at a price of 1155 with an initial stop at 1165.7; this is illustrated below with a screenshot from barchart.com.

For trade management, the downward monthly swing from November to December was used as a reference range, and stops managed “Currency style” as though in a large ABC trade.

This was a fast trade. On the next trading day, i.e. the 10th of March, the market tagged the 50% milestone and exit stops were moved to break even.

On 15 March 2022, the market reached the 75% milestone and exit stops were moved to lock in some profit, by being placed at $US25.40 above the 50% milestone. The 25.4 points comes from one-third of the average weekly bar size at the time, based on the last 60 weekly bars.

On 29 March 2022 the 100% milestone was reached.

Let’s break down the reward to risk ratio:

Initial Risk: 1165.7 – 1155.0 = 10.7 = 107 points (point size is 0.1)

Reward: 1155.0 – 969.9 = 185.1 = 1851 points

Reward to Risk Ratio = 1851/107 = approximately 17.3 to 1

According to the contract specifications of Platinum futures on the CME group website, each point of price movement changes the value of one Platinum futures contract by $5 USD, therefore in absolute dollar terms the risk and reward in USD were determined as follows:

Risk = $5 x 107 = $535

Reward = $5 x 1851 = $9255

At the time of taking profits, the reward in Australian dollars was approximately equal to $12,340.

If 3% of the account size was risked at entry (a fairly conservative percentage because the entry itself was an aggressive intraday chart entry) the percentage gain in account size would be as follows:

17.3 x 3% = 51.9%

Many brokers will also make the metals markets accessible via a CFD to allow for much lower risk in absolute dollar terms.

Work Hard, work smart.

Andrew Baraniak